Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

Annual report 20108.31 MB - Boskalis

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

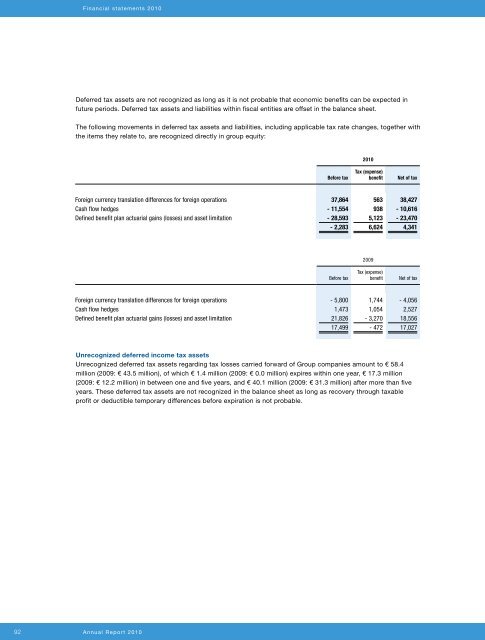

Financial statements 2010Deferred tax assets are not recognized as long as it is not probable that economic benefits can be expected infuture periods. Deferred tax assets and liabilities within fiscal entities are offset in the balance sheet.The following movements in deferred tax assets and liabilities, including applicable tax rate changes, together withthe items they relate to, are recognized directly in group equity:2010Before taxTax (expense)benefitNet of taxForeign currency translation differences for foreign operations 37,864 563 38,427Cash flow hedges - 11,554 938 - 10,616Defined benefit plan actuarial gains (losses) and asset limitation - 28,593 5,123 - 23,470- 2,283 6,624 4,3412009Before taxTax (expense)benefitNet of taxForeign currency translation differences for foreign operations - 5,800 1,744 - 4,056Cash flow hedges 1,473 1,054 2,527Defined benefit plan actuarial gains (losses) and asset limitation 21,826 - 3,270 18,55617,499 - 472 17,027Unrecognized deferred income tax assetsUnrecognized deferred tax assets regarding tax losses carried forward of Group companies amount to € 58.4million (2009: € 43.5 million), of which € 1.4 million (2009: € 0.0 million) expires within one year, € 17.3 million(2009: € 12.2 million) in between one and five years, and € 40.1 million (2009: € 31.3 million) after more than fiveyears. These deferred tax assets are not recognized in the balance sheet as long as recovery through taxableprofit or deductible temporary differences before expiration is not probable.92 <strong>Annual</strong> Report 2010