Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Report</strong>s of the Board of Directors and the Executive Board<br />

Gross profit (GP)<br />

Gross profit, a better measure for actual sales performance<br />

than net forwarding revenue in the forwarding industry,<br />

increased by 7 % from CHF 1,377 million in 2009 to<br />

CHF 1,480 million in <strong>2010</strong>. In local currencies, the increase<br />

was 11 %. This 4 % difference, which had a negative impact<br />

on GP of CHF 54 million, is largely due to the adverse<br />

movement of the euro and the US dollar against the Swiss<br />

franc. In addition to the strong rebound of world trade<br />

which boosted global trade volumes, <strong>Panalpina</strong>’s market<br />

share gains were another important factor behind the<br />

increase in the Group’s gross profit. The unit profitability<br />

(gross profit per ton of air freight and per TEU of ocean<br />

freight), a measure of the pricing power of a freight forwarder,<br />

also showed a sequential improvement every quarter<br />

(in currency neutral terms), although the <strong>2010</strong> average<br />

remained below the prior year levels which were distorted<br />

by an unusually high volatility of carrier freight rates.<br />

The gross profit margin (gross profit as a percentage of net<br />

forwarding revenue) decreased from 23 % to 21 %, mostly<br />

due to the markedly higher average fuel surcharges and<br />

freight rates, which had a positive effect on net forwarding<br />

revenue while having a relatively neutral effect on gross<br />

profit as these are normally pass-through items (subject to<br />

a certain time lag) for freight forwarders.<br />

Europe / Middle East /Africa and CIS (EMEA) is also the<br />

most important region within <strong>Panalpina</strong> in terms of<br />

gross profit generation, representing more than half of the<br />

Group’s gross profit. In <strong>2010</strong>, gross profit generated in<br />

EMEA increased by 4 % to CHF 760 million, supported by<br />

higher freight volumes on all major trade lanes. Similar<br />

to net forwarding revenue, the currency development in<br />

this region adversely affected gross profit, mainly due to<br />

the euro but also the British pound, with both significantly<br />

depreciating against the Swiss franc.<br />

In North America (NORAM), gross profit rose 4 % to<br />

CHF 266 million, which is a reflection of the higher volumes<br />

handled in this region on the back of the recovering<br />

North American economies and restocking which additionally<br />

boosted global trade flows. In this region, particularly<br />

the weakness of the US dollar adversely impacted<br />

the Group’s gross profit when translated into Swiss francs.<br />

Asia Pacific (APAC) and Central and South America (LATAM)<br />

recorded the highest increases in GP, which management<br />

attributes to the relatively better economic development<br />

of these regions in <strong>2010</strong> that manifested itself in strong<br />

intraregional and interregional trade flows in and between<br />

these parts of the world. In LATAM gross profit rose 8 %<br />

to CHF 156 million, while gross profit in APAC increased<br />

22 % to a total of CHF 298 million and thereby overtaking<br />

NORAM as the Group’s second largest region in terms of<br />

gross profit.<br />

In <strong>2010</strong>, the <strong>Panalpina</strong> Group generated 51 % of its gross<br />

profit in Europe / Middle East / Africa and CIS, 18 % in North<br />

America, 20 % in Asia Pacific and 11% in Central and<br />

South America.<br />

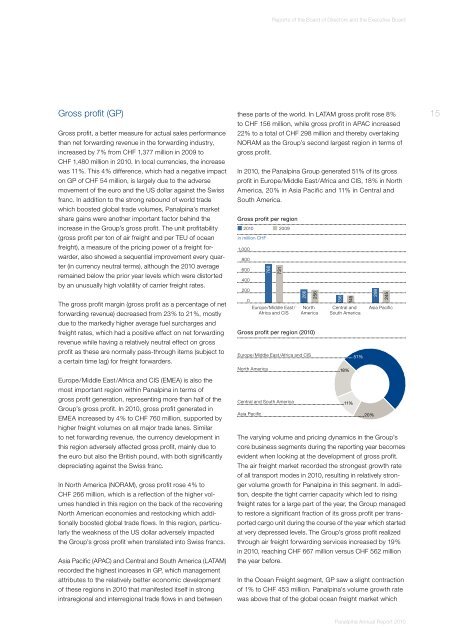

Gross profit per region<br />

<strong>2010</strong> 2009<br />

in million CHF<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

760<br />

731<br />

0<br />

Europe/Middle East/<br />

Africa and CIS<br />

266<br />

256<br />

North<br />

America<br />

Gross profit per region (<strong>2010</strong>)<br />

Europe /Middle East/Africa and CIS<br />

North America<br />

Central and South America<br />

Asia Pacific<br />

156<br />

145<br />

Central and<br />

South America<br />

18%<br />

11%<br />

51%<br />

298<br />

245<br />

Asia Pacific<br />

20%<br />

The varying volume and pricing dynamics in the Group’s<br />

core business segments during the reporting year becomes<br />

evident when looking at the development of gross profit.<br />

The air freight market recorded the strongest growth rate<br />

of all transport modes in <strong>2010</strong>, resulting in relatively stronger<br />

volume growth for <strong>Panalpina</strong> in this segment. In addition,<br />

despite the tight carrier capacity which led to rising<br />

freight rates for a large part of the year, the Group managed<br />

to restore a significant fraction of its gross profit per transported<br />

cargo unit during the course of the year which started<br />

at very depressed levels. The Group’s gross profit realized<br />

through air freight forwarding services increased by 19 %<br />

in <strong>2010</strong>, reaching CHF 667 million versus CHF 562 million<br />

the year before.<br />

In the Ocean Freight segment, GP saw a slight contraction<br />

of 1% to CHF 453 million. <strong>Panalpina</strong>’s volume growth rate<br />

was above that of the global ocean freight market which<br />

15<br />

<strong>Panalpina</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>