Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the accounts<br />

For the year ended 31st December <strong>2008</strong><br />

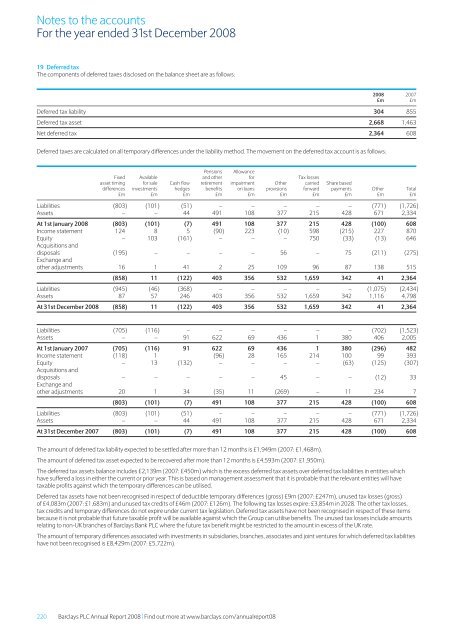

19 Deferred tax<br />

<strong>The</strong> components of deferred taxes disclosed on the balance sheet are as follows:<br />

<strong>2008</strong> 2007<br />

£m £m<br />

Deferred tax liability 304 855<br />

Deferred tax asset 2,668 1,463<br />

Net deferred tax 2,364 608<br />

Deferred taxes are calculated on all temporary differences under the liability method. <strong>The</strong> movement on the deferred tax account is as follows:<br />

Pensions Allowance<br />

Fixed Available and other for Tax losses<br />

asset timing for sale Cash flow retirement impairment Other carried Share based<br />

differences investments hedges benefits on loans provisions forward payments Other Total<br />

£m £m £m £m £m £m £m £m £m £m<br />

Liabilities (803) (101) (51) – – – – – (771) (1,726)<br />

Assets – – 44 491 108 377 215 428 671 2,334<br />

At 1st January <strong>2008</strong> (803) (101) (7) 491 108 377 215 428 (100) 608<br />

Income statement 124 8 5 (90) 223 (10) 598 (215) 227 870<br />

Equity – 103 (161) – – – 750 (33) (13) 646<br />

Acquisitions and<br />

disposals (195) – – – – 56 – 75 (211) (275)<br />

Exchange and<br />

other adjustments 16 1 41 2 25 109 96 87 138 515<br />

(858) 11 (122) 403 356 532 1,659 342 41 2,364<br />

Liabilities (945) (46) (368) – – – – – (1,075) (2,434)<br />

Assets 87 57 246 403 356 532 1,659 342 1,116 4,798<br />

At 31st December <strong>2008</strong> (858) 11 (122) 403 356 532 1,659 342 41 2,364<br />

Liabilities (705) (116) – – – – – – (702) (1,523)<br />

Assets – – 91 622 69 436 1 380 406 2,005<br />

At 1st January 2007 (705) (116) 91 622 69 436 1 380 (296) 482<br />

Income statement (118) 1 (96) 28 165 214 100 99 393<br />

Equity – 13 (132) – – – – (63) (125) (307)<br />

Acquisitions and<br />

disposals – – – – – 45 – – (12) 33<br />

Exchange and<br />

other adjustments 20 1 34 (35) 11 (269) – 11 234 7<br />

(803) (101) (7) 491 108 377 215 428 (100) 608<br />

Liabilities (803) (101) (51) – – – – – (771) (1,726)<br />

Assets – – 44 491 108 377 215 428 671 2,334<br />

At 31st December 2007 (803) (101) (7) 491 108 377 215 428 (100) 608<br />

<strong>The</strong> amount of deferred tax liability expected to be settled after more than 12 months is £1,949m (2007: £1,468m).<br />

<strong>The</strong> amount of deferred tax asset expected to be recovered after more than 12 months is £4,593m (2007: £1,950m).<br />

<strong>The</strong> deferred tax assets balance includes £2,139m (2007: £450m) which is the excess deferred tax assets over deferred tax liabilities in entities which<br />

have suffered a loss in either the current or prior year. This is based on management assessment that it is probable that the relevant entities will have<br />

taxable profits against which the temporary differences can be utilised.<br />

Deferred tax assets have not been recognised in respect of deductible temporary differences (gross) £9m (2007: £247m), unused tax losses (gross)<br />

of £4,083m (2007: £1,683m) and unused tax credits of £46m (2007: £126m). <strong>The</strong> following tax losses expire: £3,854m in 2028. <strong>The</strong> other tax losses,<br />

tax credits and temporary differences do not expire under current tax legislation. Deferred tax assets have not been recognised in respect of these items<br />

because it is not probable that future taxable profit will be available against which the <strong>Group</strong> can utilise benefits. <strong>The</strong> unused tax losses include amounts<br />

relating to non-UK branches of <strong>Barclays</strong> Bank PLC where the future tax benefit might be restricted to the amount in excess of the UK rate.<br />

<strong>The</strong> amount of temporary differences associated with investments in subsidiaries, branches, associates and joint ventures for which deferred tax liabilities<br />

have not been recognised is £8,429m (2007: £5,722m).<br />

220 <strong>Barclays</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> | Find out more at www.barclays.com/annualreport08