2012 New Releases Catalogue December - Learningemall.com

2012 New Releases Catalogue December - Learningemall.com

2012 New Releases Catalogue December - Learningemall.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

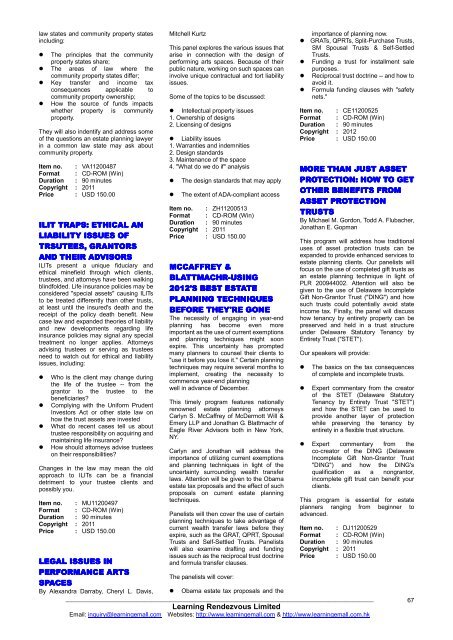

law states and <strong>com</strong>munity property statesincluding: The principles that the <strong>com</strong>munityproperty states share; The areas of law where the<strong>com</strong>munity property states differ; Key transfer and in<strong>com</strong>e taxconsequences applicable to<strong>com</strong>munity property ownership; How the source of funds impactswhether property is <strong>com</strong>munityproperty.They will also indentify and address someof the questions an estate planning lawyerin a <strong>com</strong>mon law state may ask about<strong>com</strong>munity property.Item no. : VA11200487Format : CD-ROM (Win)Duration : 90 minutesCopyright : 2011Price : USD 150.00ILIT TRAPS: ETHICAL ANLIABILITY ISSUES OFTRSUTEES, GRANTORSAND THEIR ADVISORSILITs present a unique fiduciary andethical minefield through which clients,trustees, and attorneys have been walkingblindfolded. Life insurance policies may beconsidered "special assets" causing ILITsto be treated differently than other trusts,at least until the insured's death and thereceipt of the policy death benefit. <strong>New</strong>case law and expanded theories of liabilityand new developments regarding lifeinsurance policies may signal any specialtreatment no longer applies. Attorneysadvising trustees or serving as trusteesneed to watch out for ethical and liabilityissues, including:Who is the client may change duringthe life of the trustee -- from thegrantor to the trustee to thebeneficiaries?Complying with the Uniform PrudentInvestors Act or other state law onhow the trust assets are investedWhat do recent cases tell us abouttrustee responsibility on acquiring andmaintaining life insurance?How should attorneys advise trusteeson their responsibilities?Changes in the law may mean the oldapproach to ILITs can be a financialdetriment to your trustee clients andpossibly you.Item no. : MU11200497Format : CD-ROM (Win)Duration : 90 minutesCopyright : 2011Price : USD 150.00LEGAL ISSUES INMitchell KurtzThis panel explores the various issues thatarise in connection with the design ofperforming arts spaces. Because of theirpublic nature, working on such spaces caninvolve unique contractual and tort liabilityissues.Some of the topics to be discussed: Intellectual property issues1. Ownership of designs2. Licensing of designs Liability issues1. Warranties and indemnities2. Design standards3. Maintenance of the space4. "What do we do if" analysisThe design standards that may applyThe extent of ADA-<strong>com</strong>pliant accessItem no. : ZH11200513Format : CD-ROM (Win)Duration : 90 minutesCopyright : 2011Price : USD 150.00MCCAFFREY &BLATTMACHR-USING<strong>2012</strong>'S BEST ESTATEPLANNING TECHNIQUESBEFORE THEY'RE GONEThe necessity of engaging in year-endplanning has be<strong>com</strong>e even moreimportant as the use of current exemptionsand planning techniques might soonexpire. This uncertainty has promptedmany planners to counsel their clients to"use it before you lose it." Certain planningtechniques may require several months toimplement, creating the necessity to<strong>com</strong>mence year-end planningwell in advance of <strong>December</strong>.This timely program features nationallyrenowned estate planning attorneysCarlyn S. McCaffrey of McDermott Will &Emery LLP and Jonathan G. Blattmachr ofEagle River Advisors both in <strong>New</strong> York,NY.Carlyn and Jonathan will address theimportance of utilizing current exemptionsand planning techniques in light of theuncertainty surrounding wealth transferlaws. Attention will be given to the Obamaestate tax proposals and the effect of suchproposals on current estate planningtechniques.Panelists will then cover the use of certainplanning techniques to take advantage ofcurrent wealth transfer laws before theyexpire, such as the GRAT, QPRT, SpousalTrusts and Self-Settled Trusts. Panelistswill also examine drafting and fundingissues such as the reciprocal trust doctrineand formula transfer clauses.importance of planning now. GRATs, QPRTs, Split-Purchase Trusts,SM Spousal Trusts & Self-SettledTrusts. Funding a trust for installment salepurposes. Reciprocal trust doctrine -- and how toavoid it. Formula funding clauses with "safetynets."Item no. : CE11200525Format : CD-ROM (Win)Duration : 90 minutesCopyright : <strong>2012</strong>Price : USD 150.00MORE THAN JUST ASSETPROTECTION: HOW TO GETGOTHER BENEFITS FROMASSET PROTECTIONTRUSTSBy Michael M. Gordon, Todd A. Flubacher,Jonathan E. GopmanThis program will address how traditionaluses of asset protection trusts can beexpanded to provide enhanced services toestate planning clients. Our panelists willfocus on the use of <strong>com</strong>pleted gift trusts asan estate planning technique in light ofPLR 200944002. Attention will also begiven to the use of Delaware In<strong>com</strong>pleteGift Non-Grantor Trust ("DING") and howsuch trusts could potentially avoid statein<strong>com</strong>e tax. Finally, the panel will discusshow tenancy by entirety property can bepreserved and held in a trust structureunder Delaware Statutory Tenancy byEntirety Trust ("STET").Our speakers will provide:PERFORMANCE ARTSThe panelists will cover:SPACESBy Alexandra Darraby, Cheryl L. Davis, Obama estate tax proposals and the________________________________________________________________________________________________________Learning Rendezvous LimitedEmail: inquiry@learningemall.<strong>com</strong> Websites: http://www.learningemall.<strong>com</strong> & http://www.learningemall.<strong>com</strong>.hkThe basics on the tax consequencesof <strong>com</strong>plete and in<strong>com</strong>plete trusts.Expert <strong>com</strong>mentary from the creatorof the STET (Delaware StatutoryTenancy by Entirety Trust "STET")and how the STET can be used toprovide another layer of protectionwhile preserving the tenancy byentirety in a flexible trust structure. Expert <strong>com</strong>mentary from theco-creator of the DING (DelawareIn<strong>com</strong>plete Gift Non-Grantor Trust"DING") and how the DING'squalification as a nongrantor,in<strong>com</strong>plete gift trust can benefit yourclients.This program is essential for estateplanners ranging from beginner toadvanced.Item no. : DJ11200529Format : CD-ROM (Win)Duration : 90 minutesCopyright : 2011Price : USD 150.0067