Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Barclays</strong> Bank PLC data<br />

Notes to the accounts<br />

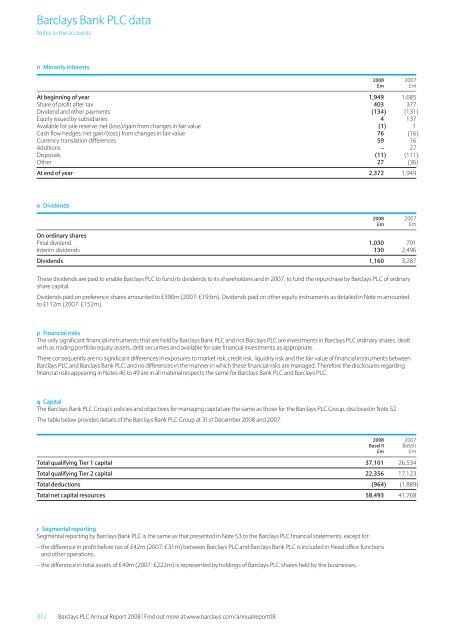

n Minority interests<br />

<strong>2008</strong> 2007<br />

£m £m<br />

At beginning of year 1,949 1,685<br />

Share of profit after tax 403 377<br />

Dividend and other payments (134) (131)<br />

Equity issued by subsidiaries 4 137<br />

Available for sale reserve: net (loss)/gain from changes in fair value (1) 1<br />

Cash flow hedges: net gain/(loss) from changes in fair value 76 (16)<br />

Currency translation differences 59 16<br />

Additions – 27<br />

Disposals (11) (111)<br />

Other 27 (36)<br />

At end of year 2,372 1,949<br />

o Dividends<br />

<strong>2008</strong> 2007<br />

£m £m<br />

On ordinary shares<br />

Final dividend 1,030 791<br />

Interim dividends 130 2,496<br />

Dividends 1,160 3,287<br />

<strong>The</strong>se dividends are paid to enable <strong>Barclays</strong> PLC to fund its dividends to its shareholders and in 2007, to fund the repurchase by <strong>Barclays</strong> PLC of ordinary<br />

share capital.<br />

Dividends paid on preference shares amounted to £390m (2007: £193m). Dividends paid on other equity instruments as detailed in Notemamounted<br />

to £112m (2007: £152m).<br />

p <strong>Financial</strong> risks<br />

<strong>The</strong> only significant financial instruments that are held by <strong>Barclays</strong> Bank PLC and not <strong>Barclays</strong> PLC are investments in <strong>Barclays</strong> PLC ordinary shares, dealt<br />

with as trading portfolio equity assets, debt securities and available for sale financial investments as appropriate.<br />

<strong>The</strong>re consequently are no significant differences in exposures to market risk, credit risk, liquidity risk and the fair value of financial instruments between<br />

<strong>Barclays</strong> PLC and <strong>Barclays</strong> Bank PLC, and no differences in the manner in which these financial risks are managed. <strong>The</strong>refore the disclosures regarding<br />

financial risks appearing in Notes 46 to 49 are in all material respects the same for <strong>Barclays</strong> Bank PLC and <strong>Barclays</strong> PLC.<br />

q Capital<br />

<strong>The</strong> <strong>Barclays</strong> Bank PLC <strong>Group</strong>’s policies and objectives for managing capital are the same as those for the <strong>Barclays</strong> PLC <strong>Group</strong>, disclosed in Note 52.<br />

<strong>The</strong> table below provides details of the <strong>Barclays</strong> Bank PLC <strong>Group</strong> at 31st December <strong>2008</strong> and 2007.<br />

<strong>2008</strong> 2007<br />

Basel II Basel I<br />

£m £m<br />

Total qualifying Tier 1 capital 37,101 26,534<br />

Total qualifying Tier 2 capital 22,356 17,123<br />

Total deductions (964) (1,889)<br />

Total net capital resources 58,493 41,768<br />

r Segmental reporting<br />

Segmental reporting by <strong>Barclays</strong> Bank PLC is the same as that presented in Note 53 to the <strong>Barclays</strong> PLC financial <strong>statements</strong>, except for:<br />

– the difference in profit before tax of £42m (2007: £31m) between <strong>Barclays</strong> PLC and <strong>Barclays</strong> Bank PLC is included in Head office functions<br />

and other operations.<br />

– the difference in total assets of £49m (2007: £222m) is represented by holdings of <strong>Barclays</strong> PLC shares held by the businesses.<br />

312 <strong>Barclays</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> | Find out more at www.barclays.com/annualreport08