Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

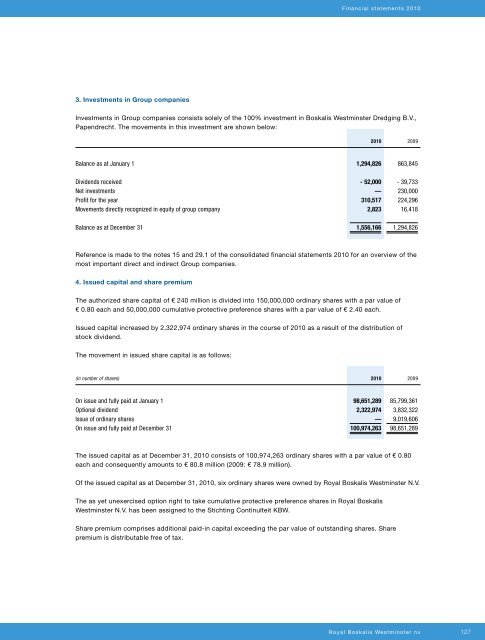

Financial statements 20103. Investments in Group companiesInvestments in Group companies consists solely of the 100% investment in <strong>Boskalis</strong> Westminster Dredging B.V.,Papendrecht. The movements in this investment are shown below:2010 2009Balance as at January 1 1,294,826 863,845Dividends received - 52,000 - 39,733Net investments — 230,000Profit for the year 310,517 224,296Movements directly recognized in equity of group company 2,823 16,418Balance as at December 31 1,556,166 1,294,826Reference is made to the notes 15 and 29.1 of the consolidated financial statements 2010 for an overview of themost important direct and indirect Group companies.4. Issued capital and share premiumThe authorized share capital of € 240 million is divided into 150,000,000 ordinary shares with a par value of€ 0.80 each and 50,000,000 cumulative protective preference shares with a par value of € 2.40 each.Issued capital increased by 2,322,974 ordinary shares in the course of 2010 as a result of the distribution ofstock dividend.The movement in issued share capital is as follows:(in number of shares) 2010 2009On issue and fully paid at January 1 98,651,289 85,799,361Optional dividend 2,322,974 3,832,322Issue of ordinary shares — 9,019,606On issue and fully paid at December 31 100,974,263 98,651,289The issued capital as at December 31, 2010 consists of 100,974,263 ordinary shares with a par value of € 0.80each and consequently amounts to € 80.8 million (2009: € 78.9 million).Of the issued capital as at December 31, 2010, six ordinary shares were owned by Royal <strong>Boskalis</strong> Westminster N.V.The as yet unexercised option right to take cumulative protective preference shares in Royal <strong>Boskalis</strong>Westminster N.V. has been assigned to the Stichting Continuïteit KBW.Share premium comprises additional paid-in capital exceeding the par value of outstanding shares. Sharepremium is distributable free of tax.Royal <strong>Boskalis</strong> Westminster nv127