Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Report</strong>s of the Board of Directors and the Executive Board<br />

18<br />

This favorable development can mostly be attributed to<br />

the increase in cost of goods sold during the reporting<br />

period and a further improved payment discipline and renegotiation<br />

of payment terms with various vendors.<br />

Borrowings (short-/long-term)<br />

Total borrowings were further reduced from CHF 13 million<br />

at year-end 2009 to CHF 10 million at year-end <strong>2010</strong>.<br />

Other liabilities<br />

The Group’s other liabilities increased significantly from<br />

CHF 369 million at year-end 2009 to CHF 471 million at<br />

year-end <strong>2010</strong>. The major reasons for the increase are<br />

provisions remaining on the balance sheet at the end of<br />

the year amounting to CHF 94 million in connection with<br />

the charges arising from the settlement of the two legal<br />

claims in the United States (FCPA, anti-trust) and associated<br />

compliance consulting costs as well as for an<br />

internal reorganization project.<br />

Total equity<br />

The most significant change in shareholders’ equity is<br />

the change in reserves which – as a result of the negative<br />

net result for the reporting year, an adverse currency<br />

translation effect as well as recognized actuarial losses<br />

on pension valuation amounting to CHF 11 million –<br />

declined from CHF 999 million on December 31, 2009<br />

to CHF 950 million on December 31, <strong>2010</strong>. Total equity<br />

decreased by CHF 52 million during the reporting<br />

period, from CHF 864 million on December 31, 2009 to<br />

CHF 812 million on December 31, <strong>2010</strong>.<br />

Cash flow<br />

Net cash from operating activities<br />

The Group’s net cash from operating activities in the<br />

reporting period amounted to CHF 37 million, CHF 223 million<br />

below last year (2009: CHF 260 million). Although<br />

the Group expanded its net profit for the period (before the<br />

CHF 128 million special charges) substantially, the growth<br />

in business led to a sizeable increase of the net working<br />

capital, whereas in the comparable prior-year period, net<br />

cash from operating activities was boosted significantly<br />

due to the severe drop in business volumes and the related<br />

reduction in net working capital. In addition, net cash from<br />

operating activities includes an outflow of CHF 27 million<br />

during the reporting year due to the payment of certain fines<br />

to US authorities.<br />

Cash flow from investing activities<br />

The largest part of investing cash outflows in <strong>2010</strong> was<br />

for expenditures on property, plant and equipment in the<br />

amount of CHF 28 million (mainly IT equipment), which<br />

were lower than in the year before (2009: CHF 33 million).<br />

On the other hand, the interest received on the current<br />

cash holdings declined from CHF 15 million in 2009 to<br />

CHF 5 million in <strong>2010</strong>, as interest rates in the latest reporting<br />

period were close to zero. Overall, the net cash flow<br />

from investing activities improved slightly from minus<br />

CHF 34 million in 2009 to minus CHF 31 million in <strong>2010</strong>.<br />

Capital expenditures in <strong>2010</strong> amounted to a historically low<br />

0.6 % of net forwarding revenue and thus underlined<br />

the asset-light character of <strong>Panalpina</strong>’s business model.<br />

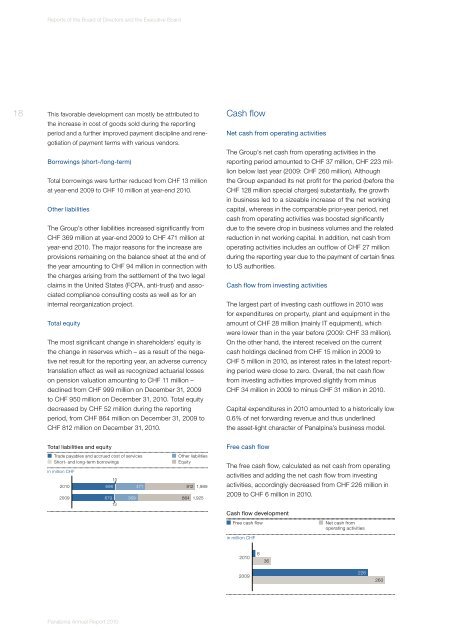

Total liabilities and equity<br />

Trade payables and accrued cost of services<br />

Short- and long-term borrowings<br />

in million CHF<br />

<strong>2010</strong><br />

2009<br />

10<br />

696<br />

679<br />

13<br />

369<br />

471<br />

Other liabilities<br />

Equity<br />

812 1,989<br />

864 1,925<br />

Free cash flow<br />

The free cash flow, calculated as net cash from operating<br />

activities and adding the net cash flow from investing<br />

activities, accordingly decreased from CHF 226 million in<br />

2009 to CHF 6 million in <strong>2010</strong>.<br />

Cash flow development<br />

Free cash flow<br />

in million CHF<br />

Net cash from<br />

operating activities<br />

<strong>2010</strong><br />

6<br />

36<br />

2009<br />

226<br />

260<br />

<strong>Panalpina</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>