non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Form M 2009 Guidebook<br />

Self Assessment System<br />

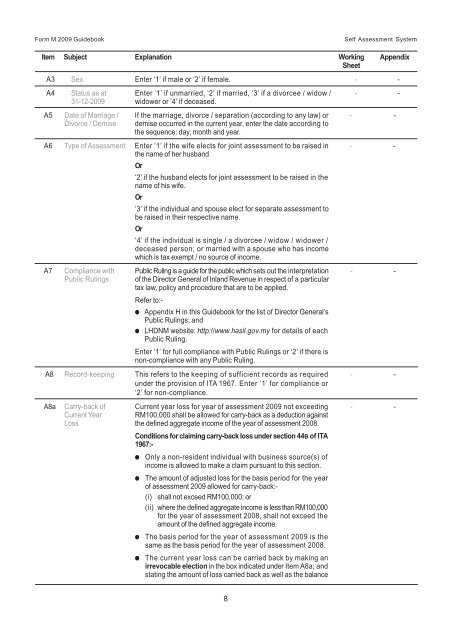

Item Subject Explanation Working Appendix<br />

Sheet<br />

A3 Sex Enter ‘1’ if male or ‘2’ if female. - -<br />

A4 Status as at Enter ‘1’ if unmarried, ‘2’ if married, ‘3’ if a divorcee / widow / - -<br />

31-12-2009 widower or ‘4’ if deceased.<br />

A5 Date of Marriage / If the marriage, divorce / separation (according to any law) or - -<br />

Divorce / Demise demise occurred in the current year, enter the date according to<br />

the sequence: day, month and year.<br />

A6 Type of Assessment Enter ‘1’ if the wife elects for joint assessment to be raised in - -<br />

the name of her husband<br />

Or<br />

‘2’ if the husband elects for joint assessment to be raised in the<br />

name of his wife.<br />

Or<br />

‘3’ if the <strong>individual</strong> and spouse elect for separate assessment to<br />

be raised in their respective name.<br />

Or<br />

‘4’ if the <strong>individual</strong> is single / a divorcee / widow / widower /<br />

deceased person; or married with a spouse who has <strong>income</strong><br />

which is <strong>tax</strong> exempt / no source of <strong>income</strong>.<br />

A7 Compliance with Public Ruling is a guide for the public which sets out the interpretation - -<br />

Public Rulings of the Director General of Inland Revenue in respect of a particular<br />

<strong>tax</strong> law, policy and procedure that are to be applied.<br />

Refer to:-<br />

Appendix H in this Guidebook for the list of Director General’s<br />

Public Rulings; and<br />

LHDNM website: http://www.hasil.gov.my for details of each<br />

Public Ruling.<br />

Enter ‘1’ for full compliance with Public Rulings or ‘2’ if there is<br />

<strong>non</strong>-compliance with any Public Ruling.<br />

A8 Record-keeping This refers to the keeping of sufficient records as required - -<br />

under the provision of ITA 1967. Enter ‘1’ for compliance or<br />

‘2’ for <strong>non</strong>-compliance.<br />

A8a Carry-back of Current year loss for year of assessment 2009 not exceeding - -<br />

Current Year RM100,000 shall be allowed for carry-back as a deduction against<br />

Loss the defined aggregate <strong>income</strong> of the year of assessment 2008.<br />

Conditions for claiming carry-back loss under section 44B of ITA<br />

1967:-<br />

Only a <strong>non</strong>-<strong>resident</strong> <strong>individual</strong> with business source(s) of<br />

<strong>income</strong> is allowed to make a claim pursuant to this section.<br />

The amount of adjusted loss for the basis period for the year<br />

of assessment 2009 allowed for carry-back:-<br />

(i) shall not exceed RM100,000; or<br />

(ii) where the defined aggregate <strong>income</strong> is less than RM100,000<br />

for the year of assessment 2008, shall not exceed the<br />

amount of the defined aggregate <strong>income</strong>.<br />

The basis period for the year of assessment 2009 is the<br />

same as the basis period for the year of assessment 2008.<br />

<br />

The current year loss can be carried back by making an<br />

irrevocable election in the box indicated under Item A8a; and<br />

stating the amount of loss carried back as well as the balance<br />

8