non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

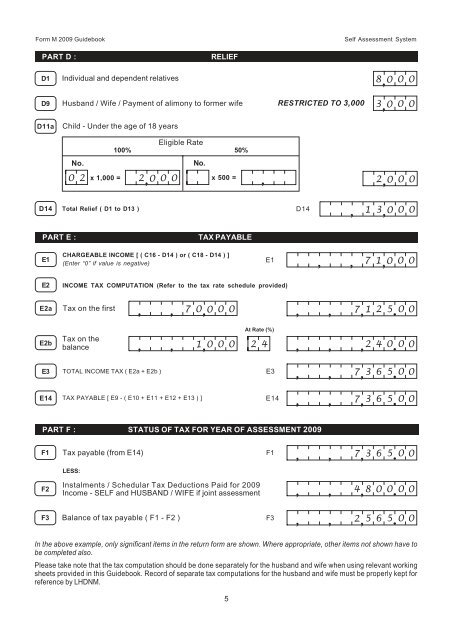

Form M 2009 Guidebook Self Assessment System<br />

PART D :<br />

RELIEF<br />

D1<br />

Individual and dependent relatives<br />

8 0 0 0 ,<br />

D9<br />

Husband / Wife / Payment of alimony to former wife<br />

RESTRICTED TO 3,000<br />

3 0 0 0 ,<br />

D11a<br />

Child - Under the age of 18 years<br />

Eligible Rate<br />

100% 50%<br />

No.<br />

No.<br />

0 2 2 , 0 0 0<br />

x 1,000 = x 500 =<br />

,<br />

2 0 0 0 ,<br />

D14<br />

Total Relief ( D1 to D13 )<br />

D14<br />

,<br />

1<br />

3 0 0 0 ,<br />

PART E :<br />

TAX PAYABLE<br />

E1<br />

CHARGEABLE INCOME [ ( C16 - D14 ) or ( C18 - D14 ) ]<br />

(Enter “0” if value is negative)<br />

E1<br />

,<br />

,<br />

7<br />

1 0 0 0 ,<br />

E2<br />

INCOME TAX COMPUTATION (Refer to the <strong>tax</strong> rate schedule provided)<br />

E2a<br />

Tax on the first<br />

,<br />

,<br />

7<br />

0 0 0 0 ,<br />

, , 7, 1 2 5 . 0 0<br />

E2b<br />

Tax on the<br />

balance<br />

,<br />

,<br />

1 0 0 0 ,<br />

At Rate (%)<br />

2 4<br />

, , , 2 4 0 . 0 0<br />

E3<br />

TOTAL INCOME TAX ( E2a + E2b )<br />

E3<br />

, , 7, 3 6 5 . 0 0<br />

E14<br />

TAX PAYABLE [ E9 - ( E10 + E11 + E12 + E13 ) ]<br />

E14<br />

, , 7, 3 6 5 . 0 0<br />

PART F : STATUS OF TAX FOR YEAR OF ASSESSMENT 2009<br />

F1<br />

Tax payable (from E14)<br />

F1<br />

, , 7, 3 6 5 . 0 0<br />

LESS:<br />

F2<br />

Instalments / Schedular Tax Deductions Paid for 2009<br />

Income - SELF and HUSBAND / WIFE if joint assessment<br />

, , 4, 8 0 0 . 0 0<br />

F3<br />

Balance of <strong>tax</strong> payable ( F1 - F2 )<br />

F3<br />

, , 2, 5 6 5 . 0 0<br />

In the above example, only significant items in the return form are shown. Where appropriate, other items not shown have to<br />

be completed also.<br />

Please take note that the <strong>tax</strong> computation should be done separately for the husband and wife when using relevant working<br />

sheets provided in this Guidebook. Record of separate <strong>tax</strong> computations for the husband and wife must be properly kept for<br />

reference by LHDNM.<br />

5