Report & accounts 2002 in full - Unilever

Report & accounts 2002 in full - Unilever

Report & accounts 2002 in full - Unilever

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

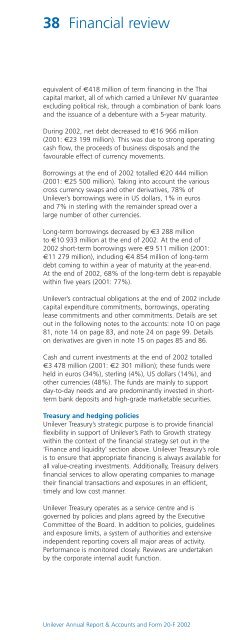

2 Operat<strong>in</strong>g costs<br />

<strong>Unilever</strong> Annual <strong>Report</strong> & Accounts and Form 20-F <strong>2002</strong><br />

Notes to the consolidated <strong>accounts</strong> 77<br />

<strong>Unilever</strong> Group<br />

€ million € million € million<br />

<strong>2002</strong> 2001 2000<br />

Cost of sales (24 030) (26 962) (25 221)<br />

Distribution and sell<strong>in</strong>g costs (12 175) (12 543) (12 045)<br />

Adm<strong>in</strong>istrative expenses (a) (7 024) (6 835) (7 135)<br />

Operat<strong>in</strong>g costs (43 229) (46 340) (44 401)<br />

(a) Includes amortisation of goodwill and <strong>in</strong>tangibles.<br />

€ million € million € million<br />

<strong>2002</strong> 2001 2000<br />

Operat<strong>in</strong>g costs <strong>in</strong>clude:<br />

Staff costs 3 (7 008) (7 131) (6 905)<br />

Raw materials and packag<strong>in</strong>g (18 086) (19 924) (18 085)<br />

Amortisation of goodwill and<br />

<strong>in</strong>tangibles (b) (1 245) (1 387) (435)<br />

Depreciation of tangible<br />

fixed assets (c) (1 337) (1 458) (1 519)<br />

Advertis<strong>in</strong>g and promotions (6 839) (6 648) (6 545)<br />

Research and development (1 166) (1 178) (1 187)<br />

Remuneration of auditors:<br />

Audit fees (15) (16) (14)<br />

Audit related services (d) (13) (11) (10)<br />

Other payments to<br />

PricewaterhouseCoopers<br />

for non-audit services:<br />

Tax (d) (6) (5) (4)<br />

General consult<strong>in</strong>g (d) (16) (60) (42)<br />

Lease rentals:<br />

M<strong>in</strong>imum lease payments (503) (548) (563)<br />

Cont<strong>in</strong>gent lease payments (15) (28) (8)<br />

(518) (576) (571)<br />

Less: Sub-lease <strong>in</strong>come 8 10 12<br />

(510) (566) (559)<br />

of which:<br />

Plant and mach<strong>in</strong>ery (141) (147) (148)<br />

Other (369) (419) (411)<br />

(b) Includes exceptional amount of €(22) million <strong>in</strong> <strong>2002</strong> and<br />

€(8) million <strong>in</strong> 2001.<br />

(c) Includes exceptional amount of €(256) million <strong>in</strong> <strong>2002</strong> and<br />

€(263) million <strong>in</strong> 2001.<br />

(d) Details of our policy on the non-audit work we allow our<br />

auditors to perform are given with<strong>in</strong> the Corporate governance<br />

section on page 45.<br />

3 Staff costs and employees<br />

€ million € million € million<br />

<strong>2002</strong> 2001 2000<br />

Staff costs:<br />

Remuneration of employees (5 834) (6 021) (5 828)<br />

Emoluments of directors<br />

as managers (17) (18) (13)<br />

Pensions and other<br />

post-retirement benefits 17 (416) (326) (305)<br />

Social security costs (741) (766) (759)<br />

Total staff costs (7 008) (7 131) (6 905)<br />

Details of the remuneration of directors and Advisory Directors<br />

which form part of these <strong>accounts</strong> are given <strong>in</strong> the auditable part of<br />

the Remuneration report on pages 49 to 60.<br />

The average number of employees dur<strong>in</strong>g the year was:<br />

‘000 ’000 ’000<br />

<strong>2002</strong> 2001 2000<br />

Europe 65 75 74<br />

North America 22 30 27<br />

Africa, Middle East and Turkey 52 49 48<br />

Asia and Pacific 84 84 79<br />

Lat<strong>in</strong> America 35 41 33<br />

Total 258 279 261<br />

4 Exceptional items<br />

€ million € million € million<br />

<strong>2002</strong> 2001 2000<br />

Included <strong>in</strong> operat<strong>in</strong>g profit<br />

Restructur<strong>in</strong>g (1 215) (1 515) (1 150)<br />

Other, pr<strong>in</strong>cipally bus<strong>in</strong>ess<br />

disposals (a) 341 927 (963)<br />

Total (874) (588) (2 113)<br />

(a) Restated for FRS 19, see note 18 on page 94.<br />

These amounts are ma<strong>in</strong>ly <strong>in</strong>cluded <strong>in</strong> adm<strong>in</strong>istrative expenses.<br />

Exceptional items are those items with<strong>in</strong> ord<strong>in</strong>ary activities which,<br />

because of their size or nature, are disclosed to give a proper<br />

understand<strong>in</strong>g of the underly<strong>in</strong>g result for the period. These<br />

<strong>in</strong>clude restructur<strong>in</strong>g charges <strong>in</strong> connection with reorganis<strong>in</strong>g<br />

bus<strong>in</strong>esses (compris<strong>in</strong>g impairment of fixed assets, costs<br />

of severance, and other costs directly attributable to the<br />

restructur<strong>in</strong>g), and profits and losses on disposal of bus<strong>in</strong>esses.<br />

United K<strong>in</strong>gdom FRS 3 would require profits and losses on<br />

disposal of most bus<strong>in</strong>esses to be excluded from operat<strong>in</strong>g<br />

profit. However, because the bus<strong>in</strong>ess disposals above and the<br />

restructur<strong>in</strong>g costs are part of a series of l<strong>in</strong>ked <strong>in</strong>itiatives, separate<br />

presentation would not give a true and fair view and therefore<br />

we have <strong>in</strong>cluded all exceptional items aris<strong>in</strong>g from these<br />

<strong>in</strong>itiatives on a s<strong>in</strong>gle l<strong>in</strong>e <strong>in</strong> operat<strong>in</strong>g profit. Costs associated<br />

with restructur<strong>in</strong>g, such as tra<strong>in</strong><strong>in</strong>g and <strong>in</strong>formation technology<br />

development costs, are recognised as they arise and are not<br />

treated as exceptional.<br />

The exceptional items <strong>in</strong> <strong>2002</strong>, 2001 and 2000 pr<strong>in</strong>cipally relate<br />

to a series of l<strong>in</strong>ked <strong>in</strong>itiatives (the ‘Path to Growth’), announced<br />

on 22 February 2000 to align the organisation beh<strong>in</strong>d plans for<br />

accelerat<strong>in</strong>g growth and expand<strong>in</strong>g marg<strong>in</strong>s and to restructur<strong>in</strong>g<br />

aris<strong>in</strong>g from the <strong>in</strong>tegration of Bestfoods.<br />

F<strong>in</strong>ancial Statements