Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

47 Credit risk (continued)<br />

Renegotiated loans and advances<br />

Loans and advances are generally renegotiated either as part of an ongoing customer relationship or in response to an adverse change in the<br />

circumstances of the borrower. In the latter case renegotiation can result in an extension of the due date of payment or repayment plans under which<br />

the <strong>Group</strong> offers a concessionary rate of interest to genuinely distressed borrowers. This will result in the asset continuing to be overdue and will be<br />

individually impaired where the renegotiated payments of interest and principal will not recover the original carrying amount of the asset. In other cases,<br />

renegotiation will lead to a new agreement, which is treated as a new loan.<br />

Collateral and other credit enhancements held<br />

<strong>Financial</strong> assets that are past due or individually assessed as impaired may be partially or fully collateralised or subject to other forms of credit enhancement.<br />

Assets in these categories subject to collateralisation are mainly corporate loans, residential mortgage loans and finance lease receivables. Credit card<br />

receivables and other personal lending are generally unsecured (although in some instances a charge over the borrowers property of other assets may<br />

be sought).<br />

Corporate loans<br />

Security is usually taken in the form of a fixed charge over the borrower’s property or a floating charge over the assets of the borrower. Loan covenants<br />

may be put in place to safeguard the <strong>Group</strong>’s financial position. If the exposure is sufficiently large, either individually or at the portfolio level, credit<br />

protection in the form of guarantees, credit derivatives or insurance may be taken out.<br />

For these and other reasons collateral given is only accurately valued on origination of the loan or in the course of enforcement actions and as a result it is<br />

not practicable to estimate the fair value of the collateral held.<br />

Residential mortgage loans<br />

<strong>The</strong>se are secured by a fixed charge over the property.<br />

A description and the estimated fair value of collateral held in respect of residential mortgage loans that are past due or individually assessed as impaired<br />

is as follows:<br />

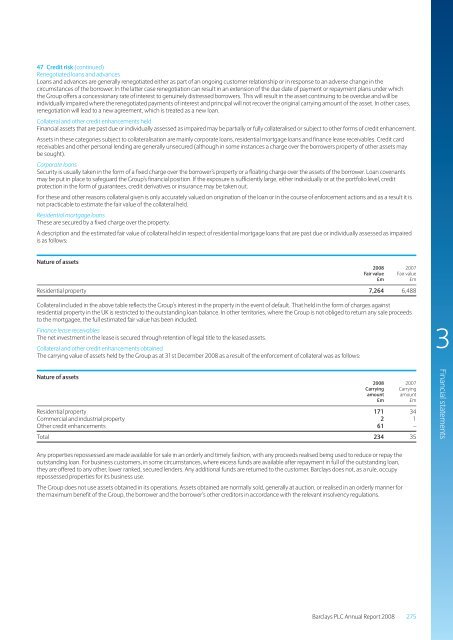

Nature of assets<br />

<strong>2008</strong> 2007<br />

Fair value Fair value<br />

£m £m<br />

Residential property 7,264 6,488<br />

Collateral included in the above table reflects the <strong>Group</strong>’s interest in the property in the event of default. That held in the form of charges against<br />

residential property in the UK is restricted to the outstanding loan balance. In other territories, where the <strong>Group</strong> is not obliged to return any sale proceeds<br />

to the mortgagee, the full estimated fair value has been included.<br />

Finance lease receivables<br />

<strong>The</strong> net investment in the lease is secured through retention of legal title to the leased assets.<br />

Collateral and other credit enhancements obtained<br />

<strong>The</strong> carrying value of assets held by the <strong>Group</strong> as at 31st December <strong>2008</strong> as a result of the enforcement of collateral was as follows:<br />

3<br />

Nature of assets<br />

<strong>2008</strong> 2007<br />

Carrying Carrying<br />

amount amount<br />

£m £m<br />

Residential property 171 34<br />

Commercial and industrial property 2 1<br />

Other credit enhancements 61 –<br />

Total 234 35<br />

<strong>Financial</strong> <strong>statements</strong><br />

Any properties repossessed are made available for sale in an orderly and timely fashion, with any proceeds realised being used to reduce or repay the<br />

outstanding loan. For business customers, in some circumstances, where excess funds are available after repayment in full of the outstanding loan,<br />

they are offered to any other, lower ranked, secured lenders. Any additional funds are returned to the customer. <strong>Barclays</strong> does not, as a rule, occupy<br />

repossessed properties for its business use.<br />

<strong>The</strong> <strong>Group</strong> does not use assets obtained in its operations. Assets obtained are normally sold, generally at auction, or realised in an orderly manner for<br />

the maximum benefit of the <strong>Group</strong>, the borrower and the borrower’s other creditors in accordance with the relevant insolvency regulations.<br />

<strong>Barclays</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> 275