non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

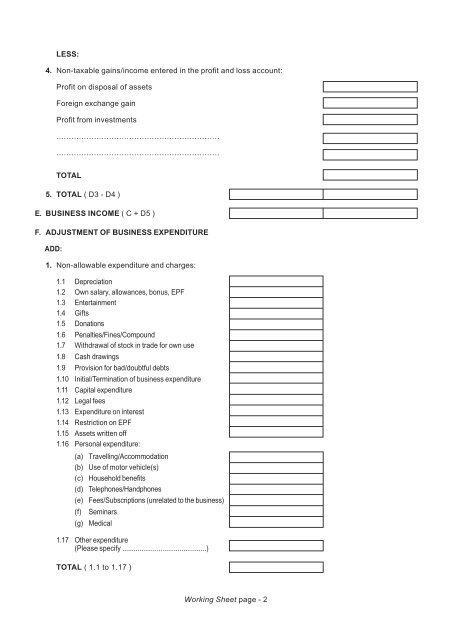

LESS:<br />

4. Non-<strong>tax</strong>able gains/<strong>income</strong> entered in the profit and loss account:<br />

Profit on disposal of assets<br />

Foreign exchange gain<br />

Profit from investments<br />

.................................................................<br />

.................................................................<br />

TOTAL<br />

5. TOTAL ( D3 - D4 )<br />

E. BUSINESS INCOME ( C + D5 )<br />

F. ADJUSTMENT OF BUSINESS EXPENDITURE<br />

ADD:<br />

1. Non-allowable expenditure and charges:<br />

1.1 Depreciation<br />

1.2 Own salary, allowances, bonus, EPF<br />

1.3 Entertainment<br />

1.4 Gifts<br />

1.5 Donations<br />

1.6 Penalties/Fines/Compound<br />

1.7 Withdrawal of stock in trade for own use<br />

1.8 Cash drawings<br />

1.9 Provision for bad/doubtful debts<br />

1.10 Initial/Termination of business expenditure<br />

1.11 Capital expenditure<br />

1.12 Legal fees<br />

1.13 Expenditure on interest<br />

1.14 Restriction on EPF<br />

1.15 Assets written off<br />

1.16 Personal expenditure:<br />

(a) Travelling/Accommodation<br />

(b) Use of motor vehicle(s)<br />

(c) Household benefits<br />

(d) Telephones/Handphones<br />

(e) Fees/Subscriptions (unrelated to the business)<br />

(f) Seminars<br />

(g) Medical<br />

1.17 Other expenditure<br />

(Please specify ............................................)<br />

TOTAL ( 1.1 to 1.17 )<br />

Working Sheet page - 2