GSK Annual Report 2002

GSK Annual Report 2002

GSK Annual Report 2002

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

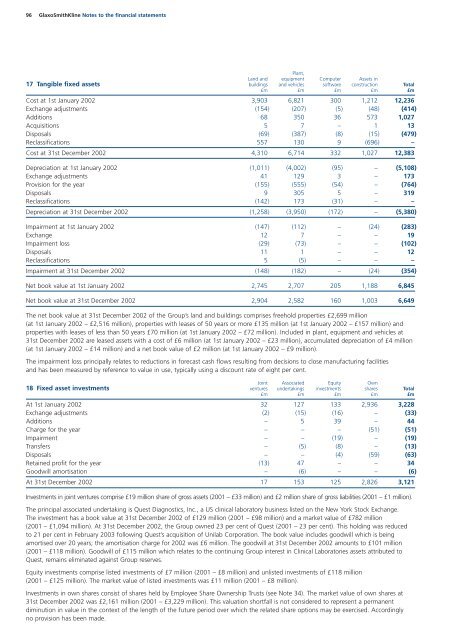

96 GlaxoSmithKline Notes to the financial statements<br />

Plant,<br />

Land and equipment Computer Assets in<br />

17 Tangible fixed assets buildings and vehicles software construction Total<br />

£m £m £m £m £m<br />

Cost at 1st January <strong>2002</strong> 3,903 6,821 300 1,212 12,236<br />

Exchange adjustments (154) (207) (5) (48) (414)<br />

Additions 68 350 36 573 1,027<br />

Acquisitions 5 7 – 1 13<br />

Disposals (69) (387) (8) (15) (479)<br />

Reclassifications 557 130 9 (696) –<br />

Cost at 31st December <strong>2002</strong> 4,310 6,714 332 1,027 12,383<br />

Depreciation at 1st January <strong>2002</strong> (1,011) (4,002) (95) – (5,108)<br />

Exchange adjustments 41 129 3 – 173<br />

Provision for the year (155) (555) (54) – (764)<br />

Disposals 9 305 5 – 319<br />

Reclassifications (142) 173 (31) – –<br />

Depreciation at 31st December <strong>2002</strong> (1,258) (3,950) (172) – (5,380)<br />

Impairment at 1st January <strong>2002</strong> (147) (112) – (24) (283)<br />

Exchange 12 7 – – 19<br />

Impairment loss (29) (73) – – (102)<br />

Disposals 11 1 – – 12<br />

Reclassifications 5 (5) – – –<br />

Impairment at 31st December <strong>2002</strong> (148) (182) – (24) (354)<br />

Net book value at 1st January <strong>2002</strong> 2,745 2,707 205 1,188 6,845<br />

Net book value at 31st December <strong>2002</strong> 2,904 2,582 160 1,003 6,649<br />

The net book value at 31st December <strong>2002</strong> of the Group’s land and buildings comprises freehold properties £2,699 million<br />

(at 1st January <strong>2002</strong> – £2,516 million), properties with leases of 50 years or more £135 million (at 1st January <strong>2002</strong> – £157 million) and<br />

properties with leases of less than 50 years £70 million (at 1st January <strong>2002</strong> – £72 million). Included in plant, equipment and vehicles at<br />

31st December <strong>2002</strong> are leased assets with a cost of £6 million (at 1st January <strong>2002</strong> – £23 million), accumulated depreciation of £4 million<br />

(at 1st January <strong>2002</strong> – £14 million) and a net book value of £2 million (at 1st January <strong>2002</strong> – £9 million).<br />

The impairment loss principally relates to reductions in forecast cash flows resulting from decisions to close manufacturing facilities<br />

and has been measured by reference to value in use, typically using a discount rate of eight per cent.<br />

Joint Associated Equity Own<br />

18 Fixed asset investments ventures undertakings investments shares Total<br />

£m £m £m £m £m<br />

At 1st January <strong>2002</strong> 32 127 133 2,936 3,228<br />

Exchange adjustments (2) (15) (16) – (33)<br />

Additions – 5 39 – 44<br />

Charge for the year – – – (51) (51)<br />

Impairment – – (19) – (19)<br />

Transfers – (5) (8) – (13)<br />

Disposals – – (4) (59) (63)<br />

Retained profit for the year (13) 47 – – 34<br />

Goodwill amortisation – (6) – – (6)<br />

At 31st December <strong>2002</strong> 17 153 125 2,826 3,121<br />

Investments in joint ventures comprise £19 million share of gross assets (2001 – £33 million) and £2 million share of gross liabilities (2001 – £1 million).<br />

The principal associated undertaking is Quest Diagnostics, Inc., a US clinical laboratory business listed on the New York Stock Exchange.<br />

The investment has a book value at 31st December <strong>2002</strong> of £129 million (2001 – £98 million) and a market value of £782 million<br />

(2001 – £1,094 million). At 31st December <strong>2002</strong>, the Group owned 23 per cent of Quest (2001 – 23 per cent). This holding was reduced<br />

to 21 per cent in February 2003 following Quest’s acquisition of Unilab Corporation. The book value includes goodwill which is being<br />

amortised over 20 years; the amortisation charge for <strong>2002</strong> was £6 million. The goodwill at 31st December <strong>2002</strong> amounts to £101 million<br />

(2001 – £118 million). Goodwill of £115 million which relates to the continuing Group interest in Clinical Laboratories assets attributed to<br />

Quest, remains eliminated against Group reserves.<br />

Equity investments comprise listed investments of £7 million (2001 – £8 million) and unlisted investments of £118 million<br />

(2001 – £125 million). The market value of listed investments was £11 million (2001 – £8 million).<br />

Investments in own shares consist of shares held by Employee Share Ownership Trusts (see Note 34). The market value of own shares at<br />

31st December <strong>2002</strong> was £2,161 million (2001 – £3,229 million). This valuation shortfall is not considered to represent a permanent<br />

diminution in value in the context of the length of the future period over which the related share options may be exercised. Accordingly<br />

no provision has been made.