GSK Annual Report 2002

GSK Annual Report 2002

GSK Annual Report 2002

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

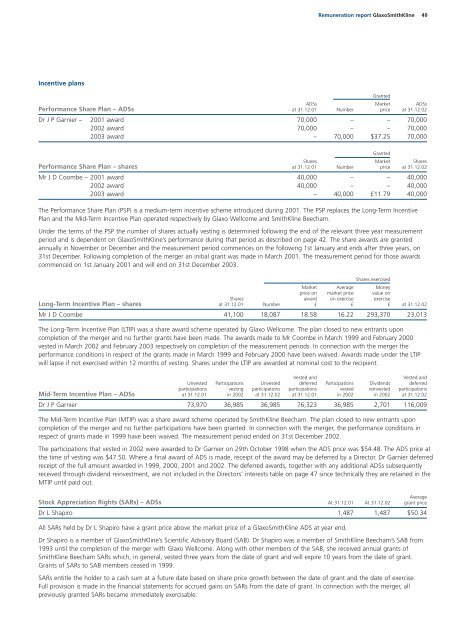

Incentive plans<br />

Remuneration report GlaxoSmithKline 49<br />

Performance Share Plan – ADSs<br />

ADSs<br />

at 31.12.01 Number<br />

Granted<br />

Market<br />

price<br />

ADSs<br />

at 31.12.02<br />

Dr J P Garnier – 2001 award 70,000 – – 70,000<br />

<strong>2002</strong> award 70,000 – – 70,000<br />

2003 award – 70,000 $37.25 70,000<br />

Performance Share Plan – shares<br />

Shares<br />

at 31.12.01 Number<br />

Granted<br />

Market<br />

price<br />

Shares<br />

at 31.12.02<br />

Mr J D Coombe – 2001 award 40,000 – – 40,000<br />

<strong>2002</strong> award 40,000 – – 40,000<br />

2003 award – 40,000 £11.79 40,000<br />

The Performance Share Plan (PSP) is a medium-term incentive scheme introduced during 2001. The PSP replaces the Long-Term Incentive<br />

Plan and the Mid-Term Incentive Plan operated respectively by Glaxo Wellcome and SmithKline Beecham.<br />

Under the terms of the PSP the number of shares actually vesting is determined following the end of the relevant three year measurement<br />

period and is dependent on GlaxoSmithKline’s performance during that period as described on page 42. The share awards are granted<br />

annually in November or December and the measurement period commences on the following 1st January and ends after three years, on<br />

31st December. Following completion of the merger an initial grant was made in March 2001. The measurement period for those awards<br />

commenced on 1st January 2001 and will end on 31st December 2003.<br />

Market Average<br />

Shares exercised<br />

Money<br />

price on market price value on<br />

Long-Term Incentive Plan – shares<br />

Shares<br />

at 31.12.01 Number<br />

award<br />

£<br />

on exercise<br />

£<br />

exercise<br />

£ at 31.12.02<br />

Mr J D Coombe 41,100 18,087 18.58 16.22 293,370 23,013<br />

The Long-Term Incentive Plan (LTIP) was a share award scheme operated by Glaxo Wellcome. The plan closed to new entrants upon<br />

completion of the merger and no further grants have been made. The awards made to Mr Coombe in March 1999 and February 2000<br />

vested in March <strong>2002</strong> and February 2003 respectively on completion of the measurement periods. In connection with the merger the<br />

performance conditions in respect of the grants made in March 1999 and February 2000 have been waived. Awards made under the LTIP<br />

will lapse if not exercised within 12 months of vesting. Shares under the LTIP are awarded at nominal cost to the recipient.<br />

Vested and Vested and<br />

Unvested Participations Unvested deferred Participations Dividends deferred<br />

participations vesting participations participations vested reinvested participations<br />

Mid-Term Incentive Plan – ADSs at 31.12.01 in <strong>2002</strong> at 31.12.02 at 31.12.01 in <strong>2002</strong> in <strong>2002</strong> at 31.12.02<br />

Dr J P Garnier 73,970 36,985 36,985 76,323 36,985 2,701 116,009<br />

The Mid-Term Incentive Plan (MTIP) was a share award scheme operated by SmithKline Beecham. The plan closed to new entrants upon<br />

completion of the merger and no further participations have been granted. In connection with the merger, the performance conditions in<br />

respect of grants made in 1999 have been waived. The measurement period ended on 31st December <strong>2002</strong>.<br />

The participations that vested in <strong>2002</strong> were awarded to Dr Garnier on 29th October 1998 when the ADS price was $54.48. The ADS price at<br />

the time of vesting was $47.50. Where a final award of ADS is made, receipt of the award may be deferred by a Director. Dr Garnier deferred<br />

receipt of the full amount awarded in 1999, 2000, 2001 and <strong>2002</strong>. The deferred awards, together with any additional ADSs subsequently<br />

received through dividend reinvestment, are not included in the Directors’ interests table on page 47 since technically they are retained in the<br />

MTIP until paid out.<br />

Average<br />

Stock Appreciation Rights (SARs) – ADSs At 31.12.01 At 31.12.02 grant price<br />

Dr L Shapiro 1,487 1,487 $50.34<br />

All SARs held by Dr L Shapiro have a grant price above the market price of a GlaxoSmithKline ADS at year end.<br />

Dr Shapiro is a member of GlaxoSmithKline’s Scientific Advisory Board (SAB). Dr Shapiro was a member of SmithKline Beecham’s SAB from<br />

1993 until the completion of the merger with Glaxo Wellcome. Along with other members of the SAB, she received annual grants of<br />

SmithKline Beecham SARs which, in general, vested three years from the date of grant and will expire 10 years from the date of grant.<br />

Grants of SARs to SAB members ceased in 1999.<br />

SARs entitle the holder to a cash sum at a future date based on share price growth between the date of grant and the date of exercise.<br />

Full provision is made in the financial statements for accrued gains on SARs from the date of grant. In connection with the merger, all<br />

previously granted SARs became immediately exercisable.