non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

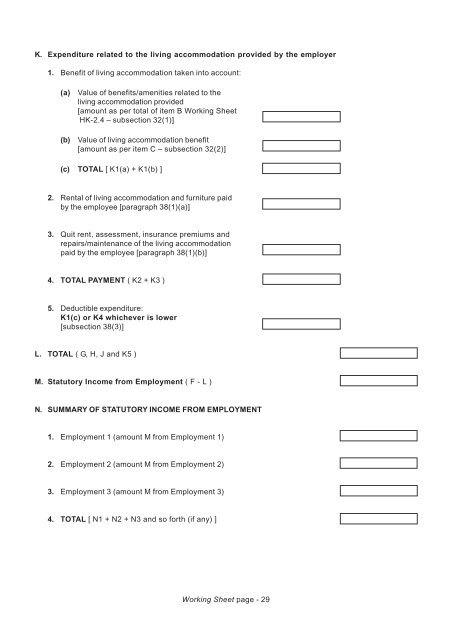

K. Expenditure related to the living accommodation provided by the employer<br />

1. Benefit of living accommodation taken into account:<br />

(a)<br />

(b)<br />

Value of benefits/amenities related to the<br />

living accommodation provided<br />

[amount as per total of item B Working Sheet<br />

HK-2.4 – subsection 32(1)]<br />

Value of living accommodation benefit<br />

[amount as per item C – subsection 32(2)]<br />

(c) TOTAL [ K1(a) + K1(b) ]<br />

2. Rental of living accommodation and furniture paid<br />

by the employee [paragraph 38(1)(a)]<br />

3. Quit rent, assessment, insurance premiums and<br />

repairs/maintenance of the living accommodation<br />

paid by the employee [paragraph 38(1)(b)]<br />

4. TOTAL PAYMENT ( K2 + K3 )<br />

5. Deductible expenditure:<br />

K1(c) or K4 whichever is lower<br />

[subsection 38(3)]<br />

L. TOTAL ( G, H, J and K5 )<br />

M. Statutory Income from Employment ( F - L )<br />

N. SUMMARY OF STATUTORY INCOME FROM EMPLOYMENT<br />

1. Employment 1 (amount M from Employment 1)<br />

2. Employment 2 (amount M from Employment 2)<br />

3. Employment 3 (amount M from Employment 3)<br />

4. TOTAL [ N1 + N2 + N3 and so forth (if any) ]<br />

Working Sheet page - 29