Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

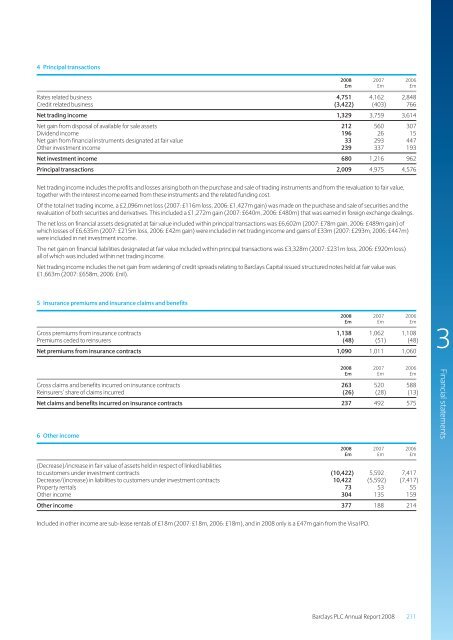

4 Principal transactions<br />

<strong>2008</strong> 2007 2006<br />

£m £m £m<br />

Rates related business 4,751 4,162 2,848<br />

Credit related business (3,422) (403) 766<br />

Net trading income 1,329 3,759 3,614<br />

Net gain from disposal of available for sale assets 212 560 307<br />

Dividend income 196 26 15<br />

Net gain from financial instruments designated at fair value 33 293 447<br />

Other investment income 239 337 193<br />

Net investment income 680 1,216 962<br />

Principal transactions 2,009 4,975 4,576<br />

Net trading income includes the profits and losses arising both on the purchase and sale of trading instruments and from the revaluation to fair value,<br />

together with the interest income earned from these instruments and the related funding cost.<br />

Of the total net trading income, a £2,096m net loss (2007: £116m loss, 2006: £1,427m gain) was made on the purchase and sale of securities and the<br />

revaluation of both securities and derivatives. This included a £1,272m gain (2007: £640m, 2006: £480m) that was earned in foreign exchange dealings.<br />

<strong>The</strong> net loss on financial assets designated at fair value included within principal transactions was £6,602m (2007: £78m gain, 2006: £489m gain) of<br />

which losses of £6,635m (2007: £215m loss, 2006: £42m gain) were included in net trading income and gains of £33m (2007: £293m, 2006: £447m)<br />

were included in net investment income.<br />

<strong>The</strong> net gain on financial liabilities designated at fair value included within principal transactions was £3,328m (2007: £231m loss, 2006: £920m loss)<br />

all of which was included within net trading income.<br />

Net trading income includes the net gain from widening of credit spreads relating to <strong>Barclays</strong> Capital issued structured notes held at fair value was<br />

£1,663m (2007: £658m, 2006: £nil).<br />

5 Insurance premiums and insurance claims and benefits<br />

<strong>2008</strong> 2007 2006<br />

£m £m £m<br />

Gross premiums from insurance contracts 1,138 1,062 1,108<br />

Premiums ceded to reinsurers (48) (51) (48)<br />

Net premiums from insurance contracts 1,090 1,011 1,060<br />

3<br />

<strong>2008</strong> 2007 2006<br />

£m £m £m<br />

Gross claims and benefits incurred on insurance contracts 263 520 588<br />

Reinsurers’ share of claims incurred (26) (28) (13)<br />

Net claims and benefits incurred on insurance contracts 237 492 575<br />

6 Other income<br />

<strong>Financial</strong> <strong>statements</strong><br />

<strong>2008</strong> 2007 2006<br />

£m £m £m<br />

(Decrease)/increase in fair value of assets held in respect of linked liabilities<br />

to customers under investment contracts (10,422) 5,592 7,417<br />

Decrease/(increase) in liabilities to customers under investment contracts 10,422 (5,592) (7,417)<br />

Property rentals 73 53 55<br />

Other income 304 135 159<br />

Other income 377 188 214<br />

Included in other income are sub-lease rentals of £18m (2007: £18m, 2006: £18m), and in <strong>2008</strong> only is a £47m gain from the Visa IPO.<br />

<strong>Barclays</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 211