Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Report</strong>s of the Board of Directors and the Executive Board<br />

Regional development<br />

The Company assesses segmental operating performance<br />

primarily from a geographical perspective, as the Group’s<br />

operations are predominantly managed by geographical<br />

location. A useful measure to assess the operating performance<br />

by region is EBITDA. The segmental EBITDA provided<br />

in the financial accounts excludes the non-recurring<br />

charges incurred in <strong>2010</strong> related to fines and related<br />

expenses as well as reorganization costs in order to make<br />

a comparison with prior year more meaningful. Moreover,<br />

the following extraordinary costs had an influence on the<br />

EBITDA per region during the reporting period:<br />

• North America booked CHF 6 million in extraordinary<br />

legal and consulting fees in <strong>2010</strong> (2009: CHF 22 million).<br />

• The region labeled “Corporate” absorbed extraordinary<br />

legal and consulting fees of CHF 12 million in <strong>2010</strong><br />

(2009: CHF 33 million).<br />

• There were no other material non-recurring charges<br />

incurred in any of the other reporting regions during the<br />

reporting year.<br />

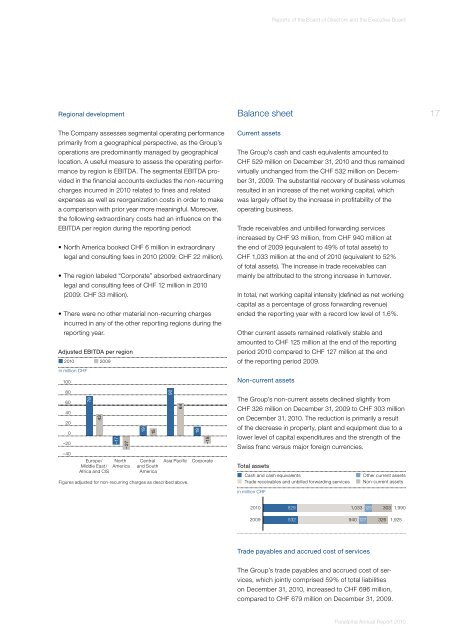

Adjusted EBITDA per region<br />

<strong>2010</strong> 2009<br />

in million CHF<br />

100<br />

Balance sheet<br />

Current assets<br />

The Group’s cash and cash equivalents amounted to<br />

CHF 529 million on December 31, <strong>2010</strong> and thus remained<br />

virtually unchanged from the CHF 532 million on December<br />

31, 2009. The substantial recovery of business volumes<br />

resulted in an increase of the net working capital, which<br />

was largely offset by the increase in profitability of the<br />

operating business.<br />

Trade receivables and unbilled forwarding services<br />

increased by CHF 93 million, from CHF 940 million at<br />

the end of 2009 (equivalent to 49 % of total assets) to<br />

CHF 1,033 million at the end of <strong>2010</strong> (equivalent to 52 %<br />

of total assets). The increase in trade receivables can<br />

mainly be attributed to the strong increase in turnover.<br />

In total, net working capital intensity (defined as net working<br />

capital as a percentage of gross forwarding revenue)<br />

ended the reporting year with a record low level of 1.6 %.<br />

Other current assets remained relatively stable and<br />

amounted to CHF 125 million at the end of the reporting<br />

period <strong>2010</strong> compared to CHF 127 million at the end<br />

of the reporting period 2009.<br />

Non-current assets<br />

17<br />

80<br />

60<br />

40<br />

20<br />

0<br />

–20<br />

–40<br />

78<br />

43<br />

Europe/<br />

Middle East/<br />

Africa and CIS<br />

–17<br />

–27<br />

North<br />

America<br />

Figures adjusted for non-recurring charges as described above.<br />

19<br />

15<br />

Central<br />

and South<br />

America<br />

92<br />

64<br />

Asia Pacific<br />

18<br />

–15<br />

Corporate<br />

The Group’s non-current assets declined slightly from<br />

CHF 326 million on December 31, 2009 to CHF 303 million<br />

on December 31, <strong>2010</strong>. The reduction is primarily a result<br />

of the decrease in property, plant and equipment due to a<br />

lower level of capital expenditures and the strength of the<br />

Swiss franc versus major foreign currencies.<br />

Total assets<br />

Cash and cash equivalents<br />

Trade receivables and unbilled forwarding services<br />

in million CHF<br />

Other current assets<br />

Non-current assets<br />

<strong>2010</strong><br />

2009<br />

529 1,033 125 303 1,990<br />

532 940 127 326 1,925<br />

Trade payables and accrued cost of services<br />

The Group’s trade payables and accrued cost of services,<br />

which jointly comprised 59 % of total liabilities<br />

on December 31, <strong>2010</strong>, increased to CHF 696 million,<br />

compared to CHF 679 million on December 31, 2009.<br />

<strong>Panalpina</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>