GSK Annual Report 2002

GSK Annual Report 2002

GSK Annual Report 2002

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

136 GlaxoSmithKline Notes to the financial statements<br />

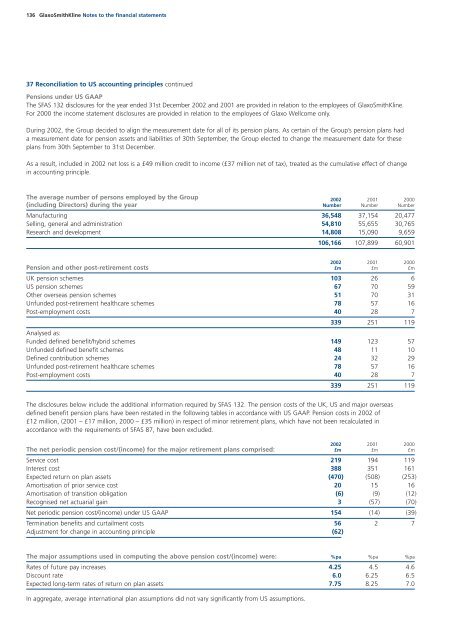

37 Reconciliation to US accounting principles continued<br />

Pensions under US GAAP<br />

The SFAS 132 disclosures for the year ended 31st December <strong>2002</strong> and 2001 are provided in relation to the employees of GlaxoSmithKline.<br />

For 2000 the income statement disclosures are provided in relation to the employees of Glaxo Wellcome only.<br />

During <strong>2002</strong>, the Group decided to align the measurement date for all of its pension plans. As certain of the Group’s pension plans had<br />

a measurement date for pension assets and liabilities of 30th September, the Group elected to change the measurement date for these<br />

plans from 30th September to 31st December.<br />

As a result, included in <strong>2002</strong> net loss is a £49 million credit to income (£37 million net of tax), treated as the cumulative effect of change<br />

in accounting principle.<br />

The average number of persons employed by the Group <strong>2002</strong> 2001 2000<br />

(including Directors) during the year Number Number Number<br />

Manufacturing 36,548 37,154 20,477<br />

Selling, general and administration 54,810 55,655 30,765<br />

Research and development 14,808 15,090 9,659<br />

106,166 107,899 60,901<br />

<strong>2002</strong> 2001 2000<br />

Pension and other post-retirement costs £m £m £m<br />

UK pension schemes 103 26 6<br />

US pension schemes 67 70 59<br />

Other overseas pension schemes 51 70 31<br />

Unfunded post-retirement healthcare schemes 78 57 16<br />

Post-employment costs 40 28 7<br />

339 251 119<br />

Analysed as:<br />

Funded defined benefit/hybrid schemes 149 123 57<br />

Unfunded defined benefit schemes 48 11 10<br />

Defined contribution schemes 24 32 29<br />

Unfunded post-retirement healthcare schemes 78 57 16<br />

Post-employment costs 40 28 7<br />

339 251 119<br />

The disclosures below include the additional information required by SFAS 132. The pension costs of the UK, US and major overseas<br />

defined benefit pension plans have been restated in the following tables in accordance with US GAAP. Pension costs in <strong>2002</strong> of<br />

£12 million, (2001 – £17 million, 2000 – £35 million) in respect of minor retirement plans, which have not been recalculated in<br />

accordance with the requirements of SFAS 87, have been excluded.<br />

<strong>2002</strong> 2001 2000<br />

The net periodic pension cost/(income) for the major retirement plans comprised: £m £m £m<br />

Service cost 219 194 119<br />

Interest cost 388 351 161<br />

Expected return on plan assets (470) (508) (253)<br />

Amortisation of prior service cost 20 15 16<br />

Amortisation of transition obligation (6) (9) (12)<br />

Recognised net actuarial gain 3 (57) (70)<br />

Net periodic pension cost/(income) under US GAAP 154 (14) (39)<br />

Termination benefits and curtailment costs 56 2 7<br />

Adjustment for change in accounting principle (62)<br />

The major assumptions used in computing the above pension cost/(income) were: %pa %pa %pa<br />

Rates of future pay increases 4.25 4.5 4.6<br />

Discount rate 6.0 6.25 6.5<br />

Expected long-term rates of return on plan assets 7.75 8.25 7.0<br />

In aggregate, average international plan assumptions did not vary significantly from US assumptions.