Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

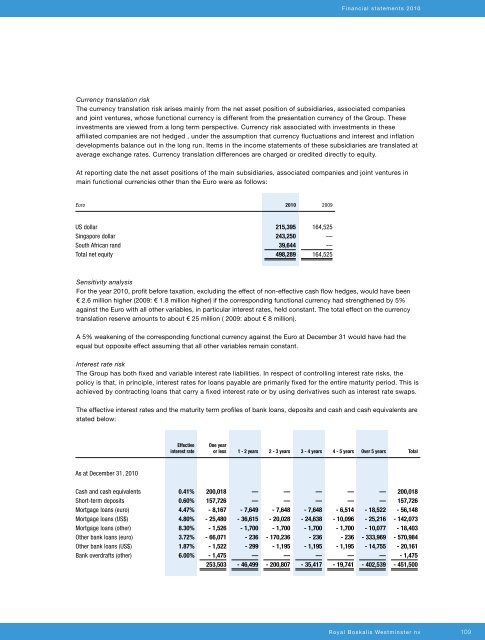

Financial statements 2010Currency translation riskThe currency translation risk arises mainly from the net asset position of subsidiaries, associated companiesand joint ventures, whose functional currency is different from the presentation currency of the Group. Theseinvestments are viewed from a long term perspective. Currency risk associated with investments in theseaffiliated companies are not hedged , under the assumption that currency fluctuations and interest and inflationdevelopments balance out in the long run. Items in the income statements of these subsidiaries are translated ataverage exchange rates. Currency translation differences are charged or credited directly to equity.At <strong>report</strong>ing date the net asset positions of the main subsidiaries, associated companies and joint ventures inmain functional currencies other than the Euro were as follows:Euro 2010 2009US dollar 215,395 164,525Singapore dollar 243,250 —South African rand 39,644 —Total net equity 498,289 164,525Sensitivity analysisFor the year 2010, profit before taxation, excluding the effect of non-effective cash flow hedges, would have been€ 2.6 million higher (2009: € 1.8 million higher) if the corresponding functional currency had strengthened by 5%against the Euro with all other variables, in particular interest rates, held constant. The total effect on the currencytranslation reserve amounts to about € 25 million ( 2009: about € 8 million).A 5% weakening of the corresponding functional currency against the Euro at December 31 would have had theequal but opposite effect assuming that all other variables remain constant.Interest rate riskThe Group has both fixed and variable interest rate liabilities. In respect of controlling interest rate risks, thepolicy is that, in principle, interest rates for loans payable are primarily fixed for the entire maturity period. This isachieved by contracting loans that carry a fixed interest rate or by using derivatives such as interest rate swaps.The effective interest rates and the maturity term profiles of bank loans, deposits and cash and cash equivalents arestated below:Effectiveinterest rateOne yearor less 1 - 2 years 2 - 3 years 3 - 4 years 4 - 5 years Over 5 years TotalAs at December 31, 2010Cash and cash equivalents 0.41% 200,018 — — — — — 200,018Short-term deposits 0.60% 157,726 — — — — — 157,726Mortgage loans (euro) 4.47% - 8,167 - 7,649 - 7,648 - 7,648 - 6,514 - 18,522 - 56,148Mortgage loans (US$) 4.80% - 25,480 - 36,615 - 20,028 - 24,638 - 10,096 - 25,216 - 142,073Mortgage loans (other) 8.30% - 1,526 - 1,700 - 1,700 - 1,700 - 1,700 - 10,077 - 18,403Other bank loans (euro) 3.72% - 66,071 - 236 - 170,236 - 236 - 236 - 333,969 - 570,984Other bank loans (US$) 1.87% - 1,522 - 299 - 1,195 - 1,195 - 1,195 - 14,755 - 20,161Bank overdrafts (other) 6.00% - 1,475 — — — — — - 1,475253,503 - 46,499 - 200,807 - 35,417 - 19,741 - 402,539 - 451,500Royal <strong>Boskalis</strong> Westminster nv109