non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Form M 2009 Guidebook<br />

36<br />

Self Assessment System<br />

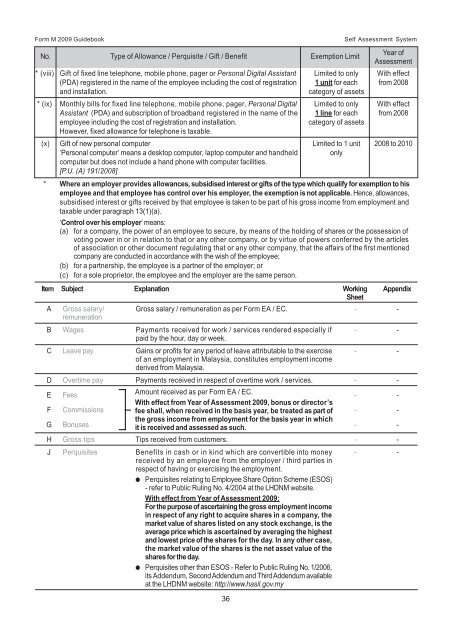

No. Type of Allowance / Perquisite / Gift / Benefit Exemption Limit<br />

Year of<br />

Assessment<br />

* (viii) Gift of fixed line telephone, mobile phone, pager or Personal Digital Assistant Limited to only With effect<br />

(PDA) registered in the name of the employee including the cost of registration 1 unit for each from 2008<br />

and installation.<br />

category of assets<br />

* (ix) Monthly bills for fixed line telephone, mobile phone, pager, Personal Digital Limited to only With effect<br />

Assistant (PDA) and subscription of broadband registered in the name of the 1 line for each from 2008<br />

employee including the cost of registration and installation.<br />

category of assets<br />

However, fixed allowance for telephone is <strong>tax</strong>able.<br />

(x) Gift of new personal computer Limited to 1 unit 2008 to 2010<br />

‘Personal computer’ means a desktop computer, laptop computer and handheld only<br />

computer but does not include a hand phone with computer facilities.<br />

[P.U. (A) 191/2008]<br />

* Where an employer provides allowances, subsidised interest or gifts of the type which qualify for exemption to his<br />

employee and that employee has control over his employer, the exemption is not applicable. Hence, allowances,<br />

subsidised interest or gifts received by that employee is taken to be part of his gross <strong>income</strong> from employment and<br />

<strong>tax</strong>able under paragraph 13(1)(a).<br />

‘Control over his employer’ means:<br />

(a) for a company, the power of an employee to secure, by means of the holding of shares or the possession of<br />

voting power in or in relation to that or any other company, or by virtue of powers conferred by the articles<br />

of association or other document regulating that or any other company, that the affairs of the first mentioned<br />

company are conducted in accordance with the wish of the employee;<br />

(b) for a partnership, the employee is a partner of the employer; or<br />

(c) for a sole proprietor, the employee and the employer are the same person.<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

A Gross salary/ Gross salary / remuneration as per Form EA / EC. - -<br />

remuneration<br />

B Wages Payments received for work / services rendered especially if - -<br />

paid by the hour, day or week.<br />

C Leave pay Gains or profits for any period of leave attributable to the exercise - -<br />

of an employment in Malaysia, constitutes employment <strong>income</strong><br />

derived from Malaysia.<br />

D Overtime pay Payments received in respect of overtime work / services. - -<br />

E Fees<br />

Amount received as per Form EA / EC.<br />

- -<br />

With effect from Year of Assessment 2009, bonus or director’s<br />

F Commissions fee shall, when received in the basis year, be treated as part of - -<br />

G Bonuses<br />

the gross <strong>income</strong> from employment for the basis year in which<br />

it is received and assessed as such.<br />

- -<br />

H Gross tips Tips received from customers. - -<br />

J Perquisites Benefits in cash or in kind which are convertible into money - -<br />

received by an employee from the employer / third parties in<br />

respect of having or exercising the employment.<br />

Perquisites relating to Employee Share Option Scheme (ESOS)<br />

- refer to Public Ruling No. 4/2004 at the LHDNM website.<br />

With effect from Year of Assessment 2009:<br />

For the purpose of ascertaining the gross employment <strong>income</strong><br />

in respect of any right to acquire shares in a company, the<br />

market value of shares listed on any stock exchange, is the<br />

average price which is ascertained by averaging the highest<br />

and lowest price of the shares for the day. In any other case,<br />

the market value of the shares is the net asset value of the<br />

shares for the day.<br />

Perquisites other than ESOS - Refer to Public Ruling No. 1/2006,<br />

its Addendum, Second Addendum and Third Addendum available<br />

at the LHDNM website: http://www.hasil.gov.my