Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the accounts<br />

For the year ended 31st December <strong>2008</strong><br />

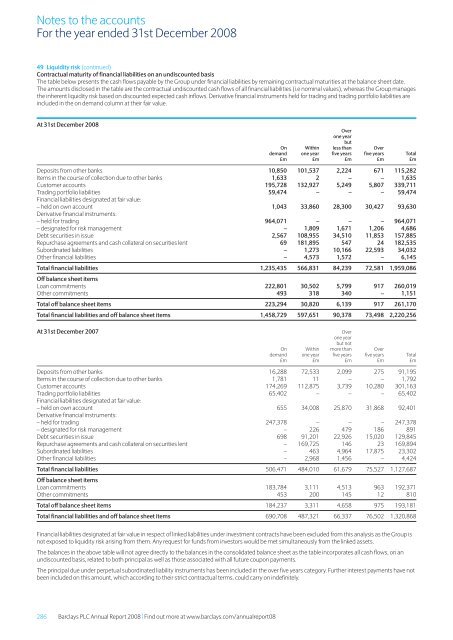

49 Liquidity risk (continued)<br />

Contractual maturity of financial liabilities on an undiscounted basis<br />

<strong>The</strong> table below presents the cash flows payable by the <strong>Group</strong> under financial liabilities by remaining contractual maturities at the balance sheet date.<br />

<strong>The</strong> amounts disclosed in the table are the contractual undiscounted cash flows of all financial liabilities (i.e nominal values), whereas the <strong>Group</strong> manages<br />

the inherent liquidity risk based on discounted expected cash inflows. Derivative financial instruments held for trading and trading portfolio liabilities are<br />

included in the on demand column at their fair value.<br />

At 31st December <strong>2008</strong><br />

Over<br />

one year<br />

but<br />

On Within less than Over<br />

demand one year five years five years Total<br />

£m £m £m £m £m<br />

Deposits from other banks 10,850 101,537 2,224 671 115,282<br />

Items in the course of collection due to other banks 1,633 2 – – 1,635<br />

Customer accounts 195,728 132,927 5,249 5,807 339,711<br />

Trading portfolio liabilities 59,474 – – – 59,474<br />

<strong>Financial</strong> liabilities designated at fair value:<br />

– held on own account 1,043 33,860 28,300 30,427 93,630<br />

Derivative financial instruments:<br />

– held for trading 964,071 – – – 964,071<br />

– designated for risk management – 1,809 1,671 1,206 4,686<br />

Debt securities in issue 2,567 108,955 34,510 11,853 157,885<br />

Repurchase agreements and cash collateral on securities lent 69 181,895 547 24 182,535<br />

Subordinated liabilities – 1,273 10,166 22,593 34,032<br />

Other financial liabilities – 4,573 1,572 – 6,145<br />

Total financial liabilities 1,235,435 566,831 84,239 72,581 1,959,086<br />

Off balance sheet items<br />

Loan commitments 222,801 30,502 5,799 917 260,019<br />

Other commitments 493 318 340 – 1,151<br />

Total off balance sheet items 223,294 30,820 6,139 917 261,170<br />

Total financial liabilities and off balance sheet items 1,458,729 597,651 90,378 73,498 2,220,256<br />

At 31st December 2007<br />

Over<br />

one year<br />

but not<br />

On Within more than Over<br />

demand one year five years five years Total<br />

£m £m £m £m £m<br />

Deposits from other banks 16,288 72,533 2,099 275 91,195<br />

Items in the course of collection due to other banks 1,781 11 – – 1,792<br />

Customer accounts 174,269 112,875 3,739 10,280 301,163<br />

Trading portfolio liabilities 65,402 – – – 65,402<br />

<strong>Financial</strong> liabilities designated at fair value:<br />

– held on own account 655 34,008 25,870 31,868 92,401<br />

Derivative financial instruments:<br />

– held for trading 247,378 – – – 247,378<br />

– designated for risk management – 226 479 186 891<br />

Debt securities in issue 698 91,201 22,926 15,020 129,845<br />

Repurchase agreements and cash collateral on securities lent – 169,725 146 23 169,894<br />

Subordinated liabilities – 463 4,964 17,875 23,302<br />

Other financial liabilities – 2,968 1,456 – 4,424<br />

Total financial liabilities 506,471 484,010 61,679 75,527 1,127,687<br />

Off balance sheet items<br />

Loan commitments 183,784 3,111 4,513 963 192,371<br />

Other commitments 453 200 145 12 810<br />

Total off balance sheet items 184,237 3,311 4,658 975 193,181<br />

Total financial liabilities and off balance sheet items 690,708 487,321 66,337 76,502 1,320,868<br />

<strong>Financial</strong> liabilities designated at fair value in respect of linked liabilities under investment contracts have been excluded from this analysis as the <strong>Group</strong> is<br />

not exposed to liquidity risk arising from them. Any request for funds from investors would be met simultaneously from the linked assets.<br />

<strong>The</strong> balances in the above table will not agree directly to the balances in the consolidated balance sheet as the table incorporates all cash flows, on an<br />

undiscounted basis, related to both principal as well as those associated with all future coupon payments.<br />

<strong>The</strong> principal due under perpetual subordinated liability instruments has been included in the over five years category. Further interest payments have not<br />

been included on this amount, which according to their strict contractual terms, could carry on indefinitely.<br />

286 <strong>Barclays</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> | Find out more at www.barclays.com/annualreport08