Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

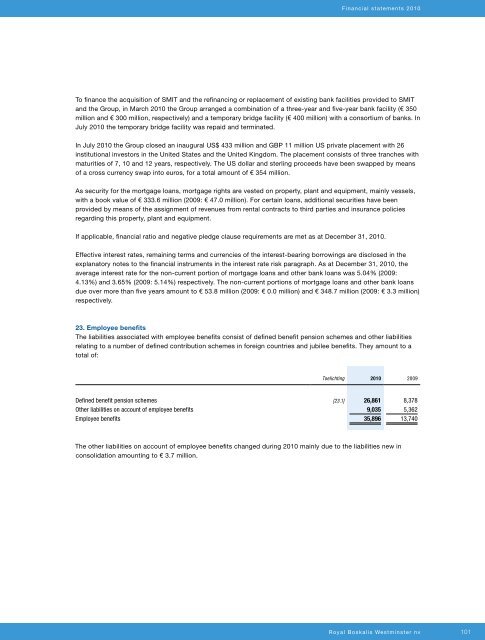

Financial statements 2010To finance the acquisition of SMIT and the refinancing or replacement of existing bank facilities provided to SMITand the Group, in March 2010 the Group arranged a combination of a three-year and five-year bank facility (€ 350million and € 300 million, respectively) and a temporary bridge facility (€ 400 million) with a consortium of banks. InJuly 2010 the temporary bridge facility was repaid and terminated.In July 2010 the Group closed an inaugural US$ 433 million and GBP 11 million US private placement with 26institutional investors in the United States and the United Kingdom. The placement consists of three tranches withmaturities of 7, 10 and 12 years, respectively. The US dollar and sterling proceeds have been swapped by meansof a cross currency swap into euros, for a total amount of € 354 million.As security for the mortgage loans, mortgage rights are vested on property, plant and equipment, mainly vessels,with a book value of € 333.6 million (2009: € 47.0 million). For certain loans, additional securities have beenprovided by means of the assignment of revenues from rental contracts to third parties and insurance policiesregarding this property, plant and equipment.If applicable, financial ratio and negative pledge clause requirements are met as at December 31, 2010.Effective interest rates, remaining terms and currencies of the interest-bearing borrowings are disclosed in theexplanatory notes to the financial instruments in the interest rate risk paragraph. As at December 31, 2010, theaverage interest rate for the non-current portion of mortgage loans and other bank loans was 5.04% (2009:4.13%) and 3.65% (2009: 5.14%) respectively. The non-current portions of mortgage loans and other bank loansdue over more than five years amount to € 53.8 million (2009: € 0.0 million) and € 348.7 million (2009: € 3.3 million)respectively.23. Employee benefitsThe liabilities associated with employee benefits consist of defined benefit pension schemes and other liabilitiesrelating to a number of defined contribution schemes in foreign countries and jubilee benefits. They amount to atotal of:Toelichting 2010 2009Defined benefit pension schemes [23.1] 26,861 8,378Other liabilities on account of employee benefits 9,035 5,362Employee benefits 35,896 13,740The other liabilities on account of employee benefits changed during 2010 mainly due to the liabilities new inconsolidation amounting to € 3.7 million.Royal <strong>Boskalis</strong> Westminster nv101