0130679593

0130679593

0130679593

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NAME CLASS DATE<br />

CHAPTER<br />

16<br />

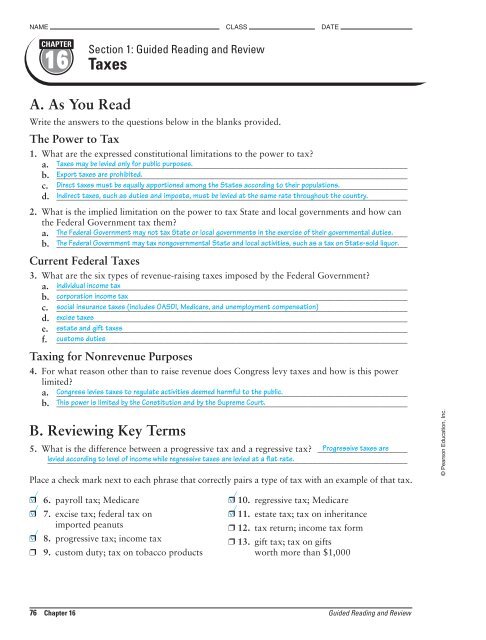

Section 1: Guided Reading and Review<br />

Taxes<br />

A. As You Read<br />

Write the answers to the questions below in the blanks provided.<br />

The Power to Tax<br />

1. What are the expressed constitutional limitations to the power to tax?<br />

a. ______________________________________________________________________________<br />

Taxes may be levied only for public purposes.<br />

b. ______________________________________________________________________________<br />

Export taxes are prohibited.<br />

c. ______________________________________________________________________________<br />

Direct taxes must be equally apportioned among the States according to their populations.<br />

d. ______________________________________________________________________________<br />

Indirect taxes, such as duties and imposts, must be levied at the same rate throughout the country.<br />

2. What is the implied limitation on the power to tax State and local governments and how can<br />

the Federal Government tax them?<br />

a. ______________________________________________________________________________<br />

The Federal Government may not tax State or local governments in the exercise of their governmental duties.<br />

b. ______________________________________________________________________________<br />

The Federal Government may tax nongovernmental State and local activities, such as a tax on State-sold liquor.<br />

Current Federal Taxes<br />

3. What are the six types of revenue-raising taxes imposed by the Federal Government?<br />

a. ______________________________________________________________________________<br />

individual income tax<br />

b. ______________________________________________________________________________<br />

corporation income tax<br />

c. ______________________________________________________________________________<br />

social insurance taxes (includes OASDI, Medicare, and unemployment compensation)<br />

d. ______________________________________________________________________________<br />

excise taxes<br />

e. ______________________________________________________________________________<br />

estate and gift taxes<br />

f. ______________________________________________________________________________<br />

customs duties<br />

Taxing for Nonrevenue Purposes<br />

4. For what reason other than to raise revenue does Congress levy taxes and how is this power<br />

limited?<br />

a. ______________________________________________________________________________<br />

Congress levies taxes to regulate activities deemed harmful to the public.<br />

b. ______________________________________________________________________________<br />

This power is limited by the Constitution and by the Supreme Court.<br />

B. Reviewing Key Terms<br />

5. What is the difference between a progressive tax and a regressive tax? ____________________<br />

Progressive taxes are<br />

________________________________________________________________________________<br />

levied according to level of income while regressive taxes are levied at a flat rate.<br />

Place a check mark next to each phrase that correctly pairs a type of tax with an example of that tax.<br />

<br />

<br />

❒<br />

❒<br />

<br />

❒<br />

❒<br />

6. payroll tax; Medicare<br />

7. excise tax; federal tax on<br />

imported peanuts<br />

8. progressive tax; income tax<br />

9. custom duty; tax on tobacco products<br />

<br />

❒ 10. regressive tax; Medicare<br />

❒<br />

11. estate tax; tax on inheritance<br />

❒ 12. tax return; income tax form<br />

❒ 13. gift tax; tax on gifts<br />

worth more than $1,000<br />

© Pearson Education, Inc.<br />

76 Chapter 16 Guided Reading and Review