Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated and <strong>Annual</strong> Financial Statements <strong>2010</strong><br />

116<br />

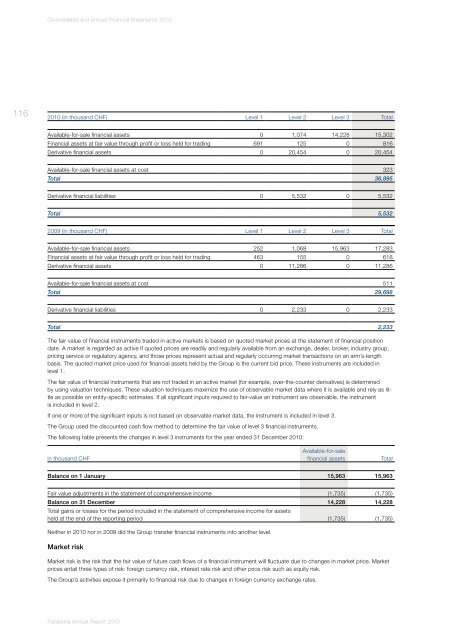

<strong>2010</strong> (in thousand CHF) Level 1 Level 2 Level 3 Total<br />

Available-for-sale financial assets 0 1,074 14,228 15,302<br />

Financial assets at fair value through profit or loss held for trading 691 125 0 816<br />

Derivative financial assets 0 20,454 0 20,454<br />

Available-for-sale financial assets at cost 323<br />

Total 36,895<br />

Derivative financial liabilities 0 5,532 0 5,532<br />

Total 5,532<br />

2009 (in thousand CHF) Level 1 Level 2 Level 3 Total<br />

Available-for-sale financial assets 252 1,068 15,963 17,283<br />

Financial assets at fair value through profit or loss held for trading 463 155 0 618<br />

Derivative financial assets 0 11,286 0 11,286<br />

Available-for-sale financial assets at cost 511<br />

Total 29,698<br />

Derivative financial liabilities 0 2,233 0 2,233<br />

Total 2,233<br />

The fair value of financial instruments traded in active markets is based on quoted market prices at the statement of financial position<br />

date. A market is regarded as active if quoted prices are readily and regularly available from an exchange, dealer, broker, industry group,<br />

pricing service or regulatory agency, and those prices represent actual and regularly occurring market transactions on an arm’s-length<br />

basis. The quoted market price used for financial assets held by the Group is the current bid price. These instruments are included in<br />

level 1.<br />

The fair value of financial instruments that are not traded in an active market (for example, over-the-counter derivatives) is determined<br />

by using valuation techniques. These valuation techniques maximize the use of observable market data where it is available and rely as little<br />

as possible on entity-specific estimates. If all significant inputs required to fair-value an instrument are observable, the instrument<br />

is included in level 2.<br />

If one or more of the significant inputs is not based on observable market data, the instrument is included in level 3.<br />

The Group used the discounted cash flow method to determine the fair value of level 3 financial instruments.<br />

The following table presents the changes in level 3 instruments for the year ended 31 December <strong>2010</strong>:<br />

in thousand CHF<br />

Available-for-sale<br />

financial assets<br />

Total<br />

Balance on 1 January 15,963 15,963<br />

Fair value adjustments in the statement of comprehensive income (1,735) (1,735)<br />

Balance on 31 December 14,228 14,228<br />

Total gains or losses for the period included in the statement of comprehensive income for assets<br />

held at the end of the reporting period (1,735) (1,735)<br />

Neither in <strong>2010</strong> nor in 2009 did the Group transfer financial instruments into another level.<br />

Market risk<br />

Market risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate due to changes in market price. Market<br />

prices entail three types of risk: foreign currency risk, interest rate risk and other price risk such as equity risk.<br />

The Group’s activities expose it primarily to financial risk due to changes in foreign currency exchange rates.<br />

<strong>Panalpina</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>