Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

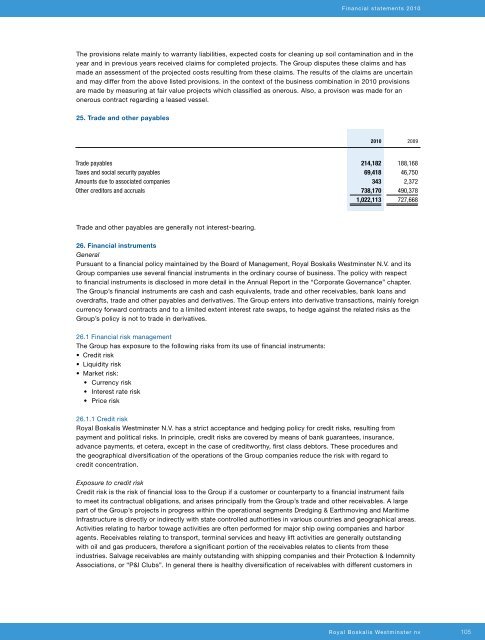

Financial statements 2010The provisions relate mainly to warranty liabilities, expected costs for cleaning up soil contamination and in theyear and in previous years received claims for completed projects. The Group disputes these claims and hasmade an assessment of the projected costs resulting from these claims. The results of the claims are uncertainand may differ from the above listed provisions. in the context of the business combination in 2010 provisionsare made by measuring at fair value projects which classified as onerous. Also, a provison was made for anonerous contract regarding a leased vessel.25. Trade and other payables2010 2009Trade payables 214,182 188,168Taxes and social security payables 69,418 46,750Amounts due to associated companies 343 2,372Other creditors and accruals 738,170 490,3781,022,113 727,668Trade and other payables are generally not interest-bearing.26. Financial instrumentsGeneralPursuant to a financial policy maintained by the Board of Management, Royal <strong>Boskalis</strong> Westminster N.V. and itsGroup companies use several financial instruments in the ordinary course of business. The policy with respectto financial instruments is disclosed in more detail in the <strong>Annual</strong> Report in the “Corporate Governance” chapter.The Group’s financial instruments are cash and cash equivalents, trade and other receivables, bank loans andoverdrafts, trade and other payables and derivatives. The Group enters into derivative transactions, mainly foreigncurrency forward contracts and to a limited extent interest rate swaps, to hedge against the related risks as theGroup’s policy is not to trade in derivatives.26.1 Financial risk managementThe Group has exposure to the following risks from its use of financial instruments:• Credit risk• Liquidity risk• Market risk:• Currency risk• Interest rate risk• Price risk26.1.1 Credit riskRoyal <strong>Boskalis</strong> Westminster N.V. has a strict acceptance and hedging policy for credit risks, resulting frompayment and political risks. In principle, credit risks are covered by means of bank guarantees, insurance,advance payments, et cetera, except in the case of creditworthy, first class debtors. These procedures andthe geographical diversification of the operations of the Group companies reduce the risk with regard tocredit concentration.Exposure to credit riskCredit risk is the risk of financial loss to the Group if a customer or counterparty to a financial instrument failsto meet its contractual obligations, and arises principally from the Group’s trade and other receivables. A largepart of the Group’s projects in progress within the operational segments Dredging & Earthmoving and MaritimeInfrastructure is directly or indirectly with state controlled authorities in various countries and geographical areas.Activities relating to harbor towage activities are often performed for major ship owing companies and harboragents. Receivables relating to transport, terminal services and heavy lift activities are generally outstandingwith oil and gas producers, therefore a significant portion of the receivables relates to clients from theseindustries. Salvage receivables are mainly outstanding with shipping companies and their Protection & IndemnityAssociations, or “P&I Clubs”. In general there is healthy diversification of receivables with different customers inRoyal <strong>Boskalis</strong> Westminster nv105