Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

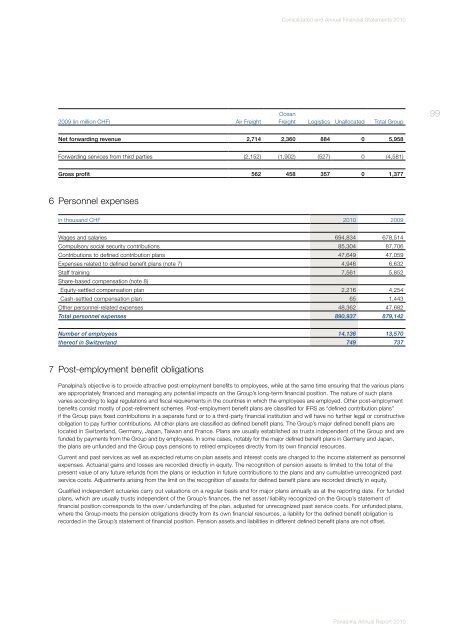

Consolidated and <strong>Annual</strong> Financial Statements <strong>2010</strong><br />

2009 (in million CHF) Air Freight<br />

Ocean<br />

Freight Logistics Unallocated Total Group<br />

99<br />

Net forwarding revenue 2,714 2,360 884 0 5,958<br />

Forwarding services from third parties (2,152) (1,902) (527) 0 (4,581)<br />

Gross profit 562 458 357 0 1,377<br />

6<br />

Personnel expenses<br />

in thousand CHF <strong>2010</strong> 2009<br />

Wages and salaries 694,834 678,514<br />

Compulsory social security contributions 85,304 87,706<br />

Contributions to defined contribution plans 47,649 47,059<br />

Expenses related to defined benefit plans (note 7) 4,946 6,632<br />

Staff training 7,561 5,852<br />

Share-based compensation (note 8)<br />

Equity-settled compensation plan 2,216 4,254<br />

Cash-settled compensation plan 65 1,443<br />

Other personnel-related expenses 48,362 47,682<br />

Total personnel expenses 890,937 879,142<br />

Number of employees 14,136 13,570<br />

thereof in Switzerland 749 737<br />

7 Post-employment benefit obligations<br />

<strong>Panalpina</strong>’s objective is to provide attractive post-employment benefits to employees, while at the same time ensuring that the various plans<br />

are appropriately financed and managing any potential impacts on the Group’s long-term financial position. The nature of such plans<br />

varies according to legal regulations and fiscal requirements in the countries in which the employees are employed. Other post-employment<br />

benefits consist mostly of post-retirement schemes. Post-employment benefit plans are classified for IFRS as “defined contribution plans”<br />

if the Group pays fixed contributions in a separate fund or to a third-party financial institution and will have no further legal or constructive<br />

obligation to pay further contributions. All other plans are classified as defined benefit plans. The Group’s major defined benefit plans are<br />

located in Switzerland, Germany, Japan, Taiwan and France. Plans are usually established as trusts independent of the Group and are<br />

funded by payments from the Group and by employees. In some cases, notably for the major defined benefit plans in Germany and Japan,<br />

the plans are unfunded and the Group pays pensions to retired employees directly from its own financial resources.<br />

Current and past services as well as expected returns on plan assets and interest costs are charged to the income statement as personnel<br />

expenses. Actuarial gains and losses are recorded directly in equity. The recognition of pension assets is limited to the total of the<br />

present value of any future refunds from the plans or reduction in future contributions to the plans and any cumulative unrecognized past<br />

service costs. Adjustments arising from the limit on the recognition of assets for defined benefit plans are recorded directly in equity.<br />

Qualified independent actuaries carry out valuations on a regular basis and for major plans annually as at the reporting date. For funded<br />

plans, which are usually trusts independent of the Group’s finances, the net asset / liability recognized on the Group’s statement of<br />

financial position corresponds to the over / underfunding of the plan, adjusted for unrecognized past service costs. For unfunded plans,<br />

where the Group meets the pension obligations directly from its own financial resources, a liability for the defined benefit obligation is<br />

recorded in the Group’s statement of financial position. Pension assets and liabilities in different defined benefit plans are not offset.<br />

<strong>Panalpina</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>