Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

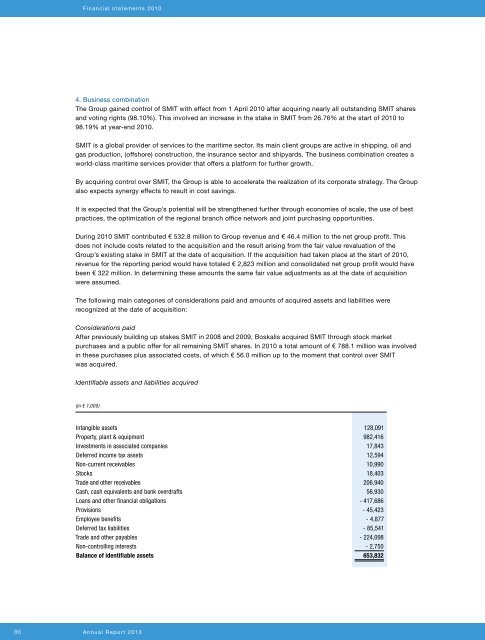

Financial statements 20104. Business combinationThe Group gained control of SMIT with effect from 1 April 2010 after acquiring nearly all outstanding SMIT sharesand voting rights (98.10%). This involved an increase in the stake in SMIT from 26.76% at the start of 2010 to98.19% at year-end 2010.SMIT is a global provider of services to the maritime sector. Its main client groups are active in shipping, oil andgas production, (offshore) construction, the insurance sector and shipyards. The business combination creates aworld-class maritime services provider that offers a platform for further growth.By acquiring control over SMIT, the Group is able to accelerate the realization of its corporate strategy. The Groupalso expects synergy effects to result in cost savings.It is expected that the Group’s potential will be strengthened further through economies of scale, the use of bestpractices, the optimization of the regional branch office network and joint purchasing opportunities.During 2010 SMIT contributed € 532.8 million to Group revenue and € 46.4 million to the net group profit. Thisdoes not include costs related to the acquisition and the result arising from the fair value revaluation of theGroup’s existing stake in SMIT at the date of acquisition. If the acquisition had taken place at the start of 2010,revenue for the <strong>report</strong>ing period would have totaled € 2,823 million and consolidated net group profit would havebeen € 322 million. In determining these amounts the same fair value adjustments as at the date of acquisitionwere assumed.The following main categories of considerations paid and amounts of acquired assets and liabilities wererecognized at the date of acquisition:Considerations paidAfter previously building up stakes SMIT in 2008 and 2009, <strong>Boskalis</strong> acquired SMIT through stock marketpurchases and a public offer for all remaining SMIT shares. In 2010 a total amount of € 788.1 million was involvedin these purchases plus associated costs, of which € 56.0 million up to the moment that control over SMITwas acquired.Identifiable assets and liabilities acquired(in € 1,000)Intangible assets 128,091Property, plant & equipment 982,416Investments in associated companies 17,843Deferred income tax assets 12,594Non-current receivables 10,990Stocks 18,403Trade and other receivables 206,940Cash, cash equivalents and bank overdrafts 56,930Loans and other financial obligations - 417,686Provisions - 45,423Employee benefits - 4,877Deferred tax liabilities - 85,541Trade and other payables - 224,098Non-controlling interests - 2,750Balance of identifiable assets 653,83286 <strong>Annual</strong> Report 2010