0130679593

0130679593

0130679593

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NAME CLASS DATE<br />

Section 4: Guided Reading and Review<br />

Financing State and Local Government<br />

CHAPTER<br />

25<br />

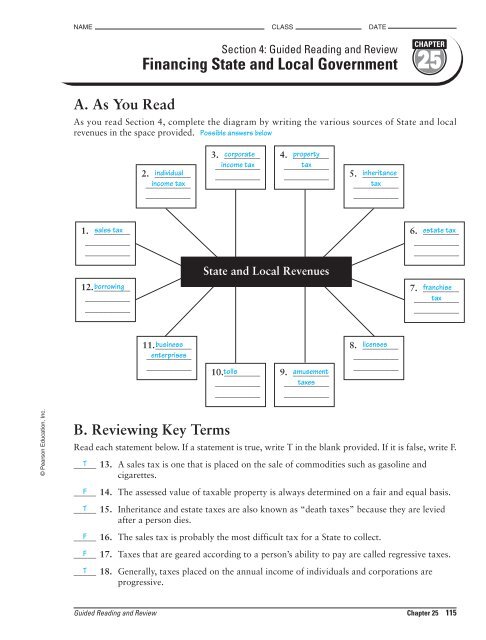

A. As You Read<br />

As you read Section 4, complete the diagram by writing the various sources of State and local<br />

revenues in the space provided. Possible answers below<br />

2. ________ individual<br />

__________<br />

income tax<br />

__________<br />

3. ________ corporate<br />

__________<br />

income tax<br />

__________<br />

4. ________ property<br />

__________ tax<br />

__________<br />

5. ________ inheritance<br />

__________ tax<br />

__________<br />

1. ________ sales tax<br />

__________<br />

__________<br />

12.________ borrowing<br />

__________<br />

__________<br />

State and Local Revenues<br />

6. ________ estate tax<br />

__________<br />

__________<br />

7. ________ franchise<br />

__________ tax<br />

__________<br />

11.________ business<br />

__________<br />

enterprises<br />

__________<br />

10.________<br />

tolls<br />

__________<br />

__________<br />

9. ________ amusement<br />

__________ taxes<br />

__________<br />

8. ________ licenses<br />

__________<br />

__________<br />

© Pearson Education, Inc.<br />

B. Reviewing Key Terms<br />

Read each statement below. If a statement is true, write T in the blank provided. If it is false, write F.<br />

_____ T 13. A sales tax is one that is placed on the sale of commodities such as gasoline and<br />

cigarettes.<br />

_____ F 14. The assessed value of taxable property is always determined on a fair and equal basis.<br />

_____ T 15. Inheritance and estate taxes are also known as “death taxes” because they are levied<br />

after a person dies.<br />

_____ F 16. The sales tax is probably the most difficult tax for a State to collect.<br />

_____ F 17. Taxes that are geared according to a person’s ability to pay are called regressive taxes.<br />

_____ T 18. Generally, taxes placed on the annual income of individuals and corporations are<br />

progressive.<br />

Guided Reading and Review Chapter 25 115