Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

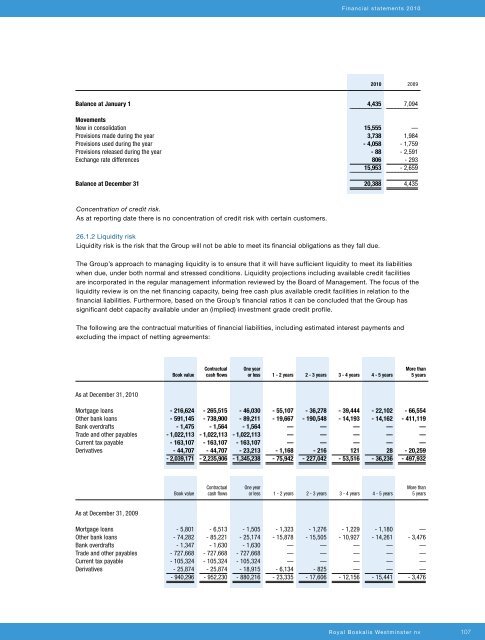

Financial statements 20102010 2009Balance at January 1 4,435 7,094MovementsNew in consolidation 15,555 —Provisions made during the year 3,738 1,984Provisions used during the year - 4,058 - 1,759Provisions released during the year - 88 - 2,591Exchange rate differences 806 - 29315,953 - 2,659Balance at December 31 20,388 4,435Concentration of credit risk.As at <strong>report</strong>ing date there is no concentration of credit risk with certain customers.26.1.2 Liquidity riskLiquidity risk is the risk that the Group will not be able to meet its financial obligations as they fall due.The Group’s approach to managing liquidity is to ensure that it will have sufficient liquidity to meet its liabilitieswhen due, under both normal and stressed conditions. Liquidity projections including available credit facilitiesare incorporated in the regular management information reviewed by the Board of Management. The focus of theliquidity review is on the net financing capacity, being free cash plus available credit facilities in relation to thefinancial liabilities. Furthermore, based on the Group’s financial ratios it can be concluded that the Group hassignificant debt capacity available under an (implied) investment grade credit profile.The following are the contractual maturities of financial liabilities, including estimated interest payments andexcluding the impact of netting agreements:Book valueContractualcash flowsOne yearor less 1 - 2 years 2 - 3 years 3 - 4 years 4 - 5 yearsMore than5 yearsAs at December 31, 2010Mortgage loans - 216,624 - 265,515 - 46,030 - 55,107 - 36,278 - 39,444 - 22,102 - 66,554Other bank loans - 591,145 - 738,900 - 89,211 - 19,667 - 190,548 - 14,193 - 14,162 - 411,119Bank overdrafts - 1,475 - 1,564 - 1,564 — — — — —Trade and other payables - 1,022,113 - 1,022,113 - 1,022,113 — — — — —Current tax payable - 163,107 - 163,107 - 163,107 — — — — —Derivatives - 44,707 - 44,707 - 23,213 - 1,168 - 216 121 28 - 20,259- 2,039,171 - 2,235,906 - 1,345,238 - 75,942 - 227,042 - 53,516 - 36,236 - 497,932Book valueContractualcash flowsOne yearor less 1 - 2 years 2 - 3 years 3 - 4 years 4 - 5 yearsMore than5 yearsAs at December 31, 2009Mortgage loans - 5,801 - 6,513 - 1,505 - 1,323 - 1,276 - 1,229 - 1,180 —Other bank loans - 74,282 - 85,221 - 25,174 - 15,878 - 15,505 - 10,927 - 14,261 - 3,476Bank overdrafts - 1,347 - 1,630 - 1,630 — — — — —Trade and other payables - 727,668 - 727,668 - 727,668 — — — — —Current tax payable - 105,324 - 105,324 - 105,324 — — — — —Derivatives - 25,874 - 25,874 - 18,915 - 6,134 - 825 — — —- 940,296 - 952,230 - 880,216 - 23,335 - 17,606 - 12,156 - 15,441 - 3,476Royal <strong>Boskalis</strong> Westminster nv107