non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Form M 2009 Guidebook<br />

Self Assessment System<br />

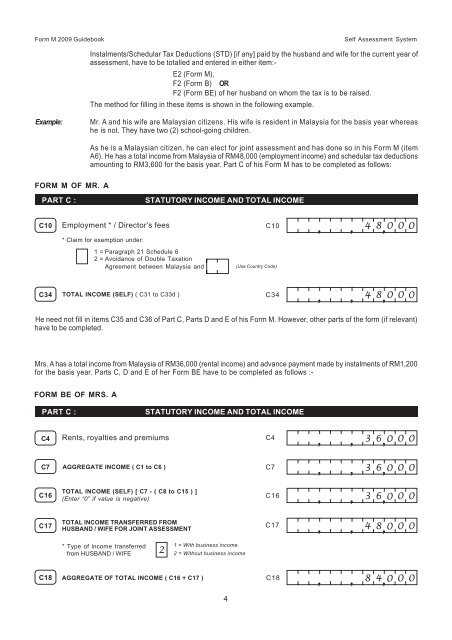

Instalments/Schedular Tax Deductions (STD) [if any] paid by the husband and wife for the current year of<br />

assessment, have to be totalled and entered in either item:-<br />

E2 (Form M),<br />

F2 (Form B) OR<br />

F2 (Form BE) of her husband on whom the <strong>tax</strong> is to be raised.<br />

The method for filling in these items is shown in the following example.<br />

Example:<br />

Mr. A and his wife are Malaysian citizens. His wife is <strong>resident</strong> in Malaysia for the basis year whereas<br />

he is not. They have two (2) school-going children.<br />

As he is a Malaysian citizen, he can elect for joint assessment and has done so in his Form M (item<br />

A6). He has a total <strong>income</strong> from Malaysia of RM48,000 (employment <strong>income</strong>) and schedular <strong>tax</strong> deductions<br />

amounting to RM3,600 for the basis year. Part C of his Form M has to be completed as follows:<br />

FORM M OF MR. A<br />

PART C :<br />

STATUTORY INCOME AND TOTAL INCOME<br />

C10<br />

Employment * / Director’s fees<br />

* Claim for exemption under:<br />

C10<br />

,<br />

,<br />

4<br />

8 0 0 0 ,<br />

1 = Paragraph 21 Schedule 6<br />

2 = Avoidance of Double Taxation<br />

Agreement between Malaysia and<br />

(Use Country Code)<br />

C34<br />

TOTAL INCOME (SELF) ( C31 to C33d )<br />

C34<br />

,<br />

,<br />

4<br />

8 0 0 0 ,<br />

He need not fill in items C35 and C36 of Part C, Parts D and E of his Form M. However, other parts of the form (if relevant)<br />

have to be completed.<br />

Mrs. A has a total <strong>income</strong> from Malaysia of RM36,000 (rental <strong>income</strong>) and advance payment made by instalments of RM1,200<br />

for the basis year. Parts C, D and E of her Form BE have to be completed as follows :-<br />

FORM BE OF MRS. A<br />

PART C :<br />

STATUTORY INCOME AND TOTAL INCOME<br />

C4<br />

Rents, royalties and premiums<br />

C4<br />

,<br />

,<br />

3<br />

6 0 0 0 ,<br />

C7 AGGREGATE INCOME ( C1 to C6 )<br />

C7<br />

,<br />

,<br />

3<br />

6 0 0 0 ,<br />

C16<br />

TOTAL INCOME (SELF) [ C7 - ( C8 to C15 ) ]<br />

(Enter “0” if value is negative)<br />

C16<br />

,<br />

,<br />

3<br />

6 0 0 0 ,<br />

C17<br />

TOTAL INCOME TRANSFERRED FROM<br />

HUSBAND / WIFE FOR JOINT ASSESSMENT<br />

C17<br />

,<br />

,<br />

4<br />

8 0 0 0 ,<br />

* Type of <strong>income</strong> transferred<br />

from HUSBAND / WIFE<br />

2<br />

1 = With business <strong>income</strong><br />

2 = Without business <strong>income</strong><br />

C18<br />

AGGREGATE OF TOTAL INCOME ( C16 + C17 )<br />

C18<br />

,<br />

,<br />

8<br />

4 0 0 0 ,<br />

4