Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated and <strong>Annual</strong> Financial Statements <strong>2010</strong><br />

112<br />

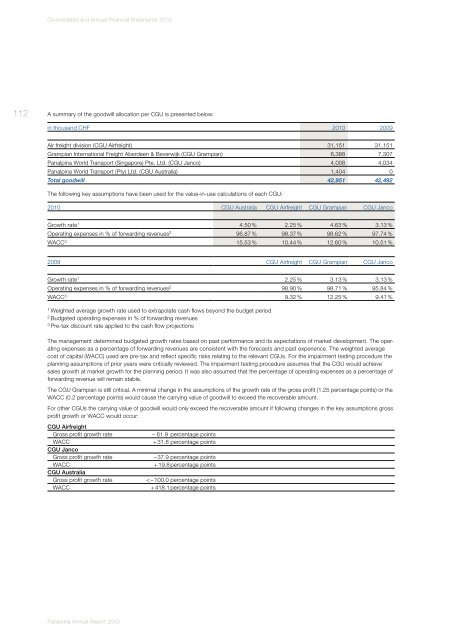

A summary of the goodwill allocation per CGU is presented below:<br />

in thousand CHF <strong>2010</strong> 2009<br />

Air freight division (CGU Airfreight) 31,151 31,151<br />

Grampian International Freight Aberdeen & Beverwijk (CGU Grampian) 6,388 7,307<br />

<strong>Panalpina</strong> World Transport (Singapore) Pte. Ltd. (CGU Janco) 4,008 4,034<br />

<strong>Panalpina</strong> World Transport (Pty) Ltd. (CGU Australia) 1,404 0<br />

Total goodwill 42,951 42,492<br />

The following key assumptions have been used for the value-in-use calculations of each CGU:<br />

<strong>2010</strong> CGU Australia CGU Airfreight CGU Grampian CGU Janco<br />

Growth rate 1 4.50 % 2.25 % 4.63 % 3.13 %<br />

Operating expenses in % of forwarding revenues 2 96.87 % 98.37 % 98.62 % 97.74 %<br />

WACC 3 15.53 % 10.44 % 12.60 % 10.51 %<br />

2009 CGU Airfreight CGU Grampian CGU Janco<br />

Growth rate 1 2.25 % 3.13 % 3.13 %<br />

Operating expenses in % of forwarding revenues 2 98.90 % 98.71 % 95.84 %<br />

WACC 3 9.32 % 12.25 % 9.41 %<br />

1 Weighted average growth rate used to extrapolate cash flows beyond the budget period<br />

2 Budgeted operating expenses in % of forwarding revenues<br />

3 Pre-tax discount rate applied to the cash flow projections<br />

The management determined budgeted growth rates based on past performance and its expectations of market development. The operating<br />

expenses as a percentage of forwarding revenues are consistent with the forecasts and past experience. The weighted average<br />

cost of capital (WACC) used are pre-tax and reflect specific risks relating to the relevant CGUs. For the impairment testing procedure the<br />

planning assumptions of prior years were critically reviewed. The impairment testing procedure assumes that the CGU would achieve<br />

sales growth at market growth for the planning period. It was also assumed that the percentage of operating expenses as a percentage of<br />

forwarding revenue will remain stable.<br />

The CGU Grampian is still critical. A minimal change in the assumptions of the growth rate of the gross profit (1.25 percentage points) or the<br />

WACC (0.2 percentage points) would cause the carrying value of goodwill to exceed the recoverable amount.<br />

For other CGUs the carrying value of goodwill would only exceed the recoverable amount if following changes in the key assumptions gross<br />

profit growth or WACC would occur:<br />

CGU Airfreight<br />

Gross profit growth rate<br />

WACC<br />

CGU Janco<br />

Gross profit growth rate<br />

WACC<br />

CGU Australia<br />

Gross profit growth rate<br />

WACC<br />

– 61.9 percentage points<br />

+ 31.8 percentage points<br />

– 37.9 percentage points<br />

+ 19.8 percentage points<br />

< – 100.0 percentage points<br />

+ 418.1 percentage points<br />

<strong>Panalpina</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>