Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the accounts<br />

For the year ended 31st December <strong>2008</strong><br />

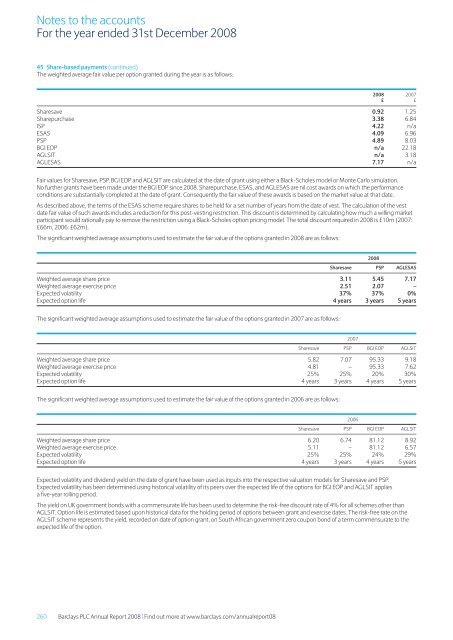

45 Share-based payments (continued)<br />

<strong>The</strong> weighted average fair value per option granted during the year is as follows:<br />

<strong>2008</strong> 2007<br />

£ £<br />

Sharesave 0.92 1.25<br />

Sharepurchase 3.38 6.84<br />

ISP 4.22 n/a<br />

ESAS 4.09 6.96<br />

PSP 4.89 8.03<br />

BGI EOP n/a 22.18<br />

AGLSIT n/a 3.18<br />

AGLESAS 7.17 n/a<br />

Fair values for Sharesave, PSP, BGI EOP and AGLSIT are calculated at the date of grant using either a Black-Scholes model or Monte Carlo simulation.<br />

No further grants have been made under the BGI EOP since <strong>2008</strong>. Sharepurchase, ESAS, and AGLESAS are nil cost awards on which the performance<br />

conditions are substantially completed at the date of grant. Consequently the fair value of these awards is based on the market value at that date.<br />

As described above, the terms of the ESAS scheme require shares to be held for a set number of years from the date of vest. <strong>The</strong> calculation of the vest<br />

date fair value of such awards includes a reduction for this post-vesting restriction. This discount is determined by calculating how much a willing market<br />

participant would rationally pay to remove the restriction using a Black-Scholes option pricing model. <strong>The</strong> total discount required in <strong>2008</strong> is £10m (2007:<br />

£66m, 2006: £62m).<br />

<strong>The</strong> significant weighted average assumptions used to estimate the fair value of the options granted in <strong>2008</strong> are as follows:<br />

<strong>2008</strong><br />

Sharesave PSP AGLESAS<br />

Weighted average share price 3.11 5.45 7.17<br />

Weighted average exercise price 2.51 2.07 –<br />

Expected volatility 37% 37% 0%<br />

Expected option life 4 years 3 years 5 years<br />

<strong>The</strong> significant weighted average assumptions used to estimate the fair value of the options granted in 2007 are as follows:<br />

2007<br />

Sharesave PSP BGI EOP AGLSIT<br />

Weighted average share price 5.82 7.07 95.33 9.18<br />

Weighted average exercise price 4.81 – 95.33 7.62<br />

Expected volatility 25% 25% 20% 30%<br />

Expected option life 4 years 3 years 4 years 5 years<br />

<strong>The</strong> significant weighted average assumptions used to estimate the fair value of the options granted in 2006 are as follows:<br />

2006<br />

Sharesave PSP BGI EOP AGLSIT<br />

Weighted average share price 6.20 6.74 81.12 8.92<br />

Weighted average exercise price 5.11 – 81.12 6.57<br />

Expected volatility 25% 25% 24% 29%<br />

Expected option life 4 years 3 years 4 years 5 years<br />

Expected volatility and dividend yield on the date of grant have been used as inputs into the respective valuation models for Sharesave and PSP.<br />

Expected volatility has been determined using historical volatility of its peers over the expected life of the options for BGI EOP and AGLSIT applies<br />

a five-year rolling period.<br />

<strong>The</strong> yield on UK government bonds with a commensurate life has been used to determine the risk-free discount rate of 4% for all schemes other than<br />

AGLSIT. Option life is estimated based upon historical data for the holding period of options between grant and exercise dates. <strong>The</strong> risk-free rate on the<br />

AGLSIT scheme represents the yield, recorded on date of option grant, on South African government zero coupon bond of a term commensurate to the<br />

expected life of the option.<br />

260 <strong>Barclays</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> | Find out more at www.barclays.com/annualreport08