Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

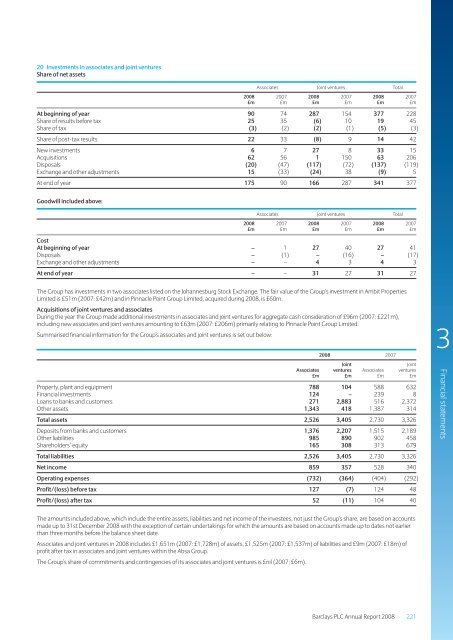

20 Investments in associates and joint ventures<br />

Share of net assets<br />

Associates Joint ventures Total<br />

<strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007<br />

£m £m £m £m £m £m<br />

At beginning of year 90 74 287 154 377 228<br />

Share of results before tax 25 35 (6) 10 19 45<br />

Share of tax (3) (2) (2) (1) (5) (3)<br />

Share of post-tax results 22 33 (8) 9 14 42<br />

New investments 6 7 27 8 33 15<br />

Acquisitions 62 56 1 150 63 206<br />

Disposals (20) (47) (117) (72) (137) (119)<br />

Exchange and other adjustments 15 (33) (24) 38 (9) 5<br />

At end of year 175 90 166 287 341 377<br />

Goodwill included above:<br />

Associates Joint ventures Total<br />

<strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007<br />

£m £m £m £m £m £m<br />

Cost<br />

At beginning of year – 1 27 40 27 41<br />

Disposals – (1) – (16) – (17)<br />

Exchange and other adjustments – – 4 3 4 3<br />

At end of year – – 31 27 31 27<br />

<strong>The</strong> <strong>Group</strong> has investments in two associates listed on the Johannesburg Stock Exchange. <strong>The</strong> fair value of the <strong>Group</strong>’s investment in Ambit Properties<br />

Limited is £51m (2007: £42m) and in Pinnacle Point <strong>Group</strong> Limited, acquired during <strong>2008</strong>, is £60m.<br />

Acquisitions of joint ventures and associates<br />

During the year the <strong>Group</strong> made additional investments in associates and joint ventures for aggregate cash consideration of £96m (2007: £221m),<br />

including new associates and joint ventures amounting to £63m (2007: £206m) primarily relating to Pinnacle Point <strong>Group</strong> Limited.<br />

Summarised financial information for the <strong>Group</strong>’s associates and joint ventures is set out below:<br />

<strong>2008</strong> 2007<br />

Joint<br />

Joint<br />

Associates ventures Associates ventures<br />

£m £m £m £m<br />

Property, plant and equipment 788 104 588 632<br />

<strong>Financial</strong> investments 124 – 239 8<br />

Loans to banks and customers 271 2,883 516 2,372<br />

Other assets 1,343 418 1,387 314<br />

Total assets 2,526 3,405 2,730 3,326<br />

Deposits from banks and customers 1,376 2,207 1,515 2,189<br />

Other liabilities 985 890 902 458<br />

Shareholders’ equity 165 308 313 679<br />

Total liabilities 2,526 3,405 2,730 3,326<br />

Net income 859 357 528 340<br />

Operating expenses (732) (364) (404) (292)<br />

Profit/(loss) before tax 127 (7) 124 48<br />

Profit/(loss) after tax 52 (11) 104 40<br />

3<br />

<strong>Financial</strong> <strong>statements</strong><br />

<strong>The</strong> amounts included above, which include the entire assets, liabilities and net income of the investees, not just the <strong>Group</strong>’s share, are based on accounts<br />

made up to 31st December <strong>2008</strong> with the exception of certain undertakings for which the amounts are based on accounts made up to dates not earlier<br />

than three months before the balance sheet date.<br />

Associates and joint ventures in <strong>2008</strong> includes £1,651m (2007: £1,728m) of assets, £1,525m (2007: £1,537m) of liabilities and £9m (2007: £18m) of<br />

profit after tax in associates and joint ventures within the Absa <strong>Group</strong>.<br />

<strong>The</strong> <strong>Group</strong>’s share of commitments and contingencies of its associates and joint ventures is £nil (2007: £6m).<br />

<strong>Barclays</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 221