Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

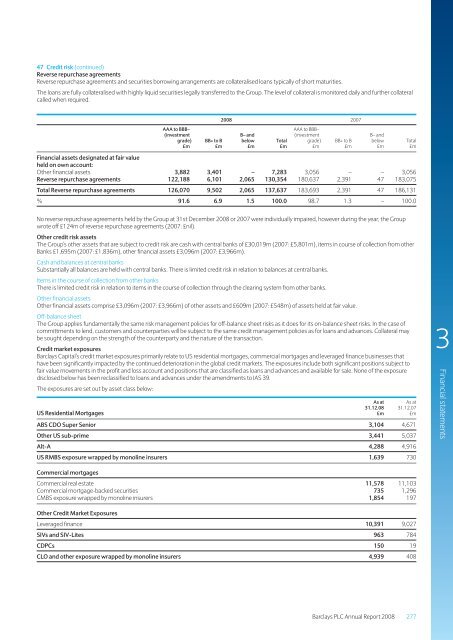

47 Credit risk (continued)<br />

Reverse repurchase agreements<br />

Reverse repurchase agreements and securities borrowing arrangements are collateralised loans typically of short maturities.<br />

<strong>The</strong> loans are fully collateralised with highly liquid securities legally transferred to the <strong>Group</strong>. <strong>The</strong> level of collateral is monitored daily and further collateral<br />

called when required.<br />

<strong>2008</strong> 2007<br />

AAA to BBB–<br />

AAA to BBB–<br />

(investment B– and (investment B– and<br />

grade) BB+ to B below Total grade) BB+ to B below Total<br />

£m £m £m £m £m £m £m £m<br />

<strong>Financial</strong> assets designated at fair value<br />

held on own account:<br />

Other financial assets 3,882 3,401 – 7,283 3,056 – – 3,056<br />

Reverse repurchase agreements 122,188 6,101 2,065 130,354 180,637 2,391 47 183,075<br />

Total Reverse repurchase agreements 126,070 9,502 2,065 137,637 183,693 2,391 47 186,131<br />

% 91.6 6.9 1.5 100.0 98.7 1.3 – 100.0<br />

No reverse repurchase agreements held by the <strong>Group</strong> at 31st December <strong>2008</strong> or 2007 were individually impaired, however during the year, the <strong>Group</strong><br />

wrote off £124m of reverse repurchase agreements (2007: £nil).<br />

Other credit risk assets<br />

<strong>The</strong> <strong>Group</strong>’s other assets that are subject to credit risk are cash with central banks of £30,019m (2007: £5,801m), items in course of collection from other<br />

Banks £1,695m (2007: £1,836m), other financial assets£3,096m (2007: £3,966m).<br />

Cash and balances at central banks<br />

Substantially all balances are held with central banks. <strong>The</strong>re is limited credit risk in relation to balances at central banks.<br />

Items in the course of collection from other banks<br />

<strong>The</strong>re is limited credit risk in relation to items in the course of collection through the clearing system from other banks.<br />

Other financial assets<br />

Other financial assets comprise £3,096m (2007: £3,966m) of other assets and £609m (2007: £548m) of assets held at fair value.<br />

Off-balance sheet<br />

<strong>The</strong> <strong>Group</strong> applies fundamentally the same risk management policies for off-balance sheet risks as it does for its on-balance sheet risks. In the case of<br />

committments to lend, customers and counterparties will be subject to the same credit management policies as for loans and advances. Collateral may<br />

be sought depending on the strength of the counterparty and the nature of the transaction.<br />

Credit market exposures<br />

<strong>Barclays</strong> Capital’s credit market exposures primarily relate to US residential mortgages, commercial mortgages and leveraged finance businesses that<br />

have been significantly impacted by the continued deterioration in the global credit markets. <strong>The</strong> exposures include both significant positions subject to<br />

fair value movements in the profit and loss account and positions that are classified as loans and advances and available for sale. None of the exposure<br />

disclosed below has been reclassified to loans and advances under the amendments to IAS 39.<br />

<strong>The</strong> exposures are set out by asset class below:<br />

As at As at<br />

31.12.08 31.12.07<br />

US Residential Mortgages £m £m<br />

ABS CDO Super Senior 3,104 4,671<br />

Other US sub-prime 3,441 5,037<br />

Alt-A 4,288 4,916<br />

US RMBS exposure wrapped by monoline insurers 1,639 730<br />

3<br />

<strong>Financial</strong> <strong>statements</strong><br />

Commercial mortgages<br />

Commercial real estate 11,578 11,103<br />

Commercial mortgage-backed securities 735 1,296<br />

CMBS exposure wrapped by monoline insurers 1,854 197<br />

Other Credit Market Exposures<br />

Leveraged finance 10,391 9,027<br />

SIVs and SIV-Lites 963 784<br />

CDPCs 150 19<br />

CLO and other exposure wrapped by monoline insurers 4,939 408<br />

<strong>Barclays</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 277