Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Annual Report 2010 (PDF, 5.2MB) - Panalpina Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

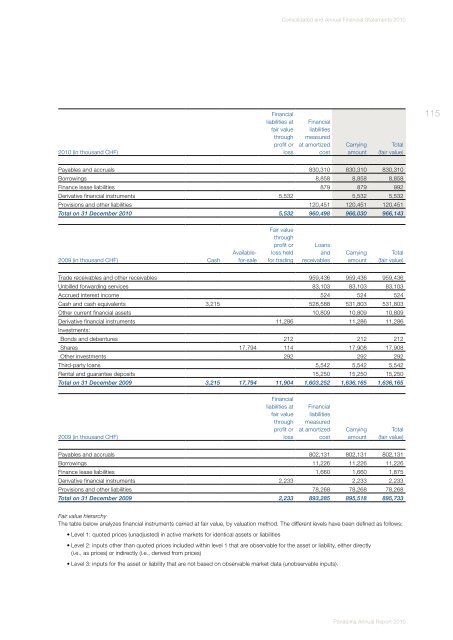

Consolidated and <strong>Annual</strong> Financial Statements <strong>2010</strong><br />

<strong>2010</strong> (in thousand CHF)<br />

Financial<br />

liabilities at<br />

fair value<br />

through<br />

profit or<br />

loss<br />

Financial<br />

liabilities<br />

measured<br />

at amortized<br />

cost<br />

Carrying<br />

amount<br />

Total<br />

(fair value)<br />

115<br />

Payables and accruals 830,310 830,310 830,310<br />

Borrowings 8,858 8,858 8,858<br />

Finance lease liabilities 879 879 992<br />

Derivative financial instruments 5,532 5,532 5,532<br />

Provisions and other liabilities 120,451 120,451 120,451<br />

Total on 31 December <strong>2010</strong> 5,532 960,498 966,030 966,143<br />

2009 (in thousand CHF) Cash<br />

Availablefor-sale<br />

Fair value<br />

through<br />

profit or<br />

loss held<br />

for trading<br />

Loans<br />

and<br />

receivables<br />

Carrying<br />

amount<br />

Total<br />

(fair value)<br />

Trade receivables and other receivables 959,436 959,436 959,436<br />

Unbilled forwarding services 83,103 83,103 83,103<br />

Accrued interest income 524 524 524<br />

Cash and cash equivalents 3,215 528,588 531,803 531,803<br />

Other current financial assets 10,809 10,809 10,809<br />

Derivative financial instruments 11,286 11,286 11,286<br />

Investments:<br />

Bonds and debentures 212 212 212<br />

Shares 17,794 114 17,908 17,908<br />

Other investments 292 292 292<br />

Third-party loans 5,542 5,542 5,542<br />

Rental and guarantee deposits 15,250 15,250 15,250<br />

Total on 31 December 2009 3,215 17,794 11,904 1,603,252 1,636,165 1,636,165<br />

2009 (in thousand CHF)<br />

Financial<br />

liabilities at<br />

fair value<br />

through<br />

profit or<br />

loss<br />

Financial<br />

liabilities<br />

measured<br />

at amortized<br />

cost<br />

Carrying<br />

amount<br />

Total<br />

(fair value)<br />

Payables and accruals 802,131 802,131 802,131<br />

Borrowings 11,226 11,226 11,226<br />

Finance lease liabilities 1,660 1,660 1,875<br />

Derivative financial instruments 2,233 2,233 2,233<br />

Provisions and other liabilities 78,268 78,268 78,268<br />

Total on 31 December 2009 2,233 893,285 895,518 895,733<br />

Fair value hierarchy<br />

The table below analyzes financial instruments carried at fair value, by valuation method. The different levels have been defined as follows:<br />

• Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities<br />

• Level 2: inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly<br />

(i.e., as prices) or indirectly (i.e., derived from prices)<br />

• Level 3: inputs for the asset or liability that are not based on observable market data (unobservable inputs).<br />

<strong>Panalpina</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>