Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

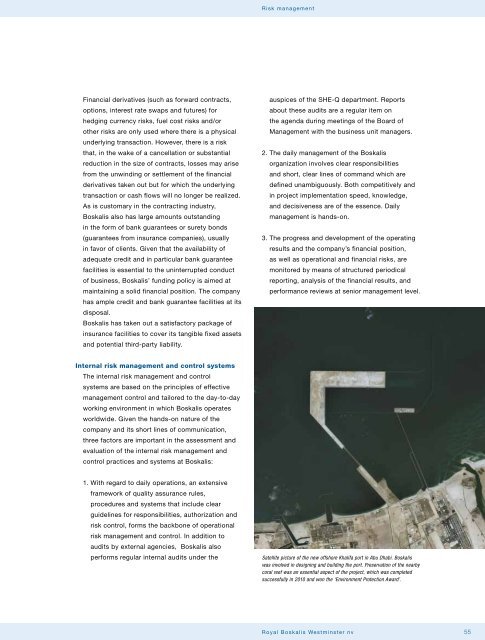

Risk managementFinancial derivatives (such as forward contracts,options, interest rate swaps and futures) forhedging currency risks, fuel cost risks and/orother risks are only used where there is a physicalunderlying transaction. However, there is a riskthat, in the wake of a cancellation or substantialreduction in the size of contracts, losses may arisefrom the unwinding or settlement of the financialderivatives taken out but for which the underlyingtransaction or cash flows will no longer be realized.As is customary in the contracting industry,<strong>Boskalis</strong> also has large amounts outstandingin the form of bank guarantees or surety bonds(guarantees from insurance companies), usuallyin favor of clients. Given that the availability ofadequate credit and in particular bank guaranteefacilities is essential to the uninterrupted conductof business, <strong>Boskalis</strong>’ funding policy is aimed atmaintaining a solid financial position. The companyhas ample credit and bank guarantee facilities at itsdisposal.<strong>Boskalis</strong> has taken out a satisfactory package ofinsurance facilities to cover its tangible fixed assetsand potential third-party liability.auspices of the SHE-Q department. Reportsabout these audits are a regular item onthe agenda during meetings of the Board ofManagement with the business unit managers.2. The daily management of the <strong>Boskalis</strong>organization involves clear responsibilitiesand short, clear lines of command which aredefined unambiguously. Both competitively andin project implementation speed, knowledge,and decisiveness are of the essence. Dailymanagement is hands-on.3. The progress and development of the operatingresults and the company’s financial position,as well as operational and financial risks, aremonitored by means of structured periodical<strong>report</strong>ing, analysis of the financial results, andperformance reviews at senior management level.Internal risk management and control systemsThe internal risk management and controlsystems are based on the principles of effectivemanagement control and tailored to the day-to-dayworking environment in which <strong>Boskalis</strong> operatesworldwide. Given the hands-on nature of thecompany and its short lines of communication,three factors are important in the assessment andevaluation of the internal risk management andcontrol practices and systems at <strong>Boskalis</strong>:1. With regard to daily operations, an extensiveframework of quality assurance rules,procedures and systems that include clearguidelines for responsibilities, authorization andrisk control, forms the backbone of operationalrisk management and control. In addition toaudits by external agencies, <strong>Boskalis</strong> alsoperforms regular internal audits under theSatellite picture of the new offshore Khalifa port in Abu Dhabi. <strong>Boskalis</strong>was involved in designing and building the port. Preservation of the nearbycoral reef was an essential aspect of the project, which was completedsuccessfully in 2010 and won the ‘Environment Protection Award’.Royal <strong>Boskalis</strong> Westminster nv55