Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated and <strong>Annual</strong> Financial Statements <strong>2010</strong><br />

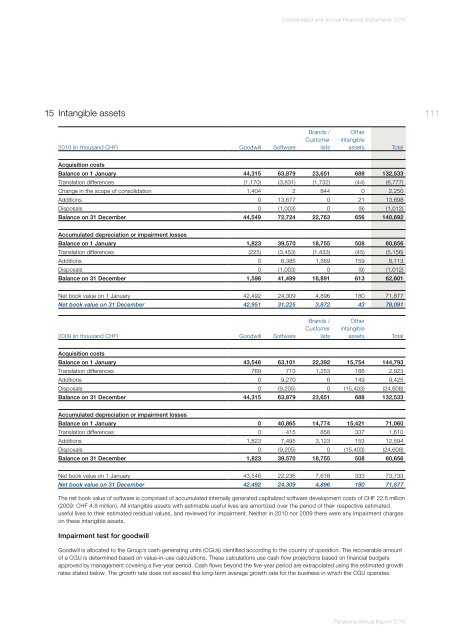

15 Intangible assets<br />

111<br />

<strong>2010</strong> (in thousand CHF) Goodwill Software<br />

Brands /<br />

Customer<br />

lists<br />

Other<br />

intangible<br />

assets<br />

Total<br />

Acquisition costs<br />

Balance on 1 January 44,315 63,879 23,651 688 132,533<br />

Translation differences (1,170) (3,831) (1,732) (44) (6,777)<br />

Change in the scope of consolidation 1,404 2 844 0 2,250<br />

Additions 0 13,677 0 21 13,698<br />

Disposals 0 (1,003) 0 (9) (1,012)<br />

Balance on 31 December 44,549 72,724 22,763 656 140,692<br />

Accumulated depreciation or impairment losses<br />

Balance on 1 January 1,823 39,570 18,755 508 60,656<br />

Translation differences (225) (3,453) (1,433) (45) (5,156)<br />

Additions 0 6,385 1,569 159 8,113<br />

Disposals 0 (1,003) 0 (9) (1,012)<br />

Balance on 31 December 1,598 41,499 18,891 613 62,601<br />

Net book value on 1 January 42,492 24,309 4,896 180 71,877<br />

Net book value on 31 December 42,951 31,225 3,872 43 78,091<br />

2009 (in thousand CHF) Goodwill Software<br />

Brands /<br />

Customer<br />

lists<br />

Other<br />

intangible<br />

assets<br />

Total<br />

Acquisition costs<br />

Balance on 1 January 43,546 63,101 22,392 15,754 144,793<br />

Translation differences 769 713 1,253 188 2,923<br />

Additions 0 9,270 6 149 9,425<br />

Disposals 0 (9,205) 0 (15,403) (24,608)<br />

Balance on 31 December 44,315 63,879 23,651 688 132,533<br />

Accumulated depreciation or impairment losses<br />

Balance on 1 January 0 40,865 14,774 15,421 71,060<br />

Translation differences 0 415 858 337 1,610<br />

Additions 1,823 7,495 3,123 153 12,594<br />

Disposals 0 (9,205) 0 (15,403) (24,608)<br />

Balance on 31 December 1,823 39,570 18,755 508 60,656<br />

Net book value on 1 January 43,546 22,236 7,618 333 73,733<br />

Net book value on 31 December 42,492 24,309 4,896 180 71,877<br />

The net book value of software is comprised of accumulated internally generated capitalized software development costs of CHF 22.6 million<br />

(2009: CHF 4.8 million). All intangible assets with estimable useful lives are amortized over the period of their respective estimated<br />

useful lives to their estimated residual values, and reviewed for impairment. Neither in <strong>2010</strong> nor 2009 there were any impairment charges<br />

on these intangible assets.<br />

Impairment test for goodwill<br />

Goodwill is allocated to the Group’s cash-generating units (CGUs) identified according to the country of operation. The recoverable amount<br />

of a CGU is determined based on value-in-use calculations. These calculations use cash flow projections based on financial budgets<br />

ap proved by management covering a five-year period. Cash flows beyond the five-year period are extrapolated using the estimated growth<br />

rates stated below. The growth rate does not exceed the long-term average growth rate for the business in which the CGU operates.<br />

<strong>Panalpina</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>