Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated and <strong>Annual</strong> Financial Statements <strong>2010</strong><br />

102<br />

Expected rates of salary increases, which are used to calculate the defined benefit obligation and the current service cost included in the<br />

income statement, are based on the latest expectation and historical behaviour within Group entities.<br />

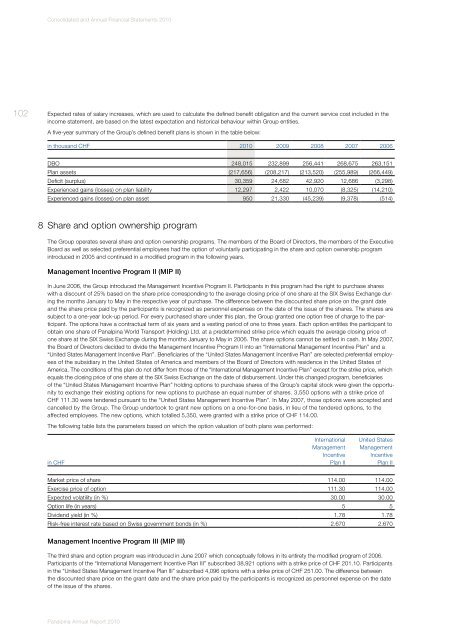

A five-year summary of the Group’s defined benefit plans is shown in the table below:<br />

in thousand CHF <strong>2010</strong> 2009 2008 2007 2006<br />

DBO 248,015 232,899 256,441 268,675 263,151<br />

Plan assets (217,656) (208,217) (213,520) (255,989) (266,449)<br />

Deficit (surplus) 30,359 24,682 42,920 12,686 (3,298)<br />

Experienced gains (losses) on plan liability 12,297 2,422 10,070 (8,325) (14,210)<br />

Experienced gains (losses) on plan asset 950 21,330 (45,239) (9,378) (514)<br />

8 Share and option ownership program<br />

The Group operates several share and option ownership programs. The members of the Board of Directors, the members of the Executive<br />

Board as well as selected preferential employees had the option of voluntarily participating in the share and option ownership program<br />

introduced in 2005 and continued in a modified program in the following years.<br />

Management Incentive Program II (MIP II)<br />

In June 2006, the Group introduced the Management Incentive Program II. Participants in this program had the right to purchase shares<br />

with a discount of 25% based on the share price corresponding to the average closing price of one share at the SIX Swiss Exchange during<br />

the months January to May in the respective year of purchase. The difference between the discounted share price on the grant date<br />

and the share price paid by the participants is recognized as personnel expenses on the date of the issue of the shares. The shares are<br />

subject to a one-year lock-up period. For every purchased share under this plan, the Group granted one option free of charge to the participant.<br />

The options have a contractual term of six years and a vesting period of one to three years. Each option entitles the participant to<br />

obtain one share of <strong>Panalpina</strong> World Transport (Holding) Ltd. at a predetermined strike price which equals the average closing price of<br />

one share at the SIX Swiss Exchange during the months January to May in 2006. The share options cannot be settled in cash. In May 2007,<br />

the Board of Directors decided to divide the Management Incentive Program II into an “International Management Incentive Plan” and a<br />

“United States Management Incentive Plan”. Beneficiaries of the “United States Management Incentive Plan” are selected preferential employees<br />

of the subsidiary in the United States of America and members of the Board of Directors with residence in the United States of<br />

America. The conditions of this plan do not differ from those of the “International Management Incentive Plan” except for the strike price, which<br />

equals the closing price of one share at the SIX Swiss Exchange on the date of disbursement. Under this changed program, beneficiaries<br />

of the “United States Management Incentive Plan” holding options to purchase shares of the Group’s capital stock were given the opportunity<br />

to exchange their existing options for new options to purchase an equal number of shares. 3,550 options with a strike price of<br />

CHF 111.30 were tendered pursuant to the “United States Management Incentive Plan”. In May 2007, those options were accepted and<br />

cancelled by the Group. The Group undertook to grant new options on a one-for-one basis, in lieu of the tendered options, to the<br />

affected employees. The new options, which totalled 5,350, were granted with a strike price of CHF 114.00.<br />

The following table lists the parameters based on which the option valuation of both plans was performed:<br />

in CHF<br />

International<br />

Management<br />

Incentive<br />

Plan II<br />

United States<br />

Management<br />

Incentive<br />

Plan II<br />

Market price of share 114.00 114.00<br />

Exercise price of option 111.30 114.00<br />

Expected volatility (in %) 30.00 30.00<br />

Option life (in years) 5 5<br />

Dividend yield (in %) 1.78 1.78<br />

Risk-free interest rate based on Swiss government bonds (in %) 2.670 2.670<br />

Management Incentive Program III (MIP III)<br />

The third share and option program was introduced in June 2007 which conceptually follows in its entirety the modified program of 2006.<br />

Participants of the “International Management Incentive Plan III” subscribed 38,921 options with a strike price of CHF 201.10. Participants<br />

in the “United States Management Incentive Plan III” subscribed 4,096 options with a strike price of CHF 251.00. The difference between<br />

the discounted share price on the grant date and the share price paid by the participants is recognized as personnel expense on the date<br />

of the issue of the shares.<br />

<strong>Panalpina</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>