Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the accounts<br />

For the year ended 31st December <strong>2008</strong><br />

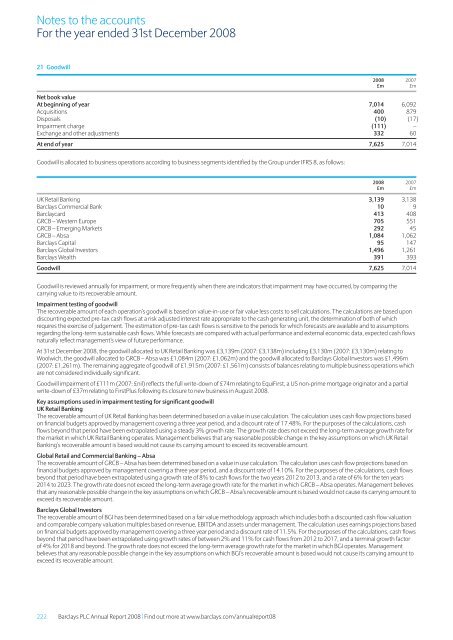

21 Goodwill<br />

<strong>2008</strong> 2007<br />

£m £m<br />

Net book value<br />

At beginning of year 7,014 6,092<br />

Acquisitions 400 879<br />

Disposals (10) (17)<br />

Impairment charge (111) –<br />

Exchange and other adjustments 332 60<br />

At end of year 7,625 7,014<br />

Goodwill is allocated to business operations according to business segments identified by the <strong>Group</strong> under IFRS 8, as follows:<br />

<strong>2008</strong> 2007<br />

£m £m<br />

UK Retail Banking 3,139 3,138<br />

<strong>Barclays</strong> Commercial Bank 10 9<br />

Barclaycard 413 408<br />

GRCB – Western Europe 705 551<br />

GRCB – Emerging Markets 292 45<br />

GRCB – Absa 1,084 1,062<br />

<strong>Barclays</strong> Capital 95 147<br />

<strong>Barclays</strong> Global Investors 1,496 1,261<br />

<strong>Barclays</strong> Wealth 391 393<br />

Goodwill 7,625 7,014<br />

Goodwill is reviewed annually for impairment, or more frequently when there are indicators that impairment may have occurred, by comparing the<br />

carrying value to its recoverable amount.<br />

Impairment testing of goodwill<br />

<strong>The</strong> recoverable amount of each operation’s goodwill is based on value-in-use or fair value less costs to sell calculations. <strong>The</strong> calculations are based upon<br />

discounting expected pre-tax cash flows at a risk adjusted interest rate appropriate to the cash generating unit, the determination of both of which<br />

requires the exercise of judgement. <strong>The</strong> estimation of pre-tax cash flows is sensitive to the periods for which forecasts are available and to assumptions<br />

regarding the long-term sustainable cash flows. While forecasts are compared with actual performance and external economic data, expected cash flows<br />

naturally reflect management’s view of future performance.<br />

At 31st December <strong>2008</strong>, the goodwill allocated to UK Retail Banking was £3,139m (2007: £3,138m) including £3,130m (2007: £3,130m) relating to<br />

Woolwich, the goodwill allocated toGRCB – Absa was £1,084m (2007: £1,062m) and the goodwill allocated to <strong>Barclays</strong> Global Investors was £1,496m<br />

(2007: £1,261m). <strong>The</strong> remaining aggregate of goodwill of £1,915m (2007: £1,561m) consists of balances relating to multiple business operations which<br />

are not considered individually significant.<br />

Goodwill impairment of £111m (2007: £nil) reflects the full write-down of £74m relating to EquiFirst, a US non-prime mortgage originator and a partial<br />

write-down of £37m relating to FirstPlus following its closure to new business in August <strong>2008</strong>.<br />

Key assumptions used in impairment testing for significant goodwill<br />

UK Retail Banking<br />

<strong>The</strong> recoverable amount of UK Retail Banking has been determined based on a value in use calculation. <strong>The</strong> calculation uses cash flow projections based<br />

on financial budgets approved by management covering a three year period, and a discount rate of 17.48%. For the purposes of the calculations, cash<br />

flows beyond that period have been extrapolated using a steady 3% growth rate. <strong>The</strong> growth rate does not exceed the long-term average growth rate for<br />

the market in which UK Retail Banking operates. Management believes that any reasonable possible change in the key assumptions on which UK Retail<br />

Banking’s recoverable amount is based would not cause its carrying amount to exceed its recoverable amount.<br />

Global Retail and Commercial Banking – Absa<br />

<strong>The</strong> recoverable amount of GRCB – Absa has been determined based on a value in use calculation. <strong>The</strong> calculation uses cash flow projections based on<br />

financial budgets approved by management covering a three year period, and a discount rate of 14.10%. For the purposes of the calculations, cash flows<br />

beyond that period have been extrapolated using a growth rate of 8% to cash flows for the two years 2012 to 2013, and a rate of 6% for the ten years<br />

2014 to 2023. <strong>The</strong> growth rate does not exceed the long-term average growth rate for the market in which GRCB – Absa operates. Management believes<br />

that any reasonable possible change in the key assumptions on which GRCB – Absa’s recoverable amount is based would not cause its carrying amount to<br />

exceed its recoverable amount.<br />

<strong>Barclays</strong> Global Investors<br />

<strong>The</strong> recoverable amount of BGI has been determined based on a fair value methodology approach which includes both a discounted cash flow valuation<br />

and comparable company valuation multiples based on revenue, EBITDA and assets under management. <strong>The</strong> calculation uses earnings projections based<br />

on financial budgets approved by management covering a three year period and a discount rate of 11.5%. For the purposes of the calculations, cash flows<br />

beyond that period have been extrapolated using growth rates of between 2% and 11% for cash flows from 2012 to 2017, and a terminal growth factor<br />

of 4% for 2018 and beyond. <strong>The</strong> growth rate does not exceed the long-term average growth rate for the market in which BGI operates. Management<br />

believes that any reasonable possible change in the key assumptions on which BGI’s recoverable amount is based would not cause its carrying amount to<br />

exceed its recoverable amount.<br />

222 <strong>Barclays</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> | Find out more at www.barclays.com/annualreport08