Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

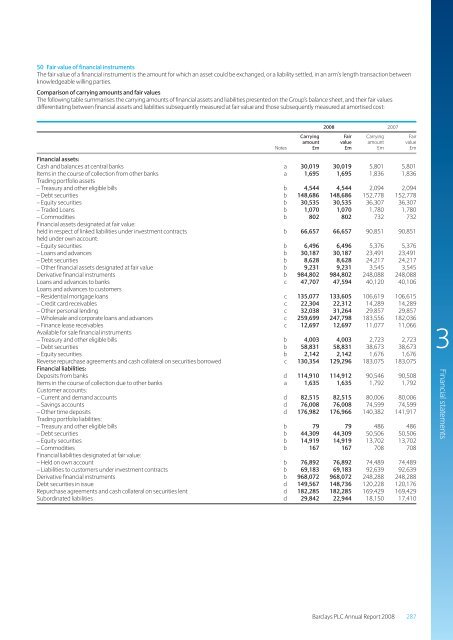

50 Fair value of financial instruments<br />

<strong>The</strong> fair value of a financial instrument is the amount for which an asset could be exchanged, or a liability settled, in an arm’s length transaction between<br />

knowledgeable willing parties.<br />

Comparison of carrying amounts and fair values<br />

<strong>The</strong> following table summarises the carrying amounts of financial assets and liabilities presented on the <strong>Group</strong>’s balance sheet, and their fair values<br />

differentiating between financial assets and liabilities subsequently measured at fair value and those subsequently measured at amortised cost:<br />

<strong>2008</strong> 2007<br />

Carrying Fair Carrying Fair<br />

amount value amount value<br />

Notes £m £m £m £m<br />

<strong>Financial</strong> assets:<br />

Cash and balances at central banks a 30,019 30,019 5,801 5,801<br />

Items in the course of collection from other banks a 1,695 1,695 1,836 1,836<br />

Trading portfolio assets<br />

– Treasury and other eligible bills b 4,544 4,544 2,094 2,094<br />

– Debt securities b 148,686 148,686 152,778 152,778<br />

– Equity securities b 30,535 30,535 36,307 36,307<br />

– Traded Loans b 1,070 1,070 1,780 1,780<br />

– Commodities b 802 802 732 732<br />

<strong>Financial</strong> assets designated at fair value:<br />

held in respect of linked liabilities under investment contracts b 66,657 66,657 90,851 90,851<br />

held under own account:<br />

– Equity securities b 6,496 6,496 5,376 5,376<br />

– Loans and advances b 30,187 30,187 23,491 23,491<br />

– Debt securities b 8,628 8,628 24,217 24,217<br />

– Other financial assets designated at fair value b 9,231 9,231 3,545 3,545<br />

Derivative financial instruments b 984,802 984,802 248,088 248,088<br />

Loans and advances to banks c 47,707 47,594 40,120 40,106<br />

Loans and advances to customers<br />

– Residential mortgage loans c 135,077 133,605 106,619 106,615<br />

– Credit card receivables c 22,304 22,312 14,289 14,289<br />

– Other personal lending c 32,038 31,264 29,857 29,857<br />

– Wholesale and corporate loans and advances c 259,699 247,798 183,556 182,036<br />

– Finance lease receivables c 12,697 12,697 11,077 11,066<br />

Available for sale financial instruments<br />

– Treasury and other eligible bills b 4,003 4,003 2,723 2,723<br />

– Debt securities b 58,831 58,831 38,673 38,673<br />

– Equity securities b 2,142 2,142 1,676 1,676<br />

Reverse repurchase agreements and cash collateral on securities borrowed c 130,354 129,296 183,075 183,075<br />

<strong>Financial</strong> liabilities:<br />

Deposits from banks d 114,910 114,912 90,546 90,508<br />

Items in the course of collection due to other banks a 1,635 1,635 1,792 1,792<br />

Customer accounts:<br />

– Current and demand accounts d 82,515 82,515 80,006 80,006<br />

– Savings accounts d 76,008 76,008 74,599 74,599<br />

– Other time deposits d 176,982 176,966 140,382 141,917<br />

Trading portfolio liabilities:<br />

– Treasury and other eligible bills b 79 79 486 486<br />

– Debt securities b 44,309 44,309 50,506 50,506<br />

– Equity securities b 14,919 14,919 13,702 13,702<br />

– Commodities b 167 167 708 708<br />

<strong>Financial</strong> liabilities designated at fair value:<br />

– Held on own account b 76,892 76,892 74,489 74,489<br />

– Liabilities to customers under investment contracts b 69,183 69,183 92,639 92,639<br />

Derivative financial instruments b 968,072 968,072 248,288 248,288<br />

Debt securities in issue d 149,567 148,736 120,228 120,176<br />

Repurchase agreements and cash collateral on securities lent d 182,285 182,285 169,429 169,429<br />

Subordinated liabilities d 29,842 22,944 18,150 17,410<br />

3<br />

<strong>Financial</strong> <strong>statements</strong><br />

<strong>Barclays</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 287