Report & accounts 2002 in full - Unilever

Report & accounts 2002 in full - Unilever

Report & accounts 2002 in full - Unilever

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

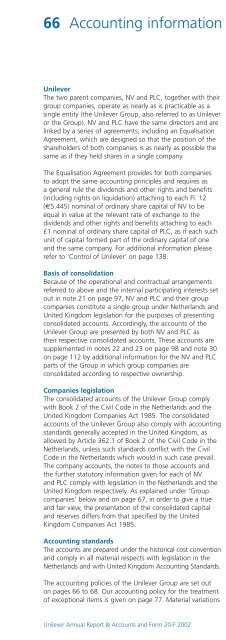

Fixed <strong>in</strong>vestments<br />

<strong>Unilever</strong> Annual <strong>Report</strong> & Accounts and Form 20-F <strong>2002</strong><br />

Notes to the company <strong>accounts</strong> 133<br />

<strong>Unilever</strong> N.V.<br />

€ million € million<br />

<strong>2002</strong> 2001<br />

Shares <strong>in</strong> group companies 11 008 7 201<br />

Book value of PLC shares held <strong>in</strong><br />

connection with share options 368 264<br />

Less NV shares held by group companies (168) (153)<br />

Other unlisted <strong>in</strong>vestments 208 16<br />

Movements dur<strong>in</strong>g the year:<br />

1 January 7 328<br />

Movement <strong>in</strong> PLC shares held <strong>in</strong><br />

connection with share options 104<br />

Movement <strong>in</strong> NV shares held by<br />

group companies (14)<br />

Other unlisted <strong>in</strong>vestments 191<br />

Additions 6 423<br />

Decrease (2 616)<br />

31 December 11 416<br />

11 416 7 328<br />

Shares <strong>in</strong> group companies are stated at cost <strong>in</strong> accordance with<br />

<strong>in</strong>ternational account<strong>in</strong>g practice <strong>in</strong> various countries, <strong>in</strong> particular<br />

the United K<strong>in</strong>gdom.<br />

Debtors<br />

€ million € million<br />

<strong>2002</strong> 2001<br />

Loans to group companies 19 214 16 607<br />

Other amounts owed by group companies 1 089 2 570<br />

Amounts owed by undertak<strong>in</strong>gs <strong>in</strong> which<br />

the company has a participat<strong>in</strong>g <strong>in</strong>terest 1 1<br />

Other 298 196<br />

20 602 19 374<br />

Of which due after more than one year 882 9<br />

Cash at bank and <strong>in</strong> hand<br />

€ million € million<br />

<strong>2002</strong> 2001<br />

This <strong>in</strong>cludes amounts for which repayment<br />

notice is required of: 187 61<br />

Creditors<br />

€ million € million<br />

<strong>2002</strong> 2001<br />

Due with<strong>in</strong> one year:<br />

Bank loans and overdrafts 4 39<br />

Bonds and other loans 4 536 5 898<br />

Loans from group companies 1 817 638<br />

Other amounts owed to group companies 12 304 8 805<br />

Taxation and social security 238 79<br />

Accruals and deferred <strong>in</strong>come 205 264<br />

Dividends 643 601<br />

Other 162 15<br />

19 909 16 339<br />

Due after more than one year:<br />

Bonds and other loans 5 257 5 883<br />

Provisions for liabilities and charges<br />

€ million € million<br />

<strong>2002</strong> 2001<br />

Pension provisions 131 124<br />

Deferred taxation and other provisions 131 172<br />

262 296<br />

Of which due with<strong>in</strong> one year 73 68<br />

Ord<strong>in</strong>ary share capital<br />

Shares numbered 1 to 2 400 are held by a subsidiary of NV and<br />

a subsidiary of PLC, each hold<strong>in</strong>g 50%. Additionally, 17 711 169<br />

€0.51 ord<strong>in</strong>ary shares are held by NV and other group companies.<br />

Full details are given <strong>in</strong> note 29 on page 111.<br />

Share premium account<br />

The share premium shown <strong>in</strong> the balance sheet is not available<br />

for the issue of bonus shares or for repayment without <strong>in</strong>curr<strong>in</strong>g<br />

withhold<strong>in</strong>g tax payable by the company. This is despite the change<br />

<strong>in</strong> the Netherlands tax law, as a result of which dividends received<br />

from 2001 onwards by <strong>in</strong>dividual shareholders who are Netherlands<br />

residents are no longer taxed.<br />

Profit reta<strong>in</strong>ed and other reserves<br />

€ million € million<br />

<strong>2002</strong> 2001<br />

Profit reta<strong>in</strong>ed 31 December 6 591 3 508<br />

Cost of NV shares purchased and held by<br />

NV and by its subsidiaries (1 041) (783)<br />

Balance 31 December 5 550 2 725<br />

Profit reta<strong>in</strong>ed shown <strong>in</strong> the company <strong>accounts</strong> and the notes<br />

thereto is greater than the amount shown <strong>in</strong> the consolidated<br />

balance sheet, ma<strong>in</strong>ly because of certa<strong>in</strong> <strong>in</strong>ter-company transactions<br />

which are elim<strong>in</strong>ated <strong>in</strong> the consolidated <strong>accounts</strong>.<br />

Cont<strong>in</strong>gent liabilities<br />

These are not expected to give rise to any material loss and <strong>in</strong>clude<br />

guarantees given for group and other companies, under which<br />

amounts outstand<strong>in</strong>g at 31 December were:<br />

€ million € million<br />

<strong>2002</strong> 2001<br />

Group companies 8 878 11 033<br />

Of the above, guaranteed also by PLC 5 864 6 247<br />

F<strong>in</strong>ancial Statements