non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

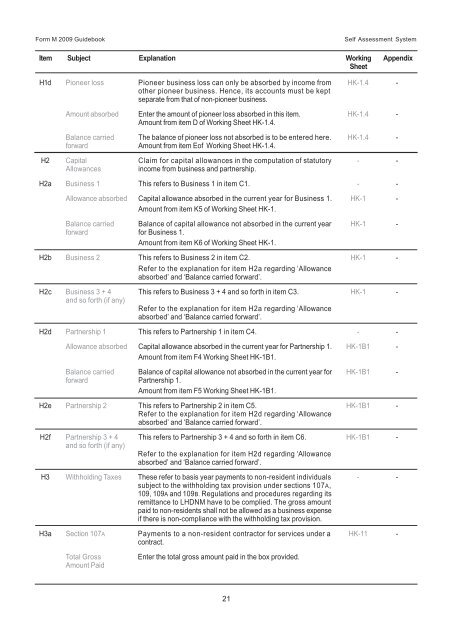

Form M 2009 Guidebook Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

H1d Pioneer loss Pioneer business loss can only be absorbed by <strong>income</strong> from HK-1.4 -<br />

other pioneer business. Hence, its accounts must be kept<br />

separate from that of <strong>non</strong>-pioneer business.<br />

Amount absorbed Enter the amount of pioneer loss absorbed in this item. HK-1.4 -<br />

Amount from item D of Working Sheet HK-1.4.<br />

Balance carried The balance of pioneer loss not absorbed is to be entered here. HK-1.4 -<br />

forward<br />

Amount from item Eof Working Sheet HK-1.4.<br />

H2 Capital Claim for capital allowances in the computation of statutory - -<br />

Allowances<br />

<strong>income</strong> from business and partnership.<br />

H2a Business 1 This refers to Business 1 in item C1. - -<br />

Allowance absorbed Capital allowance absorbed in the current year for Business 1. HK-1 -<br />

Amount from item K5 of Working Sheet HK-1.<br />

Balance carried Balance of capital allowance not absorbed in the current year HK-1 -<br />

forward for Business 1.<br />

Amount from item K6 of Working Sheet HK-1.<br />

H2b Business 2 This refers to Business 2 in item C2. HK-1 -<br />

Refer to the explanation for item H2a regarding ‘Allowance<br />

absorbed’ and ‘Balance carried forward’.<br />

H2c Business 3 + 4 This refers to Business 3 + 4 and so forth in item C3. HK-1 -<br />

and so forth (if any)<br />

Refer to the explanation for item H2a regarding ‘Allowance<br />

absorbed’ and ‘Balance carried forward’.<br />

H2d Partnership 1 This refers to Partnership 1 in item C4. - -<br />

Allowance absorbed Capital allowance absorbed in the current year for Partnership 1. HK-1B1 -<br />

Amount from item F4 Working Sheet HK-1B1.<br />

Balance carried Balance of capital allowance not absorbed in the current year for HK-1B1 -<br />

forward Partnership 1.<br />

Amount from item F5 Working Sheet HK-1B1.<br />

H2e Partnership 2 This refers to Partnership 2 in item C5. HK-1B1 -<br />

Refer to the explanation for item H2d regarding ‘Allowance<br />

absorbed’ and ‘Balance carried forward’.<br />

H2f Partnership 3 + 4 This refers to Partnership 3 + 4 and so forth in item C6. HK-1B1 -<br />

and so forth (if any)<br />

Refer to the explanation for item H2d regarding ‘Allowance<br />

absorbed’ and ‘Balance carried forward’.<br />

H3 Withholding Taxes These refer to basis year payments to <strong>non</strong>-<strong>resident</strong> <strong>individual</strong>s - -<br />

subject to the withholding <strong>tax</strong> provision under sections 107A,<br />

109, 109A and 109B. Regulations and procedures regarding its<br />

remittance to LHDNM have to be complied. The gross amount<br />

paid to <strong>non</strong>-<strong>resident</strong>s shall not be allowed as a business expense<br />

if there is <strong>non</strong>-compliance with the withholding <strong>tax</strong> provision.<br />

H3a Section 107A Payments to a <strong>non</strong>-<strong>resident</strong> contractor for services under a HK-11 -<br />

contract.<br />

Total Gross<br />

Amount Paid<br />

Enter the total gross amount paid in the box provided.<br />

21