Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

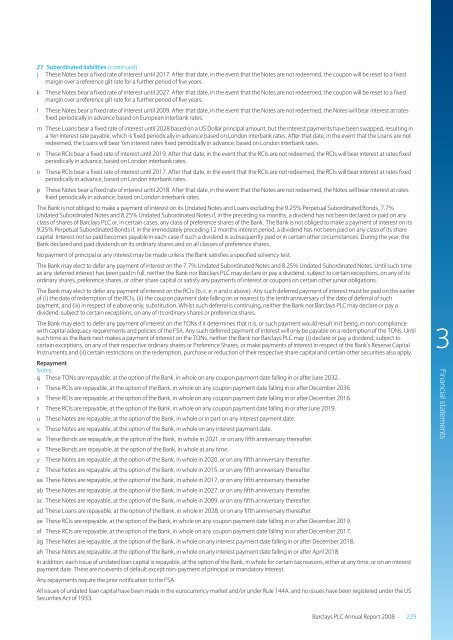

27 Subordinated liabilities (continued)<br />

j <strong>The</strong>se Notes bear a fixed rate of interest until 2017. After that date, in the event that the Notes are not redeemed, the coupon will be reset to a fixed<br />

margin over a reference gilt rate for a further period of five years.<br />

k<br />

l<br />

<strong>The</strong>se Notes bear a fixed rate of interest until 2027. After that date, in the event that the Notes are not redeemed, the coupon will be reset to a fixed<br />

margin over a reference gilt rate for a further period of five years.<br />

<strong>The</strong>se Notes bear a fixed rate of interest until 2009. After that date, in the event that the Notes are not redeemed, the Notes will bear interest at rates<br />

fixed periodically in advance based on European interbank rates.<br />

m <strong>The</strong>se Loans bear a fixed rate of interest until 2028 based on a US Dollar principal amount, but the interest payments have been swapped, resulting in<br />

a Yen interest rate payable, which is fixed periodically in advance based on London interbank rates. After that date, in the event that the Loans are not<br />

redeemed, the Loans will bear Yen interest rates fixed periodically in advance, based on London interbank rates.<br />

n<br />

o<br />

p<br />

<strong>The</strong>se RCIs bear a fixed rate of interest until 2019. After that date, in the event that the RCIs are not redeemed, the RCIs will bear interest at rates fixed<br />

periodically in advance, based on London interbank rates.<br />

<strong>The</strong>se RCIs bear a fixed rate of interest until 2017. After that date, in the event that the RCIs are not redeemed, the RCIs will bear interest at rates fixed<br />

periodically in advance, based on London interbank rates.<br />

<strong>The</strong>se Notes bear a fixed rate of interest until 2018. After that date, in the event that the Notes are not redeemed, the Notes will bear interest at rates<br />

fixed periodically in advance, based on London interbank rates.<br />

<strong>The</strong> Bank is not obliged to make a payment of interest on its Undated Notes and Loans excluding the 9.25% Perpetual Subordinated Bonds, 7.7%<br />

Undated Subordinated Notes and 8.25% Undated Subordinated Notes if, in the preceding six months, a dividend has not been declared or paid on any<br />

class of shares of <strong>Barclays</strong> PLC or, in certain cases, any class of preference shares of the Bank. <strong>The</strong> Bank is not obliged to make a payment of interest on its<br />

9.25% Perpetual Subordinated Bonds if, in the immediately preceding 12 months interest period, a dividend has not been paid on any class of its share<br />

capital. Interest not so paid becomes payable in each case if such a dividend is subsequently paid or in certain other circumstances. During the year, the<br />

Bank declared and paid dividends on its ordinary shares and on all classes of preference shares.<br />

No payment of principal or any interest may be made unless the Bank satisfies a specified solvency test.<br />

<strong>The</strong> Bank may elect to defer any payment of interest on the 7.7% Undated Subordinated Notes and 8.25% Undated Subordinated Notes. Until such time<br />

as any deferred interest has been paid in full, neither the Bank nor <strong>Barclays</strong> PLC may declare or pay a dividend, subject to certain exceptions, on any of its<br />

ordinary shares, preference shares, or other share capital or satisfy any payments of interest or coupons on certain other junior obligations.<br />

