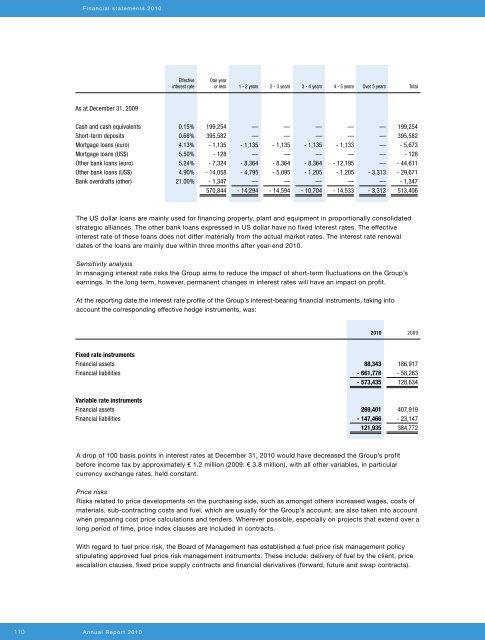

Financial statements 2010Effectiveinterest rateOne yearor less 1 - 2 years 2 - 3 years 3 - 4 years 4 - 5 years Over 5 years TotalAs at December 31, 2009Cash and cash equivalents 0.15% 199,254 — — — — — 199,254Short-term deposits 0.68% 395,582 — — — — — 395,582Mortgage loans (euro) 4.13% - 1,135 - 1,135 - 1,135 - 1,135 - 1,133 — - 5,673Mortgage loans (US$) 5.50% - 128 — — — — — - 128Other bank loans (euro) 5.24% - 7,324 - 8,364 - 8,364 - 8,364 - 12,195 — - 44,611Other bank loans (US$) 4.90% - 14,058 - 4,795 - 5,095 - 1,205 - 1,205 - 3,313 - 29,671Bank overdrafts (other) 21.00% - 1,347 — — — — — - 1,347570,844 - 14,294 - 14,594 - 10,704 - 14,533 - 3,313 513,406The US dollar loans are mainly used for financing property, plant and equipment in proportionally consolidatedstrategic alliances. The other bank loans expressed in US dollar have no fixed interest rates. The effectiveinterest rate of these loans does not differ materially from the actual market rates. The interest rate renewaldates of the loans are mainly due within three months after year-end 2010.Sensitivity analysisIn managing interest rate risks the Group aims to reduce the impact of short-term fluctuations on the Group’searnings. In the long term, however, permanent changes in interest rates will have an impact on profit.At the <strong>report</strong>ing date the interest rate profile of the Group’s interest-bearing financial instruments, taking intoaccount the corresponding effective hedge instruments, was:2010 2009Fixed rate instrumentsFinancial assets 88,343 186,917Financial liabilities - 661,778 - 58,283- 573,435 128,634Variable rate instrumentsFinancial assets 269,401 407,919Financial liabilities - 147,466 - 23,147121,935 384,772A drop of 100 basis points in interest rates at December 31, 2010 would have decreased the Group’s profitbefore income tax by approximately € 1.2 million (2009: € 3.8 million), with all other variables, in particularcurrency exchange rates, held constant.Price risksRisks related to price developments on the purchasing side, such as amongst others increased wages, costs ofmaterials, sub-contracting costs and fuel, which are usually for the Group’s account, are also taken into accountwhen preparing cost price calculations and tenders. Wherever possible, especially on projects that extend over along period of time, price index clauses are included in contracts.With regard to fuel price risk, the Board of Management has established a fuel price risk management policystipulating approved fuel price risk management instruments. These include: delivery of fuel by the client, priceescalation clauses, fixed price supply contracts and financial derivatives (forward, future and swap contracts).110 <strong>Annual</strong> Report 2010

Financial statements 201026.2 On-balance financial instruments and fair valueFinancial instruments accounted for under assets and liabilities are financial fixed assets, cash and cashequivalents, receivables, and current and non-current liabilities. The estimated fair values of these financialinstruments are close to the book value. Derivatives are mainly future cash flows hedged by forward contractsto which hedge accounting is applied. Furthermore, strategic alliances currently hold a number of interest rateswaps. These are recognized under other derivatives.The fair value of the forward exchange contracts is based on their listed market price, as at the end of the year(unadjusted market prices in active markets for identical assets and liabilities). The fair value other financialinstruments is based on the actual interest rate as at balance sheet date, taking into account terms and maturity.The fair value of non-interest bearing financial instruments with a maturity of twelve months or less is suppostedto be equal to their book value.Movements in the fair value of non-effective cash flow hedges are recognized directly or, under specificconditions, deferred in the consolidated income statement. Movements in the fair value of effective cash flowhedges are recognized directly in the hedging reserve in group equity, taking taxation into account. The fair valueof derivatives is derived from the forward rates at settlement date as at year-end. The fair value of other financialinstruments is based on current interest rates, taking maturity and conditions into account. The fair value of noninterest-bearingfinancial instruments due within one year is equal to the book value.2010 2009Book value Fair value Book value Fair valueOther financial fixed assets 40,373 40,373 6,019 6,019Trade and other receivables 793,339 793,339 601,636 601,636Derivatives (receivable) 5,036 5,036 3,633 3,633Income tax receivable 23,060 23,060 8,899 8,899Cash and cash equivalents 357,744 357,744 594,836 594,836Interest-bearing loans and borrowings (non-current) - 705,003 - 711,670 - 57,438 - 57,438Interest-bearing loans and borrowings (current) - 104,241 - 105,224 - 23,992 - 23,992Trade and other payables - 1,022,113 - 1,022,113 - 727,668 - 727,668Income tax payable - 163,107 - 163,107 - 105,324 - 105,324Derivatives (payable) - 44,707 - 44,707 - 25,874 - 25,874- 819,619 - 827,269 274,727 274,727Fair value hierarchyFor the fair value measurement of the recognized financial instruments a fair value hierarchy is defined inaccordance with IFRS 7:• Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities.• Level 2: inputs other than quoted prices included within Level 1 that are observable for the asset or liability,either directly (i.e. as prices) or indirectly (i.e. derived from prices).• Level 3: inputs for the asset or liability that are not based on observable market data (unobservable inputs).The fair value of the derivatives, which is the only category of financial instruments that qualify for this approach,is measured using level 2 input (2009: level 2).The composition of outstanding derivatives at year-end is presented below. The remaining time to maturity ofthese derivatives has a direct relation to the remaining time to maturity of the relating underlying contracts inthe order book.Royal <strong>Boskalis</strong> Westminster nv111