non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

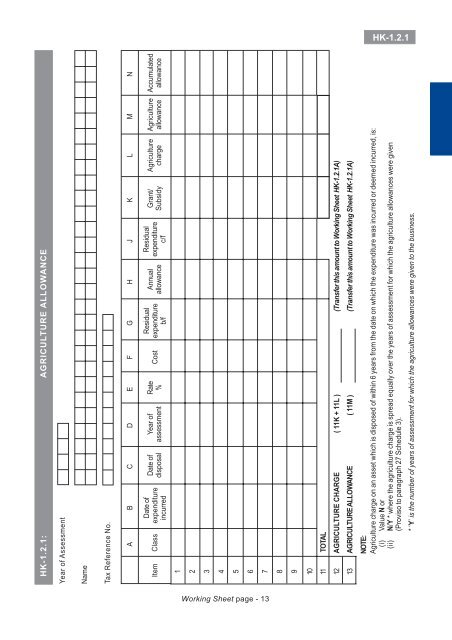

HK-1.2.1<br />

HK-1.2.1: AGRICULTURE ALLOWANCE<br />

Year of Assessment<br />

Name<br />

Tax Reference No.<br />

A B C D E F G H J K L M N<br />

Item<br />

Class<br />

Date of Residual<br />

Date of Year of Rate<br />

expenditure<br />

disposal assessment %<br />

Cost expenditure<br />

incurred b/f<br />

Annual<br />

allowance<br />

Residual<br />

expenditure<br />

c/f<br />

Grant/<br />

Subsidy<br />

Agriculture<br />

charge<br />

Agriculture<br />

allowance<br />

Accumulated<br />

allowance<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11 TOTAL<br />

12 AGRICULTURE CHARGE ( 11K + 11L ) (Transfer this amount to Working Sheet HK-1.2.1A)<br />

13 AGRICULTURE ALLOWANCE ( 11M ) (Transfer this amount to Working Sheet HK-1.2.1A)<br />

NOTE:<br />

Agriculture charge on an asset which is disposed of within 6 years from the date on which the expenditure was incurred or deemed incurred, is:<br />

(i) Value N or<br />

(ii) N/Y * where the agriculture charge is spread equally over the years of assessment for which the agriculture allowances were given<br />

(Proviso to paragraph 27 Schedule 3).<br />

* ‘Y’ is the number of years of assessment for which the agriculture allowances were given to the business.<br />

Working Sheet page - 13