non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

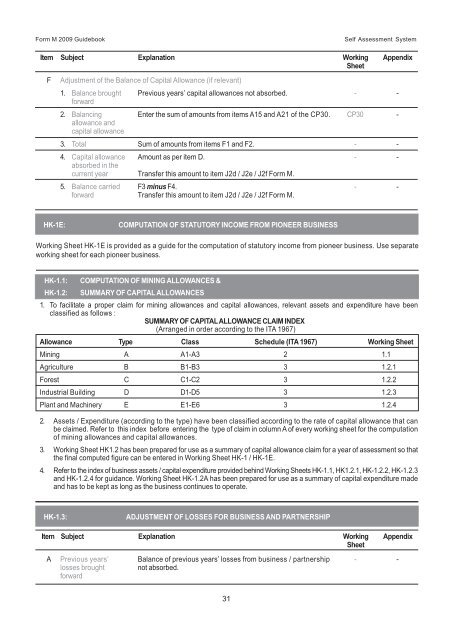

Form M 2009 Guidebook Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

F<br />

Adjustment of the Balance of Capital Allowance (if relevant)<br />

1. Balance brought Previous years’ capital allowances not absorbed. - -<br />

forward<br />

2. Balancing Enter the sum of amounts from items A15 and A21 of the CP30. CP30 -<br />

allowance and<br />

capital allowance<br />

3. Total Sum of amounts from items F1 and F2. - -<br />

4. Capital allowance Amount as per item D. - -<br />

absorbed in the<br />

current year Transfer this amount to item J2d / J2e / J2f Form M.<br />

5. Balance carried F3 minus F4. - -<br />

forward Transfer this amount to item J2d / J2e / J2f Form M.<br />

HK-1E: COMPUTATION OF STATUTORY INCOME FROM PIONEER BUSINESS<br />

Working Sheet HK-1E is provided as a guide for the computation of statutory <strong>income</strong> from pioneer business. Use separate<br />

working sheet for each pioneer business.<br />

HK-1.1: COMPUTATION OF MINING ALLOWANCES &<br />

HK-1.2: SUMMARY OF CAPITAL ALLOWANCES<br />

1. To facilitate a proper claim for mining allowances and capital allowances, relevant assets and expenditure have been<br />

classified as follows :<br />

SUMMARY OF CAPITAL ALLOWANCE CLAIM INDEX<br />

(Arranged in order according to the ITA 1967)<br />

Allowance Type Class Schedule (ITA 1967) Working Sheet<br />

Mining A A1-A3 2 1.1<br />

Agriculture B B1-B3 3 1.2.1<br />

Forest C C1-C2 3 1.2.2<br />

Industrial Building D D1-D5 3 1.2.3<br />

Plant and Machinery E E1-E6 3 1.2.4<br />

2. Assets / Expenditure (according to the type) have been classified according to the rate of capital allowance that can<br />

be claimed. Refer to this index before entering the type of claim in column A of every working sheet for the computation<br />

of mining allowances and capital allowances.<br />

3. Working Sheet HK1.2 has been prepared for use as a summary of capital allowance claim for a year of assessment so that<br />

the final computed figure can be entered in Working Sheet HK-1 / HK-1E.<br />

4. Refer to the index of business assets / capital expenditure provided behind Working Sheets HK-1.1, HK1.2.1, HK-1.2.2, HK-1.2.3<br />

and HK-1.2.4 for guidance. Working Sheet HK-1.2A has been prepared for use as a summary of capital expenditure made<br />

and has to be kept as long as the business continues to operate.<br />

HK-1.3: ADJUSTMENT OF LOSSES FOR BUSINESS AND PARTNERSHIP<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

A Previous years’ Balance of previous years’ losses from business / partnership - -<br />

losses brought not absorbed.<br />

forward<br />

31