non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

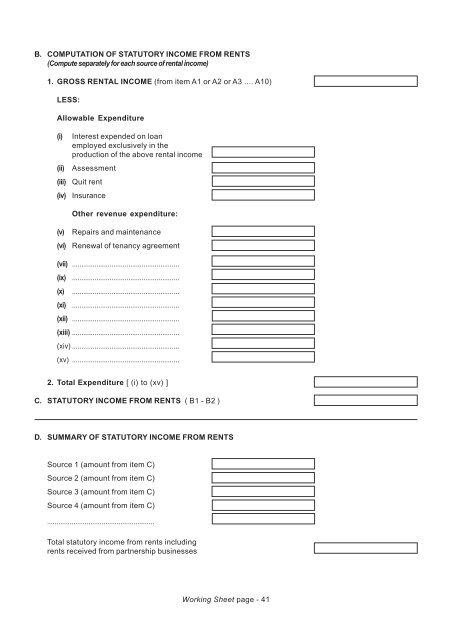

B. COMPUTATION OF STATUTORY INCOME FROM RENTS<br />

(Compute separately for each source of rental <strong>income</strong>)<br />

1. GROSS RENTAL INCOME (from item A1 or A2 or A3 .... A10)<br />

LESS:<br />

Allowable Expenditure<br />

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

Interest expended on loan<br />

employed exclusively in the<br />

production of the above rental <strong>income</strong><br />

Assessment<br />

Quit rent<br />

Insurance<br />

Other revenue expenditure:<br />

(v)<br />

(vi)<br />

Repairs and maintenance<br />

Renewal of tenancy agreement<br />

(vii) .........................................................<br />

(ix) .........................................................<br />

(x) .........................................................<br />

(xi) .........................................................<br />

(xii) .........................................................<br />

(xiii) .........................................................<br />

(xiv) .........................................................<br />

(xv) .........................................................<br />

2. Total Expenditure [ (i) to (xv) ]<br />

C. STATUTORY INCOME FROM RENTS ( B1 - B2 )<br />

D. SUMMARY OF STATUTORY INCOME FROM RENTS<br />

Source 1 (amount from item C)<br />

Source 2 (amount from item C)<br />

Source 3 (amount from item C)<br />

Source 4 (amount from item C)<br />

.........................................................<br />

Total statutory <strong>income</strong> from rents including<br />

rents received from partnership businesses<br />

Working Sheet page - 41