<strong>The</strong> Bank may elect to defer any payment of interest on the RCIs (b, c, e, n and o above). Any such deferred payment of interest must be paid on the earlier<br />

of (i) the date of redemption of the RCIs, (ii) the coupon payment date falling on or nearest to the tenth anniversary of the date of deferral of such<br />

payment, and (iii) in respect of e above only, substitution. Whilst such deferral is continuing, neither the Bank nor <strong>Barclays</strong> PLC may declare or pay a<br />

dividend, subject to certain exceptions, on any of its ordinary shares or preference shares.<br />

<strong>The</strong> Bank may elect to defer any payment of interest on the TONs if it determines that it is, or such payment would result in it being, in non-compliance<br />

with capital adequacy requirements and policies of the FSA. Any such deferred payment of interest will only be payable on a redemption of the TONs. Until<br />

such time as the Bank next makes a payment of interest on the TONs, neither the Bank nor <strong>Barclays</strong> PLC may (i) declare or pay a dividend, subject to<br />

certain exceptions, on any of their respective ordinary shares or Preference Shares, or make payments of interest in respect of the Bank’s Reserve Capital<br />

Instruments and (ii) certain restrictions on the redemption, purchase or reduction of their respective share capital and certain other securities also apply.<br />

Repayment<br />

Notes<br />

q <strong>The</strong>se TONs are repayable, at the option of the Bank, in whole on any coupon payment date falling in or after June 2032.<br />

r <strong>The</strong>se RCIs are repayable, at the option of the Bank, in whole on any coupon payment date falling in or after December 2036.<br />

s <strong>The</strong>se RCIs are repayable, at the option of the Bank, in whole on any coupon payment date falling in or after December 2016.<br />

t <strong>The</strong>se RCIs are repayable, at the option of the Bank, in whole on any coupon payment date falling in or after June 2019.<br />

u <strong>The</strong>se Notes are repayable, at the option of the Bank, in whole or in part on any interest payment date.<br />

v <strong>The</strong>se Notes are repayable, at the option of the Bank, in whole on any interest payment date.<br />

w <strong>The</strong>se Bonds are repayable, at the option of the Bank, in whole in 2021, or on any fifth anniversary thereafter.<br />

x <strong>The</strong>se Bonds are repayable, at the option of the Bank, in whole at any time.<br />

y <strong>The</strong>se Notes are repayable, at the option of the Bank, in whole in 2020, or on any fifth anniversary thereafter.<br />

z <strong>The</strong>se Notes are repayable, at the option of the Bank, in whole in 2015, or on any fifth anniversary thereafter.<br />

aa <strong>The</strong>se Notes are repayable, at the option of the Bank, in whole in 2017, or on any fifth anniversary thereafter.<br />

ab <strong>The</strong>se Notes are repayable, at the option of the Bank, in whole in 2027, or on any fifth anniversary thereafter.<br />

ac <strong>The</strong>se Notes are repayable, at the option of the Bank, in whole in 2009, or on any fifth anniversary thereafter.<br />

ad <strong>The</strong>se Loans are repayable, at the option of the Bank, in whole in 2028, or on any fifth anniversary thereafter.<br />

ae <strong>The</strong>se RCIs are repayable, at the option of the Bank, in whole on any coupon payment date falling in or after December 2019.<br />

af <strong>The</strong>se RCIs are repayable, at the option of the Bank, in whole on any coupon payment date falling in or after December 2017.<br />

ag <strong>The</strong>se Notes are repayable, at the option of the Bank, in whole on any interest payment date falling in or after December 2018.<br />

ah <strong>The</strong>se Notes are repayable, at the option of the Bank, in whole on any interest payment date falling in or after April 2018.<br />

In addition, each issue of undated loan capital is repayable, at the option of the Bank, in whole for certain tax reasons, either at any time, or on an interest<br />

payment date. <strong>The</strong>re are no events of default except non-payment of principal or mandatory interest.<br />

Any repayments require the prior notification to the FSA.<br />

All issues of undated loan capital have been made in the eurocurrency market and/or under Rule 144A, and no issues have been registered under the US<br />

Securities Act of 1933.<br />

3<br />

<strong>Financial</strong> <strong>statements</strong><br />

<strong>Barclays</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 229