Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Barclays plc - Annual Report 2008 - Financial statements - The Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the accounts<br />

For the year ended 31st December <strong>2008</strong><br />

31 Ordinary shares, share premium, and other equity (continued)<br />

In addition to the above, the independent trustee of the <strong>Barclays</strong> <strong>Group</strong> (ESAS) Employees’ Benefit Trust (ESAS Trust), established by <strong>Barclays</strong> Bank PLC<br />

in 1996, operates the Executive Share Award Scheme (ESAS). ESAS is a deferred share bonus plan for employees of the <strong>Group</strong>. <strong>The</strong> key terms of the ESAS<br />

are described in Note 45. <strong>The</strong> independent trustees of the ESAS Trust make awards of <strong>Barclays</strong> shares and grant options over <strong>Barclays</strong> shares to<br />

beneficiaries of the ESAS Trust. Beneficiaries of the ESAS Trust include employees and former employees of the <strong>Barclays</strong> <strong>Group</strong>.<br />

<strong>The</strong> independent trustee of the <strong>Barclays</strong> <strong>Group</strong> (PSP and ESOS) Employees’ Benefit Trust (PSP Trust), established by <strong>Barclays</strong> Bank PLC in 1996, operates<br />

the Performance Share Plan (PSP) and may satisfy awards under the ESOS. No awards have been made under this trust since 1999. All awards are in the<br />

form of options over <strong>Barclays</strong> shares.<br />

<strong>The</strong> Sharepurchase scheme which was established in 2002 is open to all eligible UK employees, including executive Directors. <strong>The</strong> key terms of the<br />

Sharepurchase scheme are described in Note 45.<br />

Other equity – Mandatorily Convertible Notes<br />

On 27th November <strong>2008</strong>, <strong>Barclays</strong> Bank PLC issued £4,050m of 9.75% Mandatorily Convertible Notes (MCNs) maturing on 30th September 2009 to<br />

Qatar Holding LLC, Challenger Universal Limited and entities representing the beneficial interests of HH Sheikh Mansour Bin Zayed Al Nahyan, a member<br />

of the Royal Family of Abu Dhabi and existing institutional shareholders and other institutional investors. If not converted at the holders’ option<br />

beforehand, these instruments mandatorily convert to ordinary shares of <strong>Barclays</strong> PLC on 30th June 2009. <strong>The</strong> conversion price is £1.53276, and, after<br />

taking into account MCNs that were converted on or before 31st December <strong>2008</strong>, will result in the issue of 2,642 million new ordinary shares. Following<br />

conversion the relevant amounts will be credited to share capital and share premium.<br />

Of the proceeds of the MCNs, £233m has been included in the <strong>Group</strong>’s liabilities, being the fair value of the coupon before issue costs at the date of issue.<br />

<strong>The</strong> remaining proceeds are included in other equity and will be transferred to share capital and share premium on conversion in both the <strong>Barclays</strong> PLC <strong>Group</strong><br />

and Company.<br />

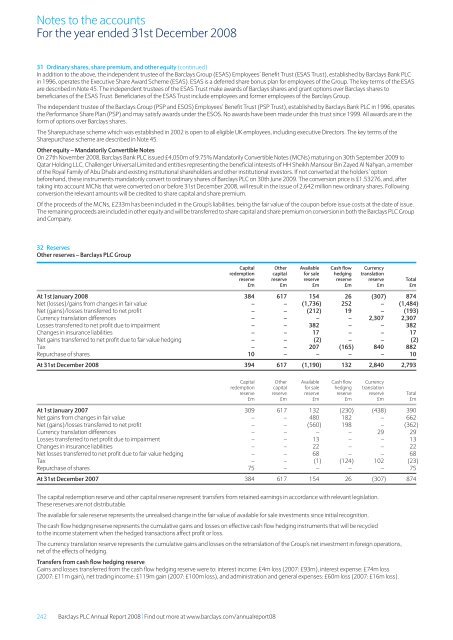

32 Reserves<br />

Other reserves – <strong>Barclays</strong> PLC <strong>Group</strong><br />

Capital Other Available Cash flow Currency<br />

redemption capital for sale hedging translation<br />

reserve reserve reserve reserve reserve Total<br />

£m £m £m £m £m £m<br />

At 1st January <strong>2008</strong> 384 617 154 26 (307) 874<br />

Net (losses)/gains from changes in fair value – – (1,736) 252 – (1,484)<br />

Net (gains)/losses transferred to net profit – – (212) 19 – (193)<br />

Currency translation differences – – – – 2,307 2,307<br />

Losses transferred to net profit due to impairment – – 382 – – 382<br />

Changes in insurance liabilities – – 17 – – 17<br />

Net gains transferred to net profit due to fair value hedging – – (2) – – (2)<br />

Tax – – 207 (165) 840 882<br />

Repurchase of shares 10 – – – – 10<br />

At 31st December <strong>2008</strong> 394 617 (1,190) 132 2,840 2,793<br />

Capital Other Available Cash flow Currency<br />

redemption capital for sale hedging translation<br />

reserve reserve reserve reserve reserve Total<br />

£m £m £m £m £m £m<br />

At 1st January 2007 309 617 132 (230) (438) 390<br />

Net gains from changes in fair value – – 480 182 – 662<br />

Net (gains)/losses transferred to net profit – – (560) 198 – (362)<br />

Currency translation differences – – – – 29 29<br />

Losses transferred to net profit due to impairment – – 13 – – 13<br />

Changes in insurance liabilities – – 22 – – 22<br />

Net losses transferred to net profit due to fair value hedging – – 68 – – 68<br />

Tax – – (1) (124) 102 (23)<br />

Repurchase of shares 75 – – – – 75<br />

At 31st December 2007 384 617 154 26 (307) 874<br />

<strong>The</strong> capital redemption reserve and other capital reserve represent transfers from retained earnings in accordance with relevant legislation.<br />

<strong>The</strong>se reserves are not distributable.<br />

<strong>The</strong> available for sale reserve represents the unrealised change in the fair value of available for sale investments since initial recognition.<br />

<strong>The</strong> cash flow hedging reserve represents the cumulative gains and losses on effective cash flow hedging instruments that will be recycled<br />

to the income statement when the hedged transactions affect profit or loss.<br />

<strong>The</strong> currency translation reserve represents the cumulative gains and losses on the retranslation of the <strong>Group</strong>’s net investment in foreign operations,<br />

net of the effects of hedging.<br />

Transfers from cash flow hedging reserve<br />

Gains and losses transferred from the cash flow hedging reserve were to: interest income: £4m loss (2007: £93m), interest expense: £74m loss<br />

(2007: £11m gain), net trading income: £119m gain (2007: £100m loss), and administration and general expenses: £60m loss (2007: £16m loss).<br />

242 <strong>Barclays</strong> PLC <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> | Find out more at www.barclays.com/annualreport08