Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

26 Insurance assets and liabilities (continued)<br />

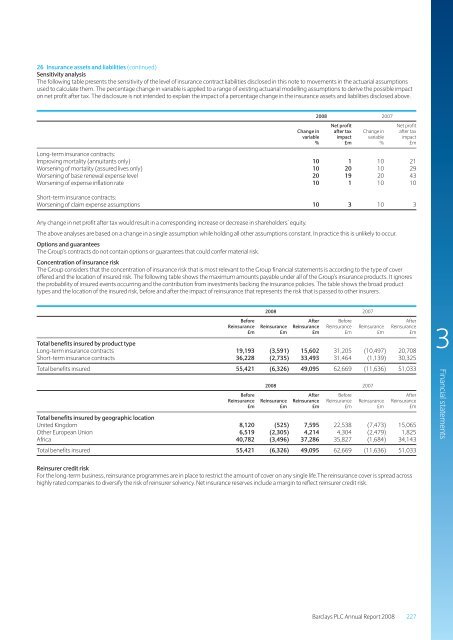

Sensitivity analysis<br />

<strong>The</strong> following table presents the sensitivity of the level of insurance contract liabilities disclosed in this note to movements in the actuarial assumptions<br />

used to calculate them. <strong>The</strong> percentage change in variable is applied to a range of existing actuarial modelling assumptions to derive the possible impact<br />

on net profit after tax. <strong>The</strong> disclosure is not intended to explain the impact of a percentage change in the insurance assets and liabilities disclosed above.<br />

<strong>2008</strong> 2007<br />

Net profit<br />

Net profit<br />

Change in after tax Change in after tax<br />

variable impact variable impact<br />

% £m % £m<br />

Long-term insurance contracts:<br />

Improving mortality (annuitants only) 10 1 10 21<br />

Worsening of mortality (assured lives only) 10 20 10 29<br />

Worsening of base renewal expense level 20 19 20 43<br />

Worsening of expense inflation rate 10 1 10 10<br />

Short-term insurance contracts:<br />

Worsening of claim expense assumptions 10 3 10 3<br />

Any change in net profit after tax would result in a corresponding increase or decrease in shareholders’ equity.<br />

<strong>The</strong> above analyses are based on a change in a single assumption while holding all other assumptions constant. In practice this is unlikely to occur.<br />

Options and guarantees<br />

<strong>The</strong> <strong>Group</strong>’s contracts do not contain options or guarantees that could confer material risk.<br />

Concentration of insurance risk<br />

<strong>The</strong> <strong>Group</strong> considers that the concentration of insurance risk that is most relevant to the <strong>Group</strong> financial <strong>statements</strong> is according to the type of cover<br />

offered and the location of insured risk. <strong>The</strong> following table shows the maximum amounts payable under all of the <strong>Group</strong>’s insurance products. It ignores<br />

the probability of insured events occurring and the contribution from investments backing the insurance policies. <strong>The</strong> table shows the broad product<br />

types and the location of the insured risk, before and after the impact of reinsurance that represents the risk that is passed to other insurers.<br />

<strong>2008</strong> 2007<br />

Before After Before After<br />

Reinsurance Reinsurance Reinsurance Reinsurance Reinsurance Reinsurance<br />

£m £m £m £m £m £m<br />

Total benefits insured by product type<br />

Long-term insurance contracts 19,193 (3,591) 15,602 31,205 (10,497) 20,708<br />

Short-term insurance contracts 36,228 (2,735) 33,493 31,464 (1,139) 30,325<br />

Total benefits insured 55,421 (6,326) 49,095 62,669 (11,636) 51,033<br />

<strong>2008</strong> 2007<br />

Before After Before After<br />

Reinsurance Reinsurance Reinsurance Reinsurance Reinsurance Reinsurance<br />

£m £m £m £m £m £m<br />

Total benefits insured by geographic location<br />

United Kingdom 8,120 (525) 7,595 22,538 (7,473) 15,065<br />

Other European Union 6,519 (2,305) 4,214 4,304 (2,479) 1,825<br />

Africa 40,782 (3,496) 37,286 35,827 (1,684) 34,143<br />

Total benefits insured 55,421 (6,326) 49,095 62,669 (11,636) 51,033<br />

3<br />

<strong>Financial</strong> <strong>statements</strong><br />

Reinsurer credit risk<br />

For the long-term business, reinsurance programmes are in place to restrict the amount of cover on any single life.<strong>The</strong> reinsurance cover is spread across<br />

highly rated companies to diversify the risk of reinsurer solvency. Net insurance reserves include a margin to reflect reinsurer credit risk.<br />

<strong>Barclays</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 227