Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

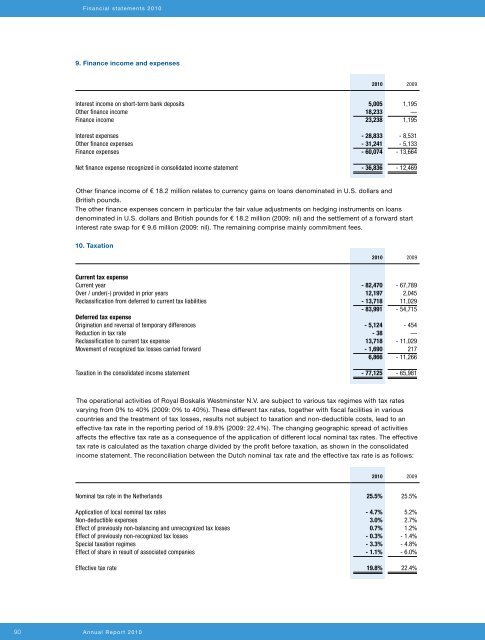

Financial statements 20109. Finance income and expenses2010 2009Interest income on short-term bank deposits 5,005 1,195Other finance income 18,233 —Finance income 23,238 1,195Interest expenses - 28,833 - 8,531Other finance expenses - 31,241 - 5,133Finance expenses - 60,074 - 13,664Net finance expense recognized in consolidated income statement - 36,836 - 12,469Other finance income of € 18.2 million relates to currency gains on loans denominated in U.S. dollars andBritish pounds.The other finance expenses concern in particular the fair value adjustments on hedging instruments on loansdenominated in U.S. dollars and British pounds for € 18.2 million (2009: nil) and the settlement of a forward startinterest rate swap for € 9.6 million (2009: nil). The remaining comprise mainly commitment fees.10. Taxation2010 2009Current tax expenseCurrent year - 82,470 - 67,789Over / under(-) provided in prior years 12,197 2,045Reclassification from deferred to current tax liabilities - 13,718 11,029- 83,991 - 54,715Deferred tax expenseOrigination and reversal of temporary differences - 5,124 - 454Reduction in tax rate - 38 —Reclassification to current tax expense 13,718 - 11,029Movement of recognized tax losses carried forward - 1,690 2176,866 - 11,266Taxation in the consolidated income statement - 77,125 - 65,981The operational activities of Royal <strong>Boskalis</strong> Westminster N.V. are subject to various tax regimes with tax ratesvarying from 0% to 40% (2009: 0% to 40%). These different tax rates, together with fiscal facilities in variouscountries and the treatment of tax losses, results not subject to taxation and non-deductible costs, lead to aneffective tax rate in the <strong>report</strong>ing period of 19.8% (2009: 22.4%). The changing geographic spread of activitiesaffects the effective tax rate as a consequence of the application of different local nominal tax rates. The effectivetax rate is calculated as the taxation charge divided by the profit before taxation, as shown in the consolidatedincome statement. The reconciliation between the Dutch nominal tax rate and the effective tax rate is as follows:2010 2009Nominal tax rate in the Netherlands 25.5% 25.5%Application of local nominal tax rates - 4.7% 5.2%Non-deductible expenses 3.0% 2.7%Effect of previously non-balancing and unrecognized tax losses 0.7% 1.2%Effect of previously non-recognized tax losses - 0.3% - 1.4%Special taxation regimes - 3.3% - 4.8%Effect of share in result of associated companies - 1.1% - 6.0%Effective tax rate 19.8% 22.4%90 <strong>Annual</strong> Report 2